- Stablecoins are gaining traction, cementing the U.S. greenback’s dominance within the digital age

- May this be the subsequent evolution of worldwide monetary energy?

Are stablecoins the important thing to sustaining U.S greenback dominance? David Sacks thinks so.

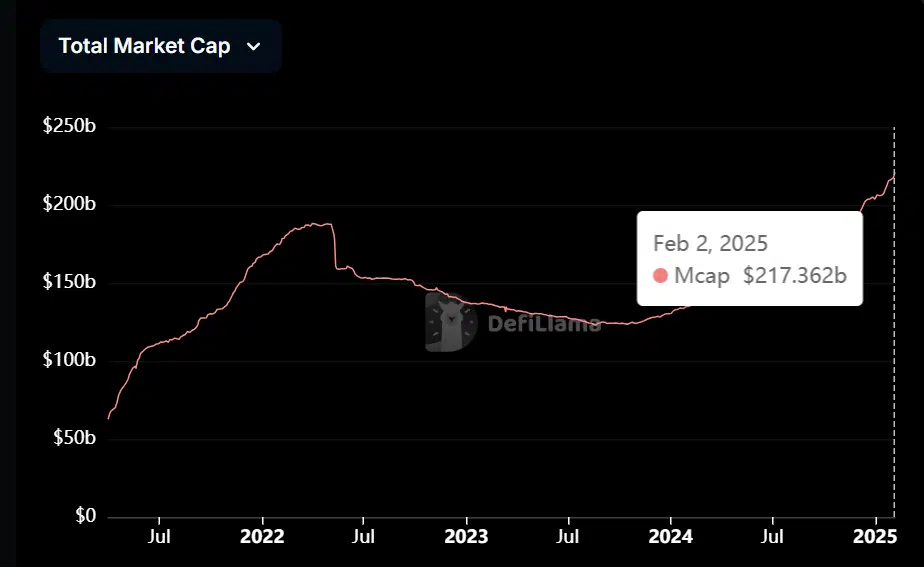

With real-world purposes from cross-border transactions to appearing as a protected haven in unstable markets, stablecoins have surged in adoption – Pushing their mixed market cap previous $227 billion.

Nevertheless, with stricter laws on the horizon, might the crypto panorama shift from being Bitcoin-centric to 1 that’s extra targeted on “digital property?”

A strategic shift into stablecoins

We’re within the digital age. Whereas the united statesdollar has been the worldwide foreign money, stablecoins are shortly stepping up. No surprise, the brand new administration is specializing in laws that would make stablecoins a substitute for the greenback.

Why does this matter? The usdebt market has reached an all-time excessive of $36.22 trillion. To handle this, it’s essential to maintain rates of interest low. A method to do that is by inflating the availability of stablecoins.

Whereas Trump has beforehand touted Bitcoin as a method to repay the debt, stablecoins current a extra sensible resolution. As historical past has proven, rising stablecoin provide typically boosts Bitcoin’s value, absorbing liquidity.

This shift triggers a drop in U.S yields and stabilizes rates of interest, as buyers scramble to scoop up Bitcoin.

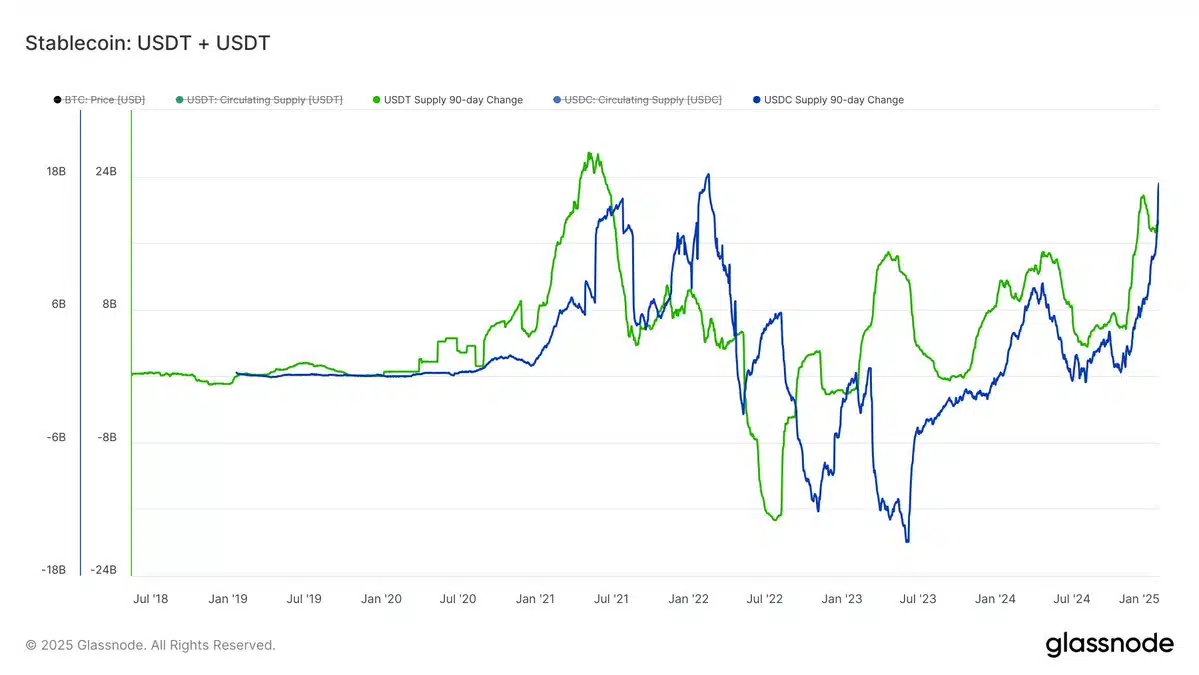

Have a look at the numbers – Since Trump’s election win, USDT’s provide has jumped by $20 billion, bringing the entire to $140 billion, whereas USDC has risen by $17 billion to hit $52 billion.

Supply: Glassnode

To high it off, Tether has develop into the third-largest purchaser of U.S. Treasuries, investing a staggering $113 billion in 2024.

Given all this, the stablecoin laws is anticipated to take a much bigger leap. In response, we’re more likely to see an enormous surge of liquidity flowing into the crypto market.

Nevertheless, it’s not nearly market motion—It’s a part of a much bigger plan to make stablecoins a key participant in the united statesfinancial system.

The place does it go away Bitcoin?

The crypto market has at all times revolved round Bitcoin, however the recreation is altering. With considerations over inflating real-world property, the main focus is shifting to stablecoins.

Analysts predict the stablecoin market might soar to $1 trillion – 5x its present valuation. If the invoice passes, provide is about to blow up, with Tether main the cost.

Supply: DeFiLlama

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

Not less than 5% of this surge is anticipated to circulate into Bitcoin, making this laws a possible game-changer.

This may very well be the second crypto transitions from hypothesis to an actual monetary powerhouse — Hold an in depth eye on this one in 2025!