- Cboe BZX filed 19b-4 functions for spot XRP ETFs on behalf of Bitwise, 21Shares, and Canary Capital.

- The SEC approval course of for crypto ETFs accelerated after spot Bitcoin and Ethereum ETFs had been authorised in 2024.

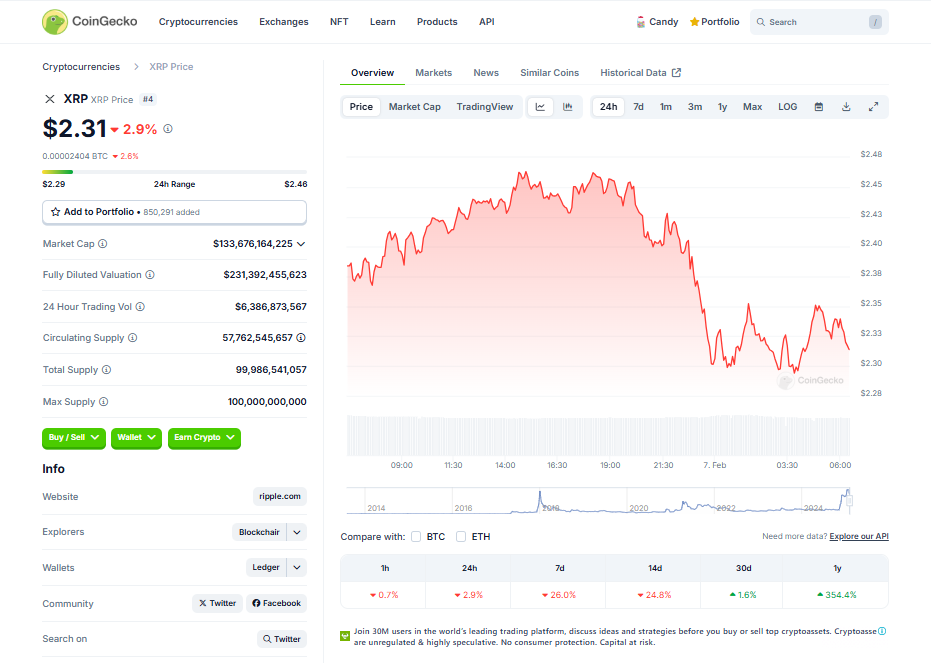

- XRP’s worth dropped 2.5% to $2.34 regardless of elevated ETF filings and regulatory exercise.

Cboe BZX Change has filed a number of 19b-4 functions on behalf of Bitwise, 21Shares, and Canary Capital to listing and commerce a spot XRP ETF, marking the most recent push for extra crypto-backed monetary merchandise within the U.S. market. XRP, at present the fourth-largest cryptocurrency by market cap, is the main focus of this new wave of filings.

What’s a 19b-4 Submitting?

A 19b-4 is the second step in proposing a crypto ETF to the U.S. Securities and Change Fee (SEC). As soon as the SEC acknowledges the submitting, it’s revealed within the Federal Register, kicking off the formal approval course of. Bitwise started the race for a spot XRP ETF in October, adopted by 21Shares in November, and different companies like WisdomTree and CoinShares quickly joined the competitors.

NYSE Arca not too long ago filed to transform Grayscale’s XRP belief into an ETF, and Canadian agency Objective Investments is vying to develop into the world’s first XRP ETF issuer after submitting a prospectus on January 31.

A Professional-Crypto Regulatory Panorama

For the reason that SEC authorised spot Bitcoin ETFs in January 2024 and spot Ethereum ETFs final summer season, crypto issuers have rushed to file new functions. The present Trump administration’s pro-crypto stance has solely fueled this pattern, creating an atmosphere the place spot crypto ETFs are gaining momentum.

XRP Market Impression

Regardless of these developments, XRP’s worth slipped by 2.5% to $2.34 on the time of reporting. Market watchers speculate that profitable ETF approvals may enhance demand and worth stability for XRP in the long term. For now, competitors amongst main asset managers and exchanges to safe ETF listings continues to accentuate.