One other day, one other batch of recent tokens making their approach onto Coinbase’s roadmap. This time, the U.S.-based trade has added three new cryptocurrencies to the combination: Morpho (MORPHO), Pudgy Penguins (PENGU) and Popcat (POPCAT).

A roadmap inclusion, as at all times, doesn’t assure a full itemizing, but it surely does give merchants a heads-up about what is perhaps subsequent. Extra transparency, fewer surprises — not less than in concept.

Who received the shot?

Meme cash refuse to fade, and Coinbase is aware of it. POPCAT and PENGU? Each lean closely into web tradition. Popcat takes its inspiration from a picture of a cat named Oatmeal, which turned a viral phenomenon in 2020.

From Instagram music edits to on-line clicker video games, the meme refused to die, and ultimately, it discovered its approach into crypto. There is no such thing as a complicated tech behind it – simply neighborhood enthusiasm fueling its existence.

Pudgy Penguins (PENGU) function on Solana as a neighborhood token, however its attain goes past blockchain. The Ethereum-based NFT assortment of 8,888 distinctive, randomly generated penguins has constructed a model round itself. From digital collectibles to real-world merchandise like Pudgy Toys and even Pudgy World, this venture is making strikes past the crypto bubble.

Morpho (MORPHO) is a distinct story. Not like the meme-heavy picks, this one is all about DeFi. It’s a non-custodial lending protocol that optimizes borrowing and lending processes on Aave and Compound.

As an alternative of conventional pool-based lending, Morpho matches lenders and debtors instantly, making transactions extra environment friendly. Much less unfold, higher charges, extra capital effectivity.

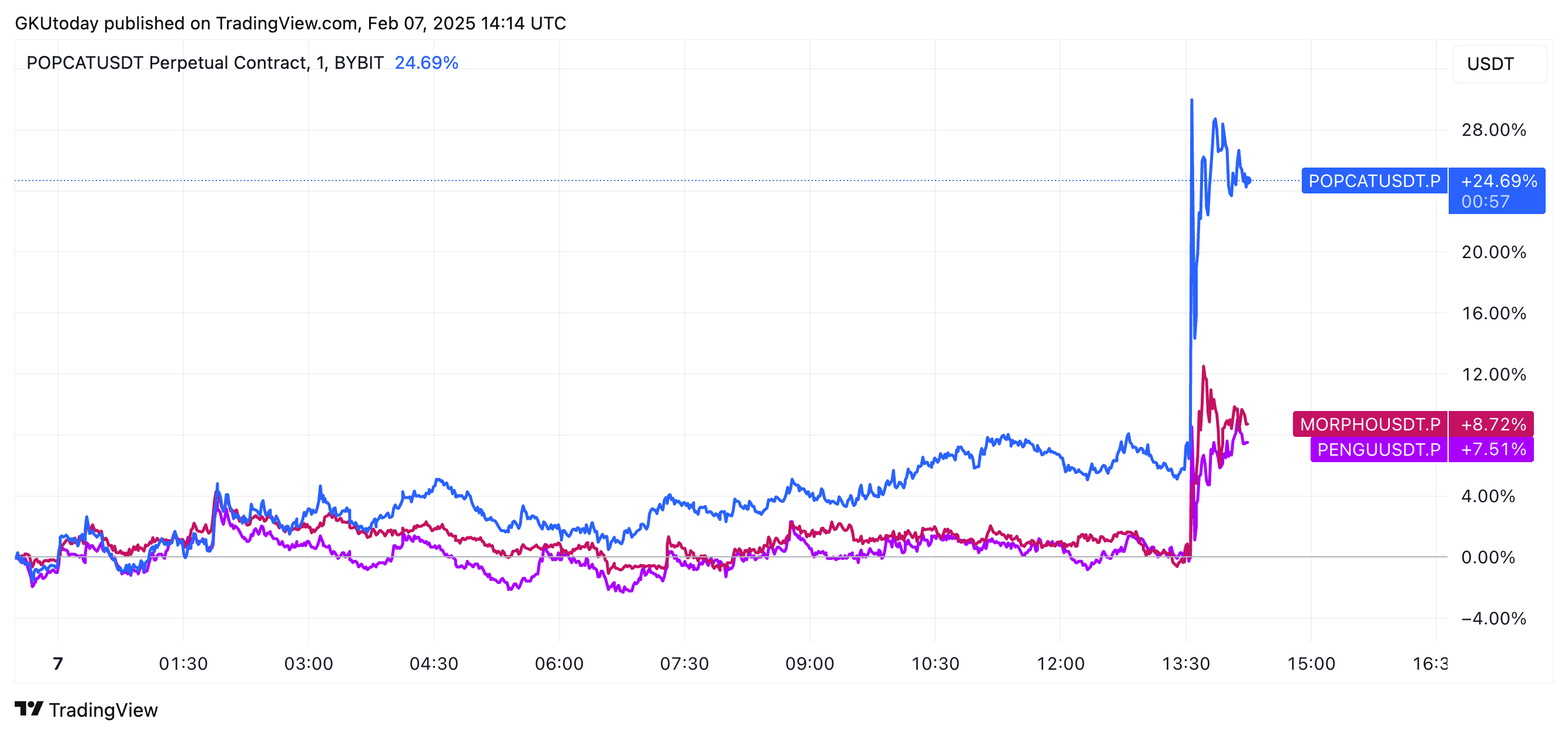

Then there may be the market response — predictable, but at all times intriguing. Following the announcement, costs moved. POPCAT jumped 25%, residing as much as its identify. Morpho noticed an 8% enhance. PENGU adopted go well with with the same achieve. Merchants who received in early? They’re doubtless happy.