A intently adopted crypto strategist is warning that Bitcoin (BTC) might collapse by double-digit proportion factors if it loses one key stage.

Analyst Ali Martinez tells his 122,900 followers on the social media platform X that Bitcoin might plummet to $74,400, a stage final seen in November, if BTC can’t maintain $92,180 as assist.

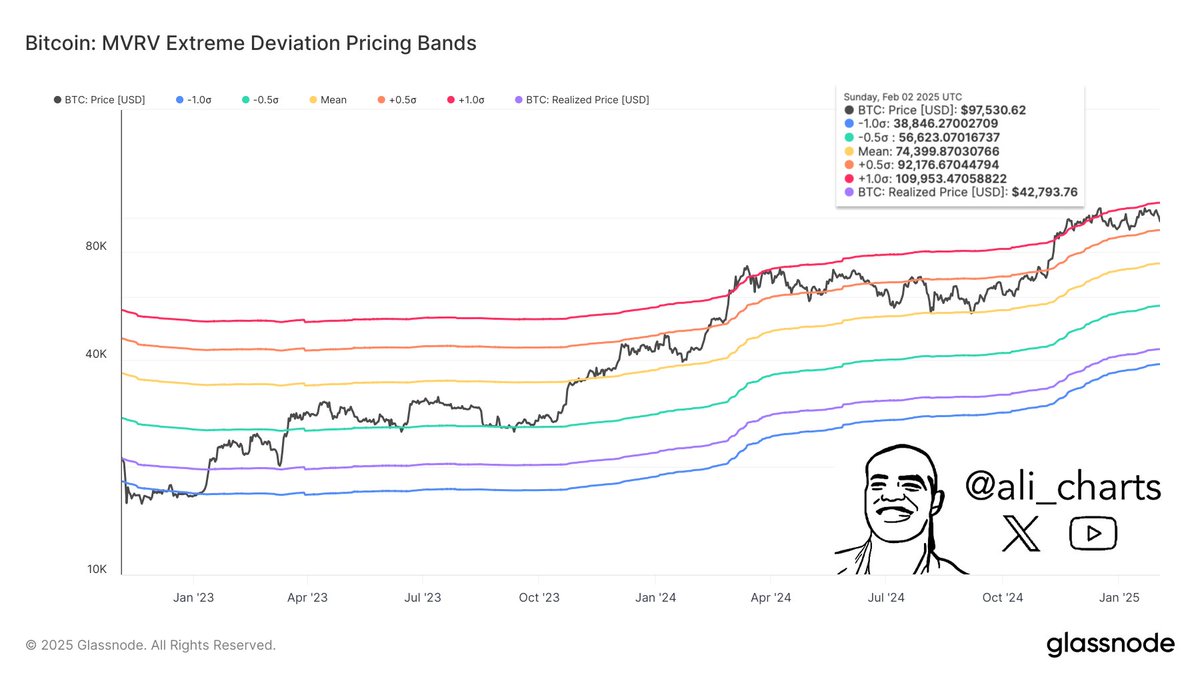

Martinez makes use of pricing bands derived from Bitcoin’s Market Worth to Realized Worth (MVRV) to establish the important thing ranges of assist.

The MVRV is the ratio of a crypto asset’s market capitalization relative to its realized capitalization or the worth of all of the cash on the worth they had been purchased. When the MVRV worth drops beneath zero, it signifies that the asset is oversold as merchants who purchased it at a sure time-frame are witnessing losses.

“$92,180 is now probably the most essential assist ranges for Bitcoin, primarily based on the MVRV Pricing Bands. If this stage breaks, $74,400 turns into the following goal.”

He additionally says that Bitcoin’s MVRV metric signifies that the flagship crypto asset has remained in a downtrend since January 1st.

“The MVRV Momentum indicator reveals that Bitcoin has remained in adverse territory because the begin of the yr, signaling potential weak spot out there!”

Bitcoin is buying and selling for $96,234 at time of writing, down 1.6% within the final 24 hours.

Subsequent up, the analyst warns that memecoin dogwifhat (WIF) could also be forming a bearish flag sample and is prone to declining by greater than 35% from its present worth.

“If it is a bearish flag, WIF targets $0.51!”

WIF is buying and selling for $0.79 at time of writing, down marginally within the final 24 hours.

He additionally says scaling resolution Optimism (OP) could also be forming a head-and-shoulders sample, which usually means that an asset is dropping momentum and will reverse its uptrend if the value breaks beneath the construction’s assist.

“OP seems to type a head-and-shoulders sample, signaling a possible worth correction forward!”

OP is buying and selling for $1.09 at time of writing, down 2.6% within the final 24 hours.

Lastly, he says that Optimism rival Polygon (POL) could appropriate even additional.

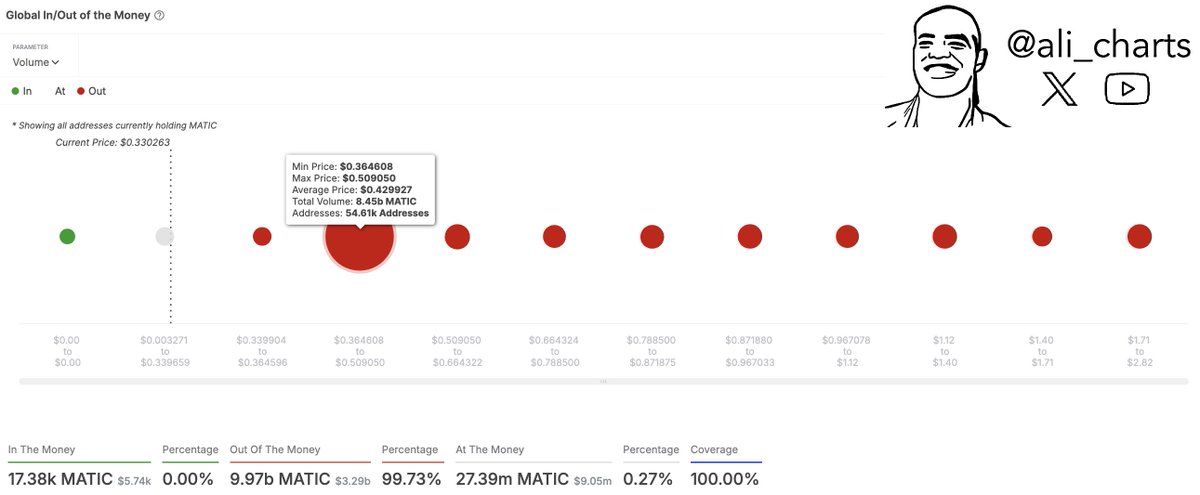

Martinez makes use of the In/Out of the Cash Round Value (IOMAP) metric – which classifies crypto addresses as both profiting, breaking even, or dropping cash – to find out assist and resistance ranges for POL.

“On-chain information reveals that the majority Polygon tokens had been gathered between $0.364 and $0.509. Reclaiming this zone as assist is essential! Failure to take action might set off one other sell-off as buyers look to reduce losses.”

POL is buying and selling for $0.3115 at time of writing, down marginally on the day.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney