XRP value has dropped 22% previously week, with technical indicators displaying each bearish stress and indicators of potential stabilization. The RSI stays impartial after a pointy rebound from oversold ranges earlier this month, whereas the variety of whales has stabilized after a short surge.

In the meantime, XRP’s Exponential Transferring Averages (EMAs) have fashioned a bearish loss of life cross, suggesting that draw back dangers stay except a reversal takes form. Including to the broader market narrative, XRP ETFs at the moment are eyeing SEC approval following Cboe’s 19b-4 submitting, which may play a key position in shaping future value motion.

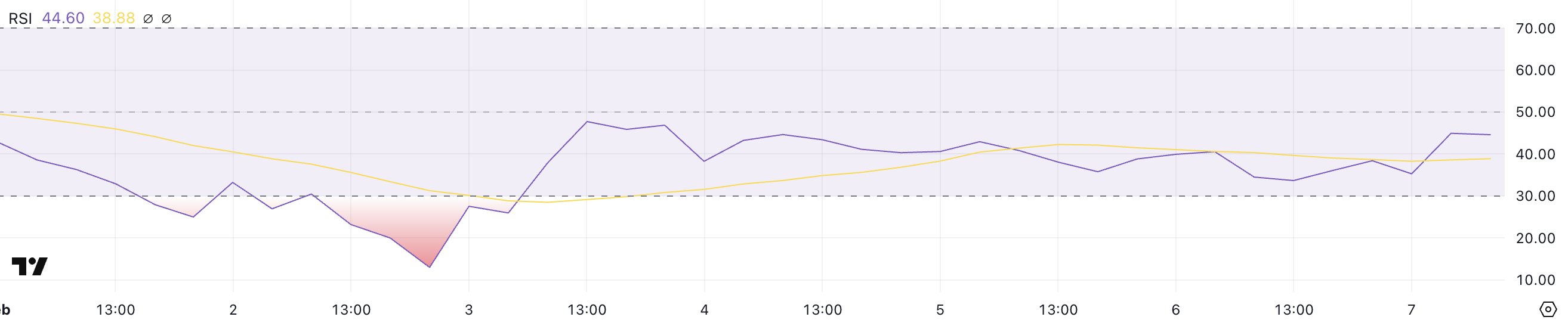

XRP RSI Is Nonetheless Impartial, Following The Similar Sample Since February 3

XRP Relative Energy Index (RSI) has surged from 35.2 to 44.6 in only a few hours, reflecting a shift in momentum after current weak spot. This improve suggests rising shopping for curiosity, although XRP stays inside a impartial vary.

RSI is a broadly used momentum indicator that oscillates between 0 and 100. It helps merchants gauge whether or not an asset is overbought or oversold.

Usually, an RSI above 70 signifies overbought circumstances, the place costs could also be due for a correction, whereas an RSI under 30 indicators oversold territory, usually a possible shopping for alternative. Values between 30 and 70 are thought-about impartial, that means the market is neither in a powerful bullish nor bearish part.

Since February 3, XRP RSI has remained in impartial territory after hitting excessive lows of round 13 on February 2. This rebound means that the extraordinary promoting stress that drove XRP to oversold ranges has subsided, permitting value stabilization.

With the RSI now at 44.6, momentum is progressively shifting towards the higher finish of the impartial vary.

Whereas this isn’t but a transparent bullish sign, it signifies rising demand, which may result in XRP testing resistance ranges if shopping for stress continues. A sustained push above 50 can be a stronger affirmation of bullish momentum, probably opening the door for additional upside in value motion.

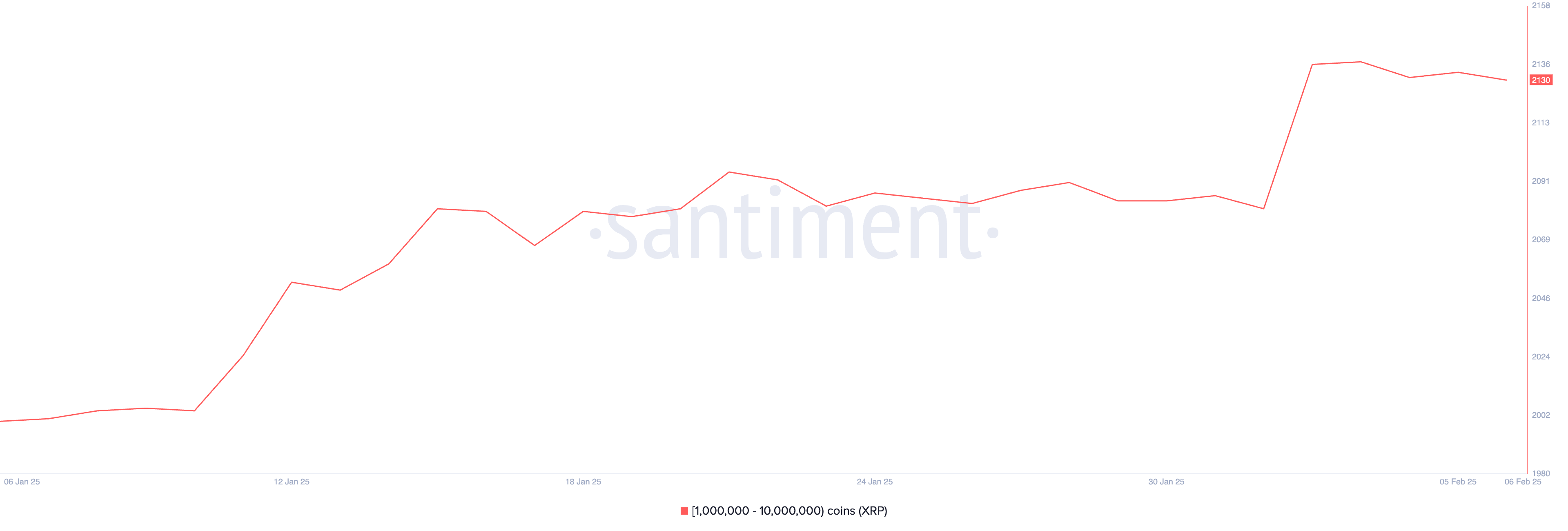

XRP Whales Are Slowly Declining After Surging 6 Days In the past

The variety of XRP whales – addresses holding between 1,000,000 and 10,000,000 XRP – at present stands at 2,130. This determine surged from 2,081 to 2,136 between February 1 and February 2, indicating a pointy accumulation part earlier than slowly declining.

Monitoring these massive holders is essential as they usually have the flexibility to affect market tendencies because of the sheer quantity of XRP they management.

When whale exercise will increase, it might probably sign rising confidence amongst high-net-worth buyers, whereas a decline could point out profit-taking or a shift in sentiment.

With the present variety of XRP whales stabilizing at 2,130 after a short surge, the market seems to be in a consolidation part. If the variety of whales continues to drop, it may counsel that some massive holders are offloading their positions, probably resulting in short-term value weak spot.

Nonetheless, if the decline stabilizes or reverses into one other accumulation part, it may point out renewed confidence in XRP’s prospects. A sustained improve in whale addresses can be a bullish sign.

This implies that institutional or large-scale buyers see long-term worth in XRP and are positioned for potential future upside.

XRP Value Prediction: Will XRP Commerce Above $3 In February?

XRP’s Exponential Transferring Common (EMA) strains point out a bearish setup, as a brand new loss of life cross fashioned two days in the past. This happens when short-term EMAs cross under long-term EMAs, signaling sustained downward momentum.

Over the previous seven days, XRP value has declined by 22%, reinforcing the adverse sentiment.

If the bearish pattern persists, key help ranges to look at are at $2.32, with additional draw back potential to $2.20 and even $1.99 if promoting stress intensifies.

The continued positioning of short-term EMAs under long-term EMAs means that bears nonetheless have management, and a failure to carry vital help ranges may result in additional draw back exploration.

Nonetheless, a pattern reversal may shift momentum in XRP’s favor, with the primary resistance stage at $2.60. If consumers regain energy and push XRP past this mark, the following targets lie at $2.82 and probably above $3.

Ought to XRP value get well the bullish momentum seen in earlier months, probably pushed by the SEC’s approval of the XRP ETF, it may prolong beneficial properties towards $3.15, a stage that may point out renewed confidence in its uptrend.

Disclaimer

In keeping with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.