Ethereum (ETH) rival Solana (SOL) skyrocketed a number of multiples when it comes to whole worth locked (TVL) within the final quarter of 2024, Messari’s newest information reveals.

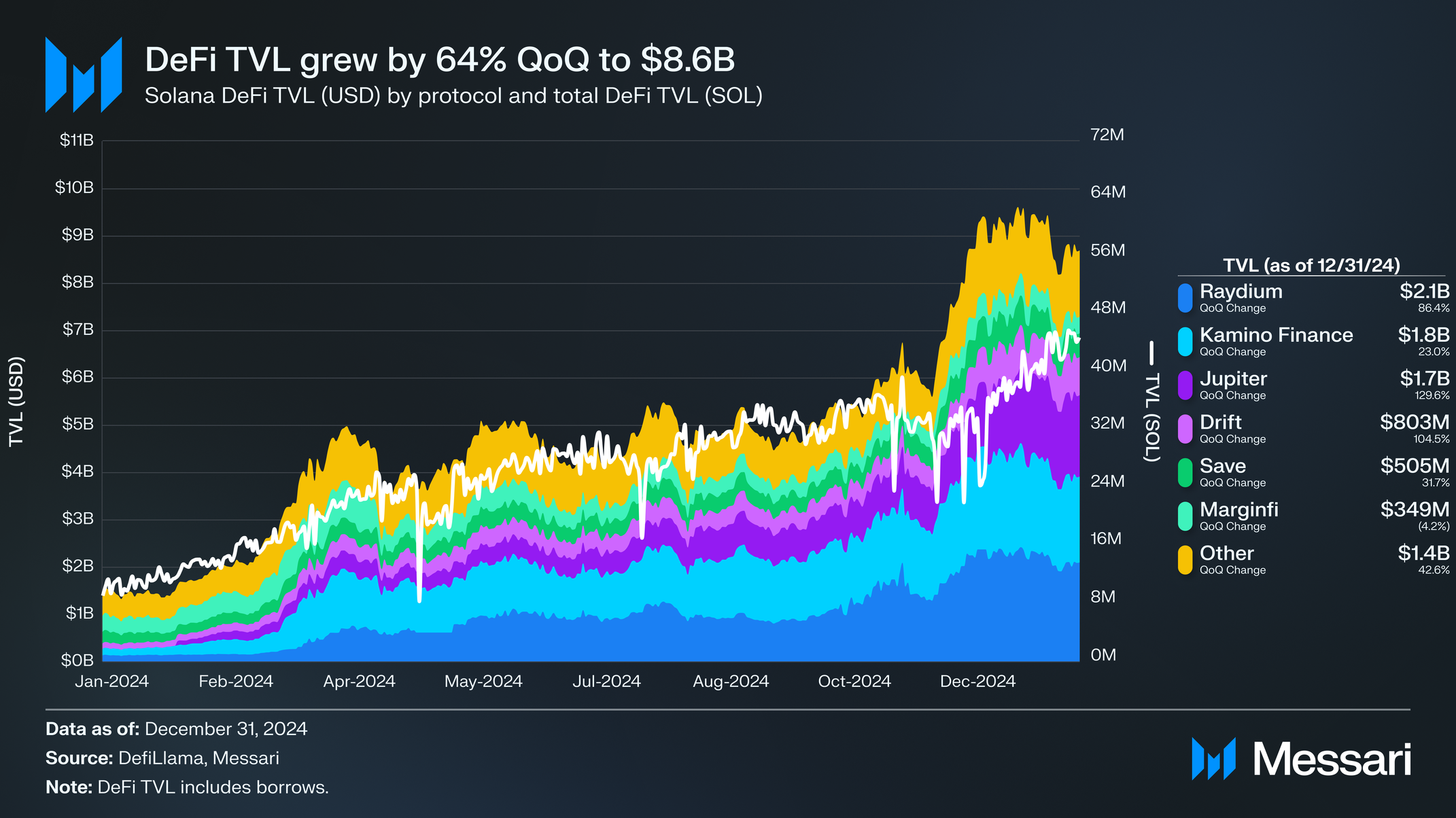

In its new “State of Solana This autumn 2024” report, the crypto analytics agency notes that TVL on Solana grew by 64% quarter-on-quarter (QoQ) and 486% year-on-year (YoY) to $8.6 billion, rating it second amongst blockchains, surpassing Tron (TRX) in November.

TVL refers back to the whole worth of digital belongings locked or staked inside a blockchain or utility’s sensible contracts.

Main the cost on Solana, in line with Messari, was Raydium, which is presently the most important decentralized trade (DEX) on the community. Raydium’s TVL grew 86% QoQ and ended This autumn with a 24% market share.

Messari says Raydium’s dominance could be attributed to speculators buying and selling memecoins and synthetic intelligence (AI)-related crypto belongings.

“Solana continued to determine its place as a dynamic power within the blockchain ecosystem all through This autumn 2024. The quarter noticed outstanding development throughout a number of sectors, together with DeFi, liquid staking, NFTs (non-fungible tokens), and institutional involvement.

DeFi (decentralized finance) remained a cornerstone of the expansion on Solana, with its Whole Worth Locked (TVL) hovering by 64% to $8.6 billion, securing the community’s place because the second-largest within the house. This improve was pushed by important jumps in lending platforms and decentralized exchanges (DEXs), with Raydium and Jupiter main the cost in day by day volumes. The memecoin development offered additional momentum, boosting utility revenues and market exercise. In the meantime, the liquid staking charge rose by 33% QoQ to 11.2%, solidifying its position within the rising yield-bearing SOL ecosystem.”

You possibly can learn the complete Messari report right here.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE3