Este artículo también está disponible en español.

Ethereum’s value motion in the previous seven days has led to the creation of a capitulation candle that may ship it on one other surge inside the subsequent eight to 12 weeks. This capitulation candle caught the eye of crypto analyst Ted Pillows, who famous an fascinating repeating capitulation sample for Ethereum.

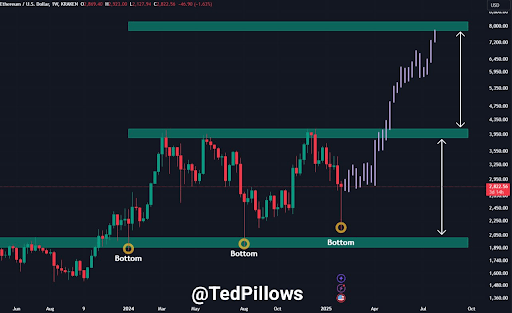

In accordance with technical evaluation by Ted Pillows, Ethereum has printed a capitulation candle in early 2025, simply because it did within the first quarter of 2024 and the third quarter of 2023.

Capitulation Candles And Ethereum Historic Patterns

TedPillows’ evaluation highlights that the Ethereum value has undergone three main capitulation occasions prior to now two years, all of which led to substantial value rebounds. Notably, these capitulations have taken place within the weekly candlestick timeframe, the place the Ethereum value witnessed intense promoting strain all through the week. Nonetheless, historic value playout reveals that these capitulations have typically marked the underside earlier than an enormous value rally.

Associated Studying

The primary of such capitulations occurred in Q1 2024 and ultimately led to a 100% rally over the subsequent three months, with the Ethereum value reaching $3,950. The second capitulation befell in Q3 2024, resulting in an analogous upswing. With Ethereum now experiencing one other capitulation second in early 2025, the analyst means that the sample is about to repeat. He believes that Ethereum is as soon as once more forming a market backside, setting the stage for an aggressive upward transfer.

Ethereum’s 100% Value Surge And Potential Peak

If Ethereum follows its earlier trajectory, the subsequent eight to 12 weeks might convey a major value improve, even because the main altcoin presently struggles round $2,700. A 90%-100% pump after the latest capitulation would push the Ethereum value previous key resistance ranges and above its present all-time excessive.

Associated Studying

TedPillows’ evaluation means that Ethereum’s final value goal following this capitulation might attain as excessive as $8,000. Nonetheless, it’s more likely to encounter vital resistance close to $3,950, a stage that has traditionally triggered rejections in previous capitulation cycles. Ought to Ethereum wrestle to interrupt via this barrier once more, a brief pullback could possibly be on the horizon earlier than any sustained transfer larger.

In the meantime, Spot Ethereum ETFs are attracting heavy inflows regardless of Ethereum’s value downturn. Institutional traders seem like capitalizing on the dip and growing their ETH holdings in anticipation of a broader market rebound.

Spot Ethereum ETFs have recorded $513.8 million in inflows within the final six buying and selling days, with BlackRock main the cost by buying $424.1 million value of ETH. This regular accumulation from institutional holders suggests rising confidence in Ethereum’s long-term potential and will lay the muse for the projected 100% surge within the subsequent eight to 12 months.

On the time of writing, Ethereum is buying and selling at $2,725, down by 4% prior to now 24 hours.

Featured picture from Unsplash, chart from Tradingview.com