Ethereum has shed 18% of its worth over the previous month. As its value continues to slip, the proportion of ETH’s provide held in revenue has fallen to its lowest degree since October, signaling mounting challenges for the altcoin.

With the strengthening of promoting stress, ETH holders could report extra short-term losses on their investments.

Ethereum Holders Depend Their Losses

ETH’s double-digit decline has pushed its value beneath the essential assist fashioned at $3,000. The altcoin at present trades at $2,640 and stays beneath vital bearish stress.

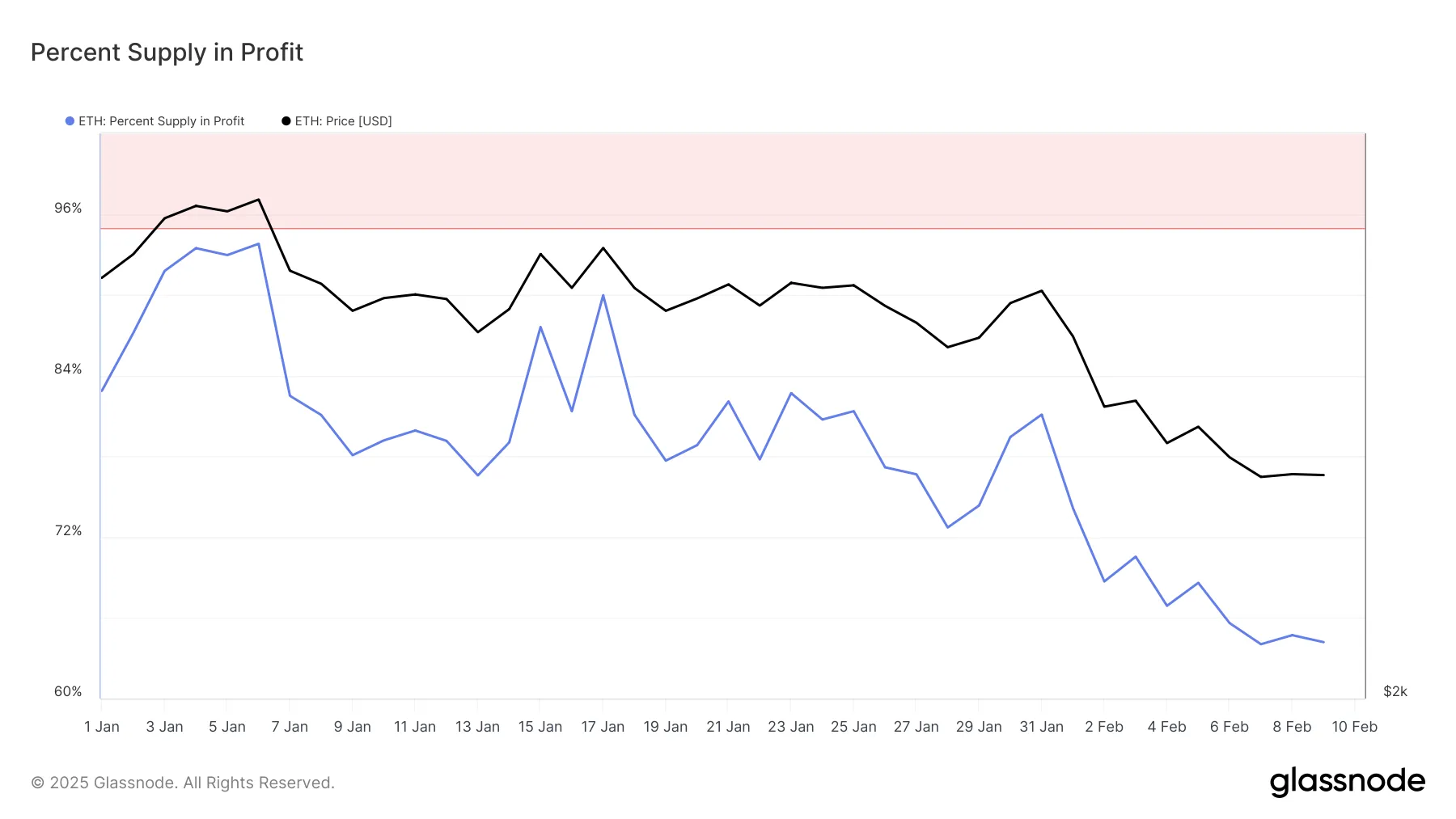

The latest value drop has pushed many Ethereum holders into the pink. In accordance with Glassnode, the proportion of ETH’s circulating provide in revenue has plummeted to its lowest level since October. As of now, simply 64.19% of Ethereum’s whole circulating provide is in revenue. Put in another way, 48 million ETH out of 121 million ETH stays in revenue.

For context, as of January 1, 83% of ETH’s whole circulating provide was in revenue. When the proportion of an asset’s circulating provide in revenue drops, a bigger portion of holders at the moment are dealing with losses, because the asset’s market value has fallen beneath their buy value.

This decline typically alerts lowered investor confidence and might point out potential draw back dangers for the asset’s value.

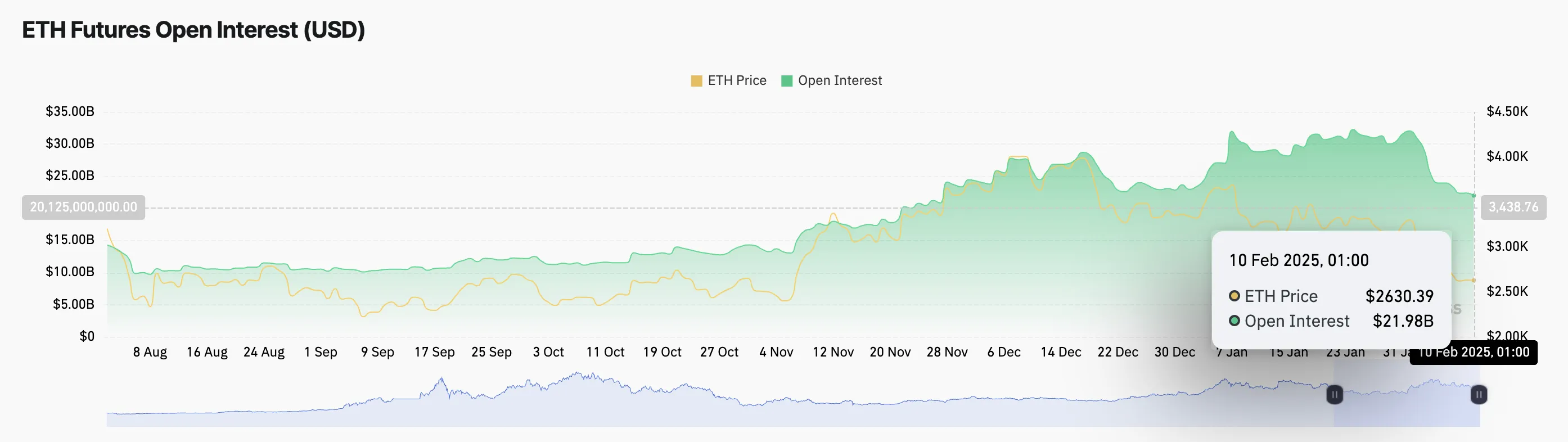

Notably, ETH’s open curiosity has additionally declined, confirming the lower in investor confidence. As of this writing, this stands at $22 billion, falling by 31% for the reason that starting of February.

Open curiosity measures the overall variety of excellent contracts (lengthy or brief), resembling futures or choices that haven’t been settled. When open curiosity drops like this, it signifies a lower in market exercise or investor participation, which may counsel lowered confidence or a shift in market sentiment.

ETH Worth Prediction: Drop to $2,224 or Reversal to $2,811?

On the each day chart, ETH trades on the decrease line of its descending channel, which kinds assist at $2,553. If selloffs acquire extra momentum, the bulls could also be unable to defend this degree, inflicting ETH’s value to increase its losses.

In that situation, the coin’s value may drop to $2,500 or decrease to $2,224.

Nonetheless, a reversal within the present market pattern will invalidate this bearish projection. In that case, ETH’s value may resume its uptrend and climb to $2,811.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.