The Bitcoin worth instantly regained a significant six-figure valuation with the $100,000 mark final seen on Tuesday, contemporary from the large liquidation that brought on at the least $8 billion in losses for merchants.

The current wave of market optimism that pushed the value of the main cryptocurrency into the six-figure vary was pushed by the main shifts within the rhetoric of the U.S. financial macro state of affairs.

With the unemployment charge falling in line with the most recent knowledge, suggesting a slowdown in inflation, a number of Fed audio system hinted that the Fed’s charge and financial easing might start before anticipated. In brief, merchants heard a touch of “cash printing” and instantly confirmed their response available in the market’s quotes.

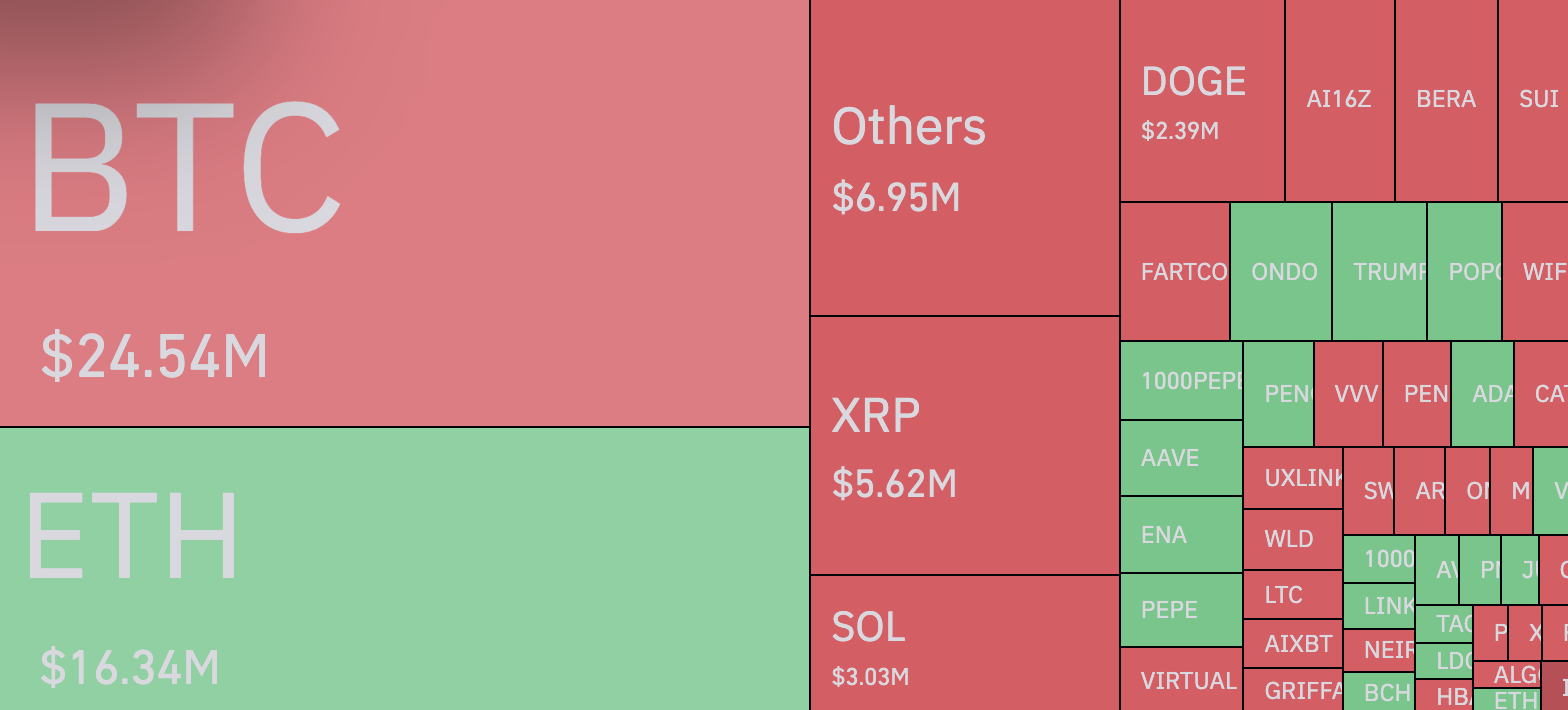

In the course of this, the bears, or sellers as they’re extra generally recognized, felt probably the most ache. Based on CoinGlass, the quantity of liquidated quick positions jumped to over $46 million within the final hour.

To place that in perspective, there was a complete of $106 million briefly liquidation over the past 24 hours, so virtually half of that got here from this spike in Bitcoin to $100,000.

Since then, the value of BTC has cooled off a bit, however such giant worth actions shouldn’t be shocking given the market circumstances of the previous few days. It will not be shocking to see the value transfer from $97,000 to $100,000 within the close to future.

One factor to control, nonetheless, is how the value of BTC will maintain the weekly shut. Ought to Bitcoin enter subsequent week with a six-figure shut close to its title, it would preserve the bullish bias for days to come back and inject a brand new sense of optimism into the market.