- Over $883 million ETH absorbed in a single day.

- Large gamers quietly including to their Ethereum holdings.

- Solana’s rise provides strain, however ETH’s adaptability stays key.

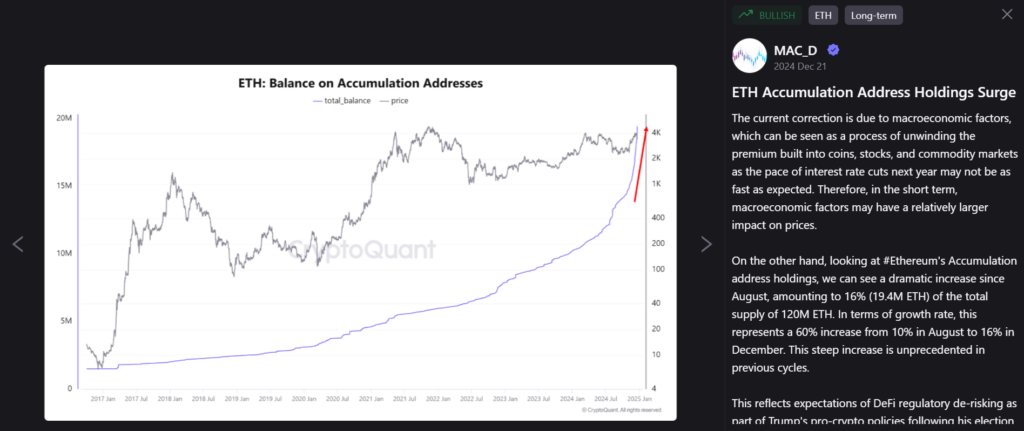

Ethereum accumulation addresses noticed a large spike on February 7, hinting at a rising perception in its long-term potential. Information from CryptoQuant revealed that over 330,705 ETH—valued at round $883 million—flowed into these addresses in a single day. That is the most important day by day influx on report, pushing the entire ETH held by long-term holders to a staggering 19.24 million.

For those who’re questioning what accumulation addresses are, consider them as vaults. These wallets obtain ETH constantly with out sending any out. They’re usually owned by long-term holders, establishments, or entities with a method to build up relatively than commerce. When inflows spike in these wallets, it’s often a sign that confidence in Ethereum’s future is rising—and it typically precedes value rallies.

A fantastic instance? Again in February 2023, when accumulation addresses hit a report influx of 244,000 ETH, Ethereum’s value surged 35% over the next two months. It’s no assure, however historical past has a approach of repeating itself in crypto.

Institutional Curiosity and Whale Exercise Develop

Ethereum’s surge in accumulation isn’t nearly retail buyers; institutional curiosity is heating up too. Spot ETFs for Ethereum within the U.S. have seen an increase in inflows, virtually matching the degrees final seen through the market upswing following Donald Trump’s reelection in late 2024. This rising institutional exercise means that greater gamers are positioning themselves for the lengthy haul.

On the similar time, whale addresses—wallets holding between 10,000 and 100,000 ETH—have been steadily rising their balances. Much more intriguing is the rise in retail accumulation. Many smaller buyers have taken benefit of Ethereum’s current value dip to purchase at multi-week lows, including to the general development of long-term accumulation.

CryptoQuant analyst MAC_D factors out that these massive inflows replicate confidence in potential regulatory de-risking underneath Trump’s pro-crypto insurance policies. It’s a transparent sign that sensible cash is piling in, no matter present value weak spot.

Competitors and the Highway Forward

Regardless of the optimistic indicators, Ethereum’s journey gained’t be with out challenges. Its multi-year hunch towards Bitcoin is one among them, with the ETH/BTC pair nonetheless down considerably from its 2021 highs. In the meantime, competitors from layer-1 blockchains like Solana has been fierce. Solana’s fast adoption and scalability have attracted tasks in DeFi and NFTs, areas the place Ethereum as soon as dominated.