Este artículo también está disponible en español.

In a dramatic shift, hedge funds seem like ramping up quick positions in Ethereum at a charge not seen earlier than, sparking questions on whether or not the second‐largest cryptocurrency by market capitalization may very well be going through troubled waters—or if one thing else is at play.

In response to famend analysts from the Kobeissi Letter (@KobeissiLetter), quick positioning in Ethereum “is now up +40% in ONE WEEK and +500% since November 2024.” Their findings, shared on X, argue that “by no means in historical past have Wall Road hedge funds been so in need of Ethereum, and it’s not even shut,” prompting the query: “What do hedge funds know is coming?”

Huge Ethereum Quick Squeeze Coming?

The Kobeissi Letter’s thread highlights an excessive divergence between Ethereum’s value motion and futures positioning amongst hedge funds. They level to an particularly unstable interval on February 2, when Ethereum plunged by 37% in simply 60 hours as commerce conflict headlines emerged, wiping out greater than a trillion {dollars} from the crypto market “in HOURS.”

Associated Studying

The analysts word how ETH inflows have been sturdy throughout December 2024—at the same time as hedge funds have been reportedly boosting quick publicity. In response to the Kobeissi Letter: “In simply 3 weeks, ETH noticed +$2 billion of recent funds with a file breaking weekly influx of +$854 million. Nevertheless, hedge funds are betting ETH’s surge and limiting breakouts.”

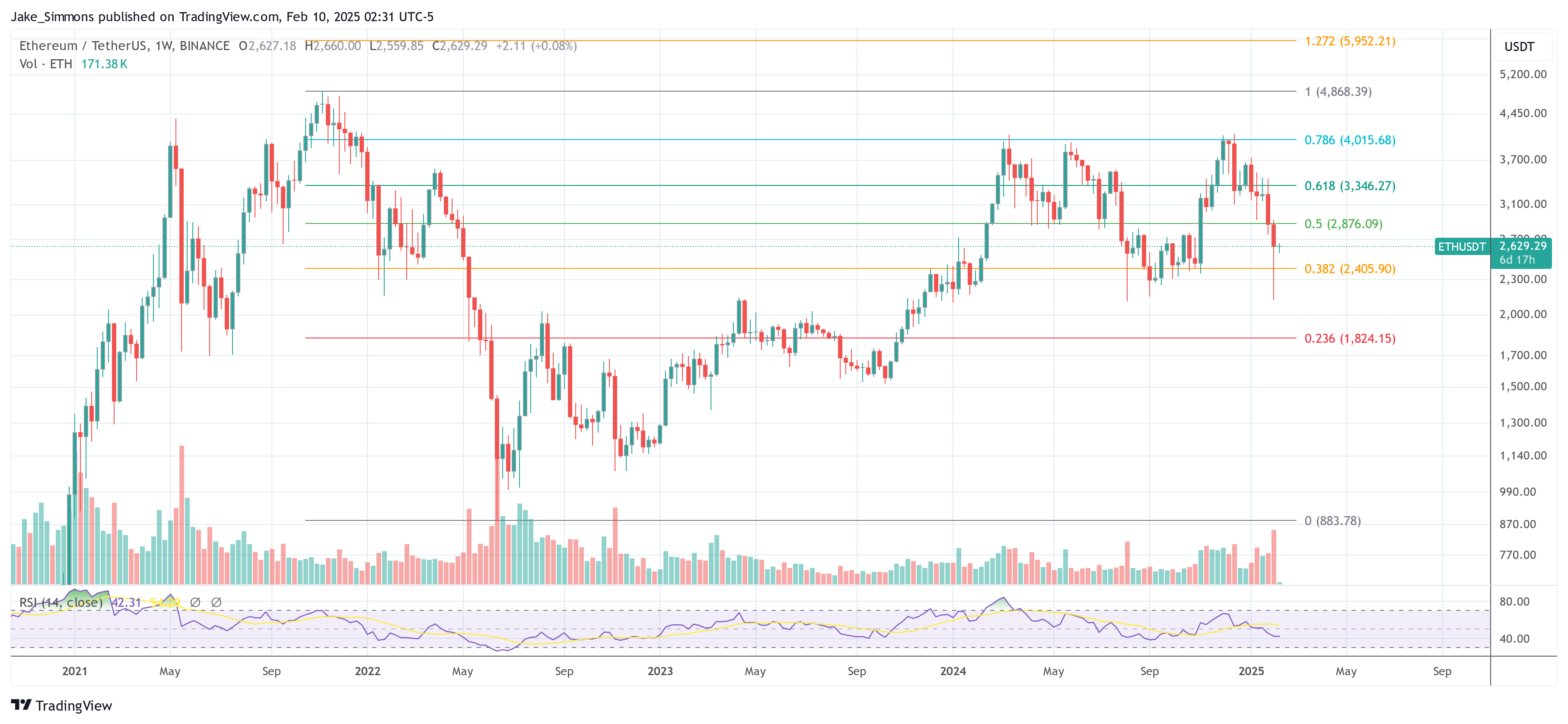

In addition they underscore spikes in Ethereum buying and selling quantity, significantly on January 21 (Inauguration Day) and across the February 3 crash. Regardless of the traditionally excessive inflows, Ethereum’s value has “did not get well the hole decrease at the same time as one week has handed,” and at present trades “~45% under its file excessive set in November 2021.”

One of many largest unknowns stays why hedge funds are so devoted to shorting ETH. The analysts write: “Potential causes vary from market manipulation, to innocent crypto hedges, to bearish outlook on Ethereum itself. Nevertheless, that is quite unusual because the Trump Administration and new regulators have favored ETH. Largely as a result of this excessive positioning, Ethereum has considerably underperformed Bitcoin.”

Associated Studying

The Kobeissi Letter concludes its thread by drawing consideration to Bitcoin’s outperformance and poses the query of whether or not a brief squeeze may very well be within the making: May Ethereum be establishing for a brief squeeze? This excessive positioning means massive swings just like the one on February third will probably be extra frequent. For the reason that begin of 2024, Bitcoin is up ~12 TIMES as a lot as Ethereum. Is a brief squeeze set to shut this hole?”

Glassnode’s CryptoVizArt Fires Again

Not everybody within the crypto analytics sphere is satisfied that the tidal wave of Ethereum quick positions alerts a bearish outlook. Senior researcher at Glassnode, CryptoVizArt.₿ (@CryptoVizArt), took to X to problem the alarmist takes circulating on social media: “Barchart is screaming, ‘Largest ETH quick in historical past!’ and crypto Twitter is working round like headless chickens. Critically, in case you fell for this clickbait headline, it’s time to up your recreation. Let’s set the file straight.”

In an in depth thread, CryptoVizArt factors out that the broadly shared chart on hedge fund quick positions doubtless represents just one subset of the market (e.g., “Leveraged Funds / Hedge Funds/CTAs”) and doesn’t account for different vital market members reminiscent of asset managers, non‐reportable merchants, and on‐chain holders. They add that comparable “huge shorts” have been seen in Bitcoin futures as properly, but BTC outperformed ETH throughout the identical interval.

Moreover, CryptoVizArt emphasizes that CME Ether futures are only one sliver of worldwide crypto derivatives. Liquidity on platforms like Binance, Bybit, OKX, in addition to on‐chain positions and spot markets, supply a broader view than anyone alternate’s information may recommend. “One group’s web quick ≠ all the market is web quick. Hedge positions ≠ purely bearish bets.”

Their last word: a lot of the positioning may very well be a part of “non‐directional methods—reminiscent of money‐and‐carry,” that are impartial methods used to lock in arbitrage beneficial properties and aren’t merely a direct guess in opposition to ETH.

At press time, ETH traded at $2,629.

Featured picture created with DALL.E, chart from TradingView.com