Bitcoin has skilled important value swings previously 24 hours, briefly surpassing the $100,000 mark earlier than retracing. The sudden drop displays the continued market uncertainty, with merchants reacting to short-term volatility.

Nonetheless, long-term stability seems to be taking form, largely supported by mature traders holding onto their positions.

Bitcoin has Taken A Completely different Strategy

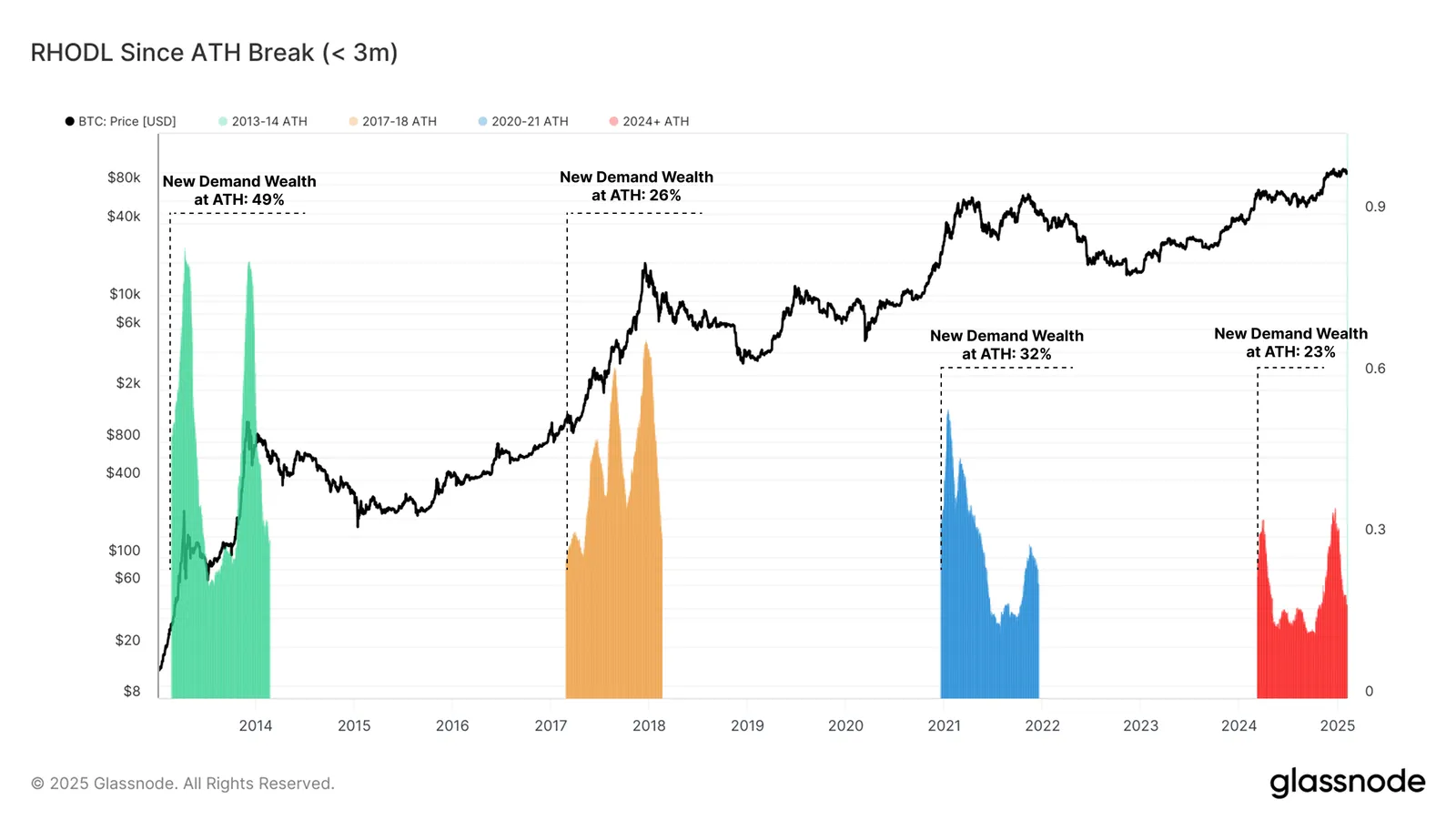

The RHODL (Realized HODL) ratio since Bitcoin’s current all-time excessive (ATH) sits at 23%. Whereas new demand stays important on this cycle, the wealth held in cash older than three months is way decrease than in earlier cycles. This means that new demand inflows have been occurring in bursts reasonably than in a sustained sample.

In contrast to earlier market cycles, which generally concluded one yr after the primary ATH break, the present cycle has taken an atypical trajectory. Bitcoin first reached a brand new ATH in March 2024, but demand has but to match the degrees seen in previous rallies. This deviation raises questions on how the remainder of the cycle will unfold.

Realized volatility on a three-month rolling window stays beneath 50% on this cycle. In distinction, previous bull runs noticed volatility ranges exceeding 80% to 100%. This discount in volatility means that Bitcoin’s value motion is extra structured, with mature traders contributing to a extra steady market atmosphere.

The 2023-25 cycle has adopted a stair-stepping sample, with value rallies adopted by consolidation durations. In contrast to earlier cycles characterised by excessive swings, Bitcoin’s present trajectory reveals indicators of gradual value will increase. This pattern helps a extra managed bull market, decreasing the chance of maximum crashes.

BTC Worth Prediction: Holding Above A Essential Assist

Though Bitcoin’s long-term outlook stays unsure as a result of rising short-term volatility, the quick forecast suggests vulnerability to correction. The cryptocurrency is buying and selling near key help ranges, and additional declines might result in a deeper retracement.

If Bitcoin loses the $95,869 help stage, it could drop towards $93,625. Whereas BTC holders have shunned important profit-taking, additional losses might set off a wave of promoting. This situation would put extra stress on the worth, extending Bitcoin’s correction.

Then again, a bounce off $95,869 might allow Bitcoin to reclaim the $100,000 stage. Efficiently breaching this psychological barrier would invalidate the bearish outlook, probably setting the stage for a renewed uptrend.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.