Regardless of latest value declines, crypto inflows soared to $1.3 billion final week. It marks the fifth consecutive week of constructive inflows, demonstrating sustained investor confidence within the cryptocurrency market.

Apparently, Ethereum inflows virtually doubled the constructive flows into Bitcoin, marking a notable paradigm shift.

Crypto Inflows Reached $1.3 Billion Final Week

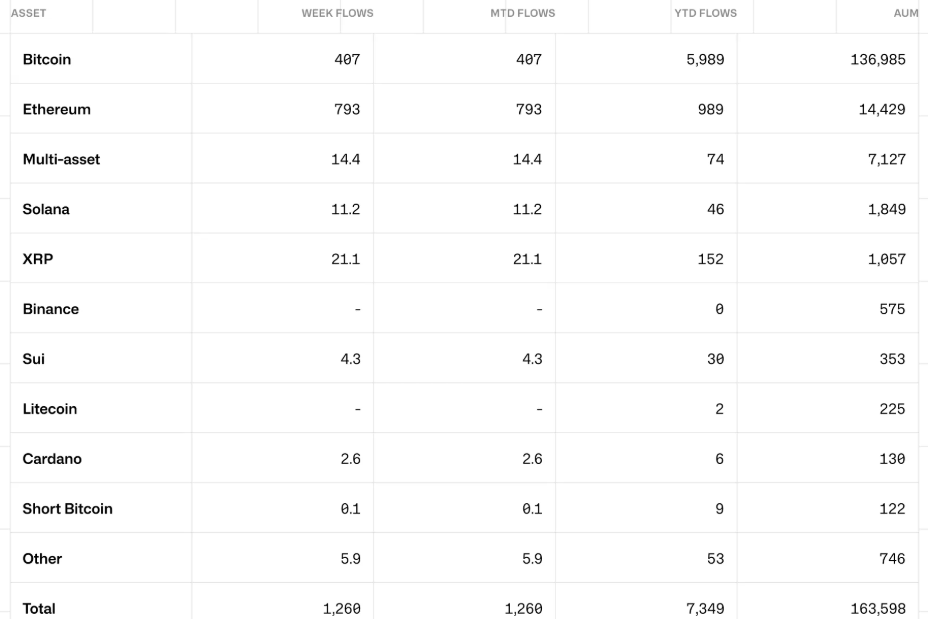

The most recent CoinShares report signifies that crypto inflows reached $1.3 billion final week. Particularly, Bitcoin noticed inflows of $407 million, whereas Ethereum noticed important ‘shopping for the dip’ after its value dropped to $2,500, resulting in inflows of $793 million.

Analysts attribute Ethereum’s inflows to the hype across the upcoming Pectra improve.

“Ethereum continues to be holding its uptrend assist since Might 2023. Final week, Ethereum ETFs had over $400 million in inflows. ETH large upgrades are coming subsequent month. Trump continues to be shopping for and holding ETH. Mark my phrases; As soon as Ethereum goes above $4,000, it’ll pump like loopy,” one analyst noticed.

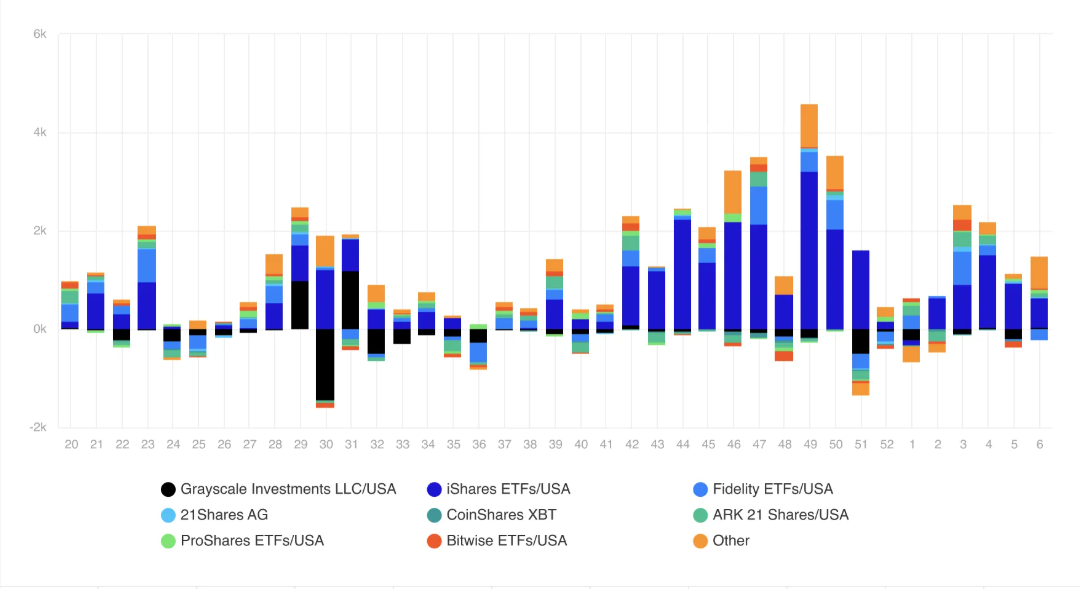

This surge in crypto inflows follows per week the place crypto investments noticed $527 million in inflows amid the DeepSeek AI frenzy and Donald Trump’s tariffs on a number of nations. The continued curiosity highlights how institutional and retail traders capitalize on market dips to build up digital property.

Nevertheless, the market corrections over the 5 buying and selling classes noticed the AUM (asset underneath administration) of ETPs drop to $163 billion. This represents a drop of round 10% from the all-time excessive of $181 billion established in late January.

However, international ETPs stay the biggest Bitcoin holder in comparison with another entity.

“With ETPs globally now representing 7.1% of the present market capitalization, making them the biggest holder relative to another entity,” an excerpt within the report said.

Buying and selling volumes remained regular at $20 billion for the week, suggesting energetic repositioning amongst merchants and traders amid latest value fluctuations. US President Donald Trump’s tariffs have been a key set off for the corrections, resulting in a historic liquidation occasion within the crypto market.

Extra Altcoin ETFs on the Horizon

In a associated growth, Nasdaq has formally filed 19b-4 varieties with the US SEC (Securities and Alternate Fee) to checklist and commerce two ETPs from CoinShares. First, the CoinShares XRP ETF and second, the Litecoin ETF, with the proposed funds anticipated to offer traders publicity to XRP and LTC, respectively.

CoinShares is just not alone—different companies akin to Grayscale, WisdomTree, Bitwise, and Canary Capital have additionally submitted filings for an XRP ETF, as reported in latest filings with the SEC.

Ripple CEO Brad Garlinghouse just lately said that an XRP ETF is inevitable, emphasizing the rising demand for structured funding automobiles that present regulated publicity to the asset.

Equally, Litecoin ETFs are gaining traction, with Canary Capital and Grayscale making use of for his or her respective funds. Nasdaq has additionally filed to checklist a Litecoin ETF, additional reflecting the increasing marketplace for crypto funding merchandise.

This surge in ETF filings aligns with broader business traits, the place institutional gamers search regulated funding automobiles for different digital property.

As hypothesis round a Litecoin ETF builds, on-chain knowledge reveals that whales are growing their LTC holdings, anticipating potential regulatory approval.

Such accumulation traits have traditionally been early indicators of sturdy institutional and retail demand.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.