Binance launched its newest month-to-month market insights report, detailing development in meme cash and ETF filings. The whole variety of tokens in circulation has reached over 37 million, the bulk launching on Solana. Additionally, there are 47 energetic ETF filings within the US.

January 2025 was a constructive month for the crypto trade, with a peaking market and features in a number of key areas. The most important loser was in AI-related crypto tasks, which took a tough beating from DeepSeek.

Binance Analysis: Meme Cash, ETFs, AI Tokens

Binance Analysis, a subsidiary of the biggest crypto trade, simply launched its latest Month-to-month Market Insights report. In it, Binance painted a constructive image, with the crypto market peaking at $3.76 trillion in January and development areas like meme cash having a dramatic impression.

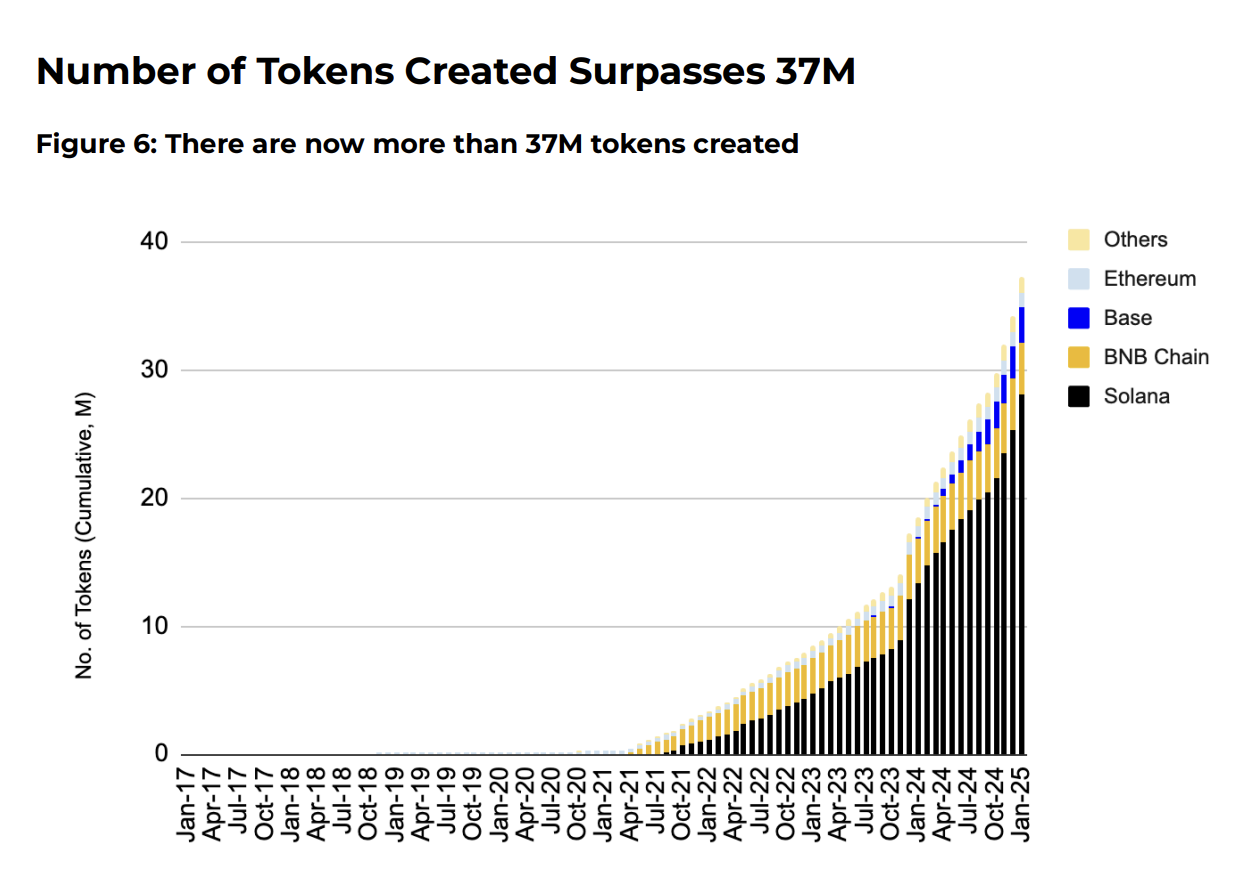

“The appearance of token launchpads and the meme coin mania has led to the creation of over 37 million tokens, with projections exceeding 100 million by year-end. This development has fragmented capital, making it more durable for tokens to maintain costs and obtain excessive valuations,” the report claimed.

Binance Analysis has been learning the meme coin craze for a number of months, so it is smart that it has a wealth of information on the topic.

Though meme cash are a development space within the trade, the report raised a number of issues. Particularly, it concurred with the analysis suggesting that this tidal wave of tasks is sapping power from conventional altcoins.

Binance claimed that this meme coin inflow “fuels hypothesis, reduces consideration spans and discourages long-term holding,” asserting that the majority tokens have a negligible market cap.

Nonetheless, it did have constructive downstream impacts, like speedy development in Solana DEX volumes. Meme cash and AI brokers helped the Solana-to-Ethereum DEX quantity ratio surpass 300% in January.

Moreover, Binance’s report mentioned political modifications after Trump’s Inauguration. Since Gary Gensler resigned as SEC Chairman, the Fee instantly noticed a rush of ETF purposes.

Binance Analysis claimed that there are at the moment 47 energetic ETF purposes within the US, overlaying 16 asset classes, together with meme cash.

All in all, Binance reported that January was a constructive month for the broader crypto trade. The one vital loser was in AI, as DeepSeek severely punished this area of interest market.

Regardless, the DeFAI sector did get better considerably, ending the month with solely a -10% return. In comparison with preliminary losses, it may have been quite a bit worse.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.