This week, the crypto market recorded a number of essential developments, from US commerce insurance policies and token listings to blockchain and regulatory developments. The highlights show how the worldwide cryptocurrency ecosystem continues to advance.

The next is a roundup of essential developments that occurred this week however will proceed shaping the sector.

Trump’s Tariffs Shake World Markets

US President Donald Trump stirred the worldwide commerce market earlier this week, proposing tariffs towards Canada, Mexico, and China. This new spherical of commerce restrictions was aimed toward defending home industries.

Following the preliminary announcement, Canada and Mexico pushed again, resulting in momentary delays in some tariff purposes. Mexico, particularly, secured a short-term reprieve as each nations entered new negotiations with the US authorities.

“We had dialog with President Trump with nice respect for our relationship and sovereignty; we reached a sequence of agreements. Our groups will start working in the present day on two fronts: safety and commerce. Tariffs will probably be paused for one month from now,” Mexican President Claudia Sheinbaum shared on X (Twitter).

In opposition to this backdrop, analysts noticed Bitcoin’s Coinbase Premium Index hitting a 2025 excessive, indicating elevated demand in North America. Traders look like shifting towards Bitcoin as a hedge towards doable financial instability brought on by these commerce insurance policies.

In the meantime, China retaliated, imposing a ten% tariff on US crude oil and agricultural equipment on its exports to the US. Whereas this reignited fears of one other extended commerce conflict, some analysts argue that China’s newest tariffs might not have as extreme an impression as initially feared.

UAE Faucets Shiba Inu

BeInCrypto additionally reported the United Arab Emirates (UAE) is advancing its aggressive push towards turning into a worldwide chief in Web3 adoption. This week, Shiba Inu (SHIB) was chosen to combine blockchain into varied authorities companies. The partnership will facilitate blockchain-based options throughout sectors, enhancing effectivity and safety.

“By embracing rising applied sciences, we intention to set a worldwide benchmark for innovation, delivering transformative options that profit each our residents and the broader group,” His Excellency Eng Sharif Al Olama, Undersecretary for Power and Petroleum Affairs at UAE’s Ministry of Power and Infrastructure, acknowledged.

Past this collaboration, the UAE stays one of the crypto-friendly jurisdictions, bolstered by its tax exemption coverage for digital asset corporations. With no company tax levied on crypto companies, the nation attracts world blockchain corporations and expertise, positioning itself as a pivotal participant within the digital economic system.

The worth of Shiba Inu briefly surged after the announcement. At press time, the meme coin was buying and selling at $0.00001563.

Coinbase Mulls Two Altcoins for Itemizing

Coinbase, the biggest US-based crypto change, added two new altcoins—Ether.fi (ETHFI) and Bittensor (TAO)—to its itemizing roadmap. Following the announcement, the tokens’ values surged by almost 40%, reflecting the standard value motion seen when belongings achieve visibility on main exchanges.

Traditionally, tokens listed on Coinbase or Binance change are likely to witness vital value appreciation because of elevated accessibility and liquidity. For instance, Binance’s latest addition of AI-powered altcoins led to cost spikes throughout the sector. Equally, the TOSHI token soared upon the Coinbase itemizing announcement.

Cognizant of such turnouts, buyers typically monitor these itemizing bulletins in a calculated try to capitalize on anticipated features.

SEC Litigator Reassignment

The US Securities and Trade Fee (SEC) lately reassigned one among its lead litigators to the company’s IT division. What was shocking, nevertheless, was that litigator Jorge Tenreiro was pivotal within the high-profile Ripple (XRP) case.

Ripple has been in a authorized battle with the SEC over classifying XRP as a safety. The reassignment suggests a doable shift in regulatory focus. Particularly, it fueled hypothesis that the SEC is likely to be stepping again from its aggressive strategy towards XRP. It additionally meant a doable imminent finish to the longstanding case.

Certainly, the fee has given a number of hints that it’s going to drop the Ripple case. Most lately, the SEC fully eliminated the lawsuit from its web site. Reassigning Tenreiro to a non-crypto-related position additional means that the lawsuit is likely to be coming to an finish.

These adjustments comply with the latest resignation of former SEC chair Gary Gensler. In his place, SEC commissioner Mark Uyeda stepped in as interim chair, doubtlessly laying the groundwork for Paul Atkins.

UBS Brings Gold Buying and selling to Blockchain

Including to the record of fascinating issues that occurred in crypto this week, UBS unveiled a brand new initiative. BeInCrypto reported that the Swiss banking large built-in gold buying and selling with blockchain know-how.

The financial institution is leveraging Ethereum’s zkSync layer to facilitate safe and clear gold transactions on the blockchain. This marks one other vital step in conventional finance (TradFi) adopting decentralized ledger know-how.

The transfer by UBS might improve effectivity in gold markets. Particularly, it might present a extra accessible and verifiable technique of buying and selling the valuable metallic.

As extra monetary establishments discover blockchain for asset tokenization, Ethereum continues establishing itself as a most well-liked platform for institutional adoption.

XRP ETF Eyes SEC Approval

In one other main growth for XRP, Cboe World Markets filed a 19b-4 software with the SEC—the choices change plans to launch an XRP-based exchange-traded fund (XRP ETF). If permitted, this is able to mark a big milestone for institutional adoption of XRP.

XRP ETF approval would supply buyers with a regulated and handy solution to achieve publicity to the asset, which might enhance liquidity and value stability for the XRP token.

Given the continuing authorized battle between Ripple and the SEC, the approval course of is predicted to face scrutiny. However, market members stay optimistic a couple of favorable consequence following Gensler’s ouster.

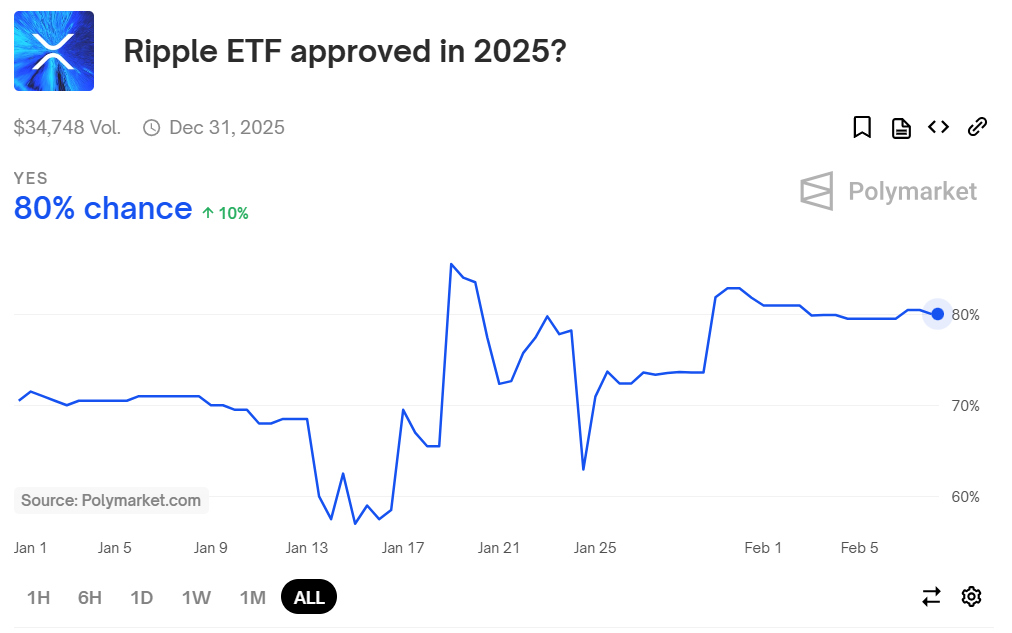

On the prediction platform Polymarket, the chance of an XRP ETF receiving approval in 2025 has been strikingly excessive. The percentages stood at a notable 80% on the time of this report.

MicroStrategy Rebrands to Technique

MicroStrategy, one of many largest company holders of Bitcoin, rebranded itself this week, taking the moniker “Technique.” The transfer aligns with its dedication to Bitcoin accumulation and adoption of blockchain know-how.

“Technique is likely one of the strongest and optimistic phrases within the human language. It additionally represents a simplification of our firm identify to its most essential, strategic core. After 35 years, our new model completely represents our pursuit of perfection,” The agency’s government chair, Michael Saylor, defined.

Below Michael Saylor’s management, the corporate has persistently elevated its Bitcoin holdings, viewing it as a long-term asset. The rebranding reinforces its dedication to leveraging Bitcoin for company treasury administration and institutional funding methods.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.