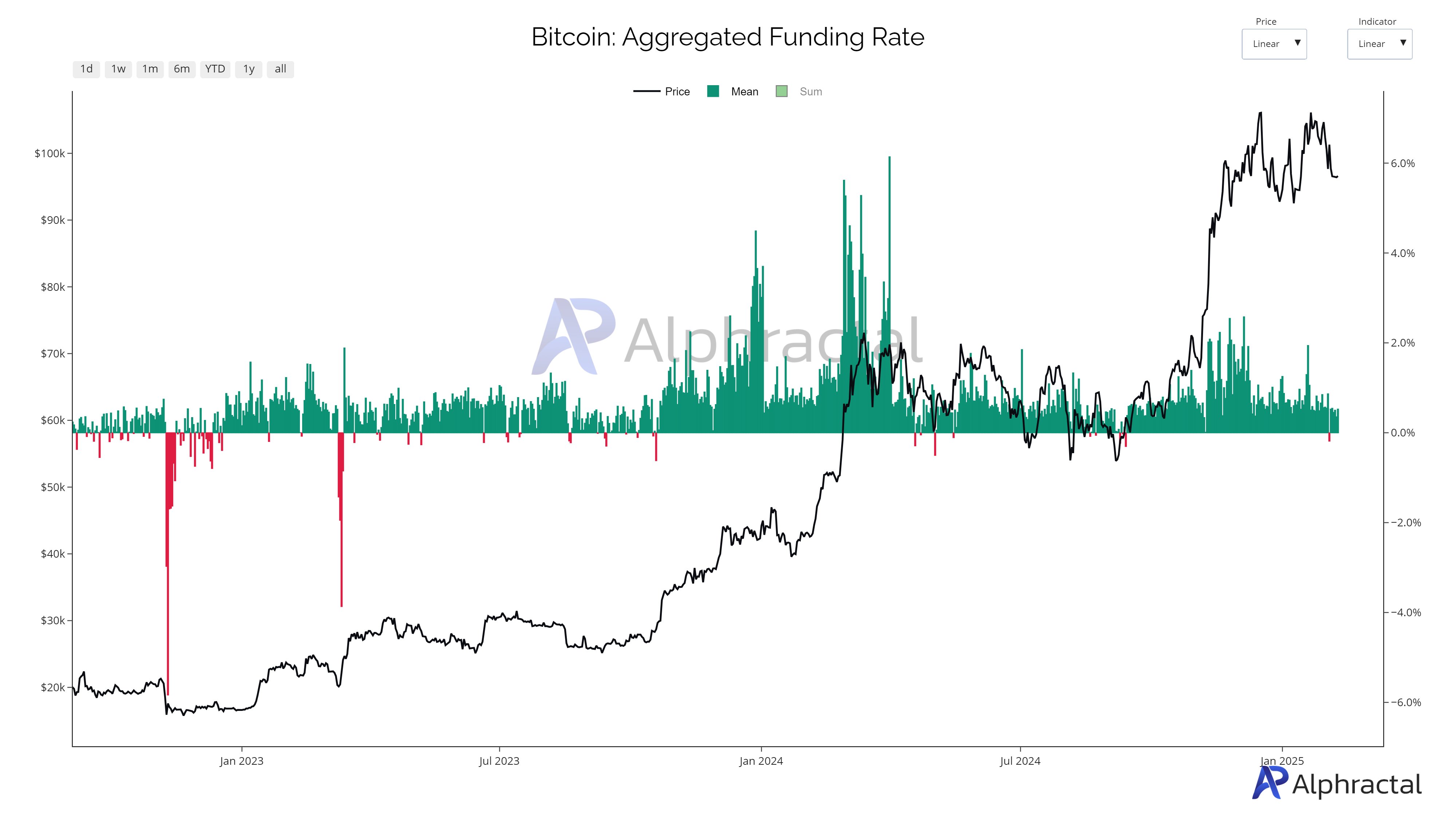

Alphractal, a cryptocurrency analytics agency, has launched a brand new evaluation of Bitcoin, highlighting that regardless of latest worth drops, the general funding fee throughout main exchanges stays constructive.

This signifies that extra merchants are betting on Bitcoin’s worth to rise, with lengthy positions paying charges each eight hours, whereas quick positions obtain compensation.

At present, the funding charges are principally constructive, apart from BitMEX and OKX, that are seeing detrimental charges. Bitfinex stands out with the best constructive fee.

Alphractal has outlined two potential eventualities primarily based on these funding developments: one means that sustained constructive charges might replicate over-optimism, probably resulting in a threat of liquidation if Bitcoin’s worth falls additional.

Then again, if funding charges flip detrimental throughout all platforms, it might mark the beginning of a bearish part dominated by quick merchants.

Whereas Bitcoin has seen some downward motion, the general constructive funding fee means that market sentiment hasn’t fully turned bearish but. Nonetheless, Alphractal advises warning, as sudden shifts in funding charges might point out a big change in market dynamics.