- Ethereum ETFs are drawing important capital, signaling sturdy institutional curiosity in ETH’s future

- Elevated Ethereum ETF volumes and the Pectra improve may spark a possible market rebound

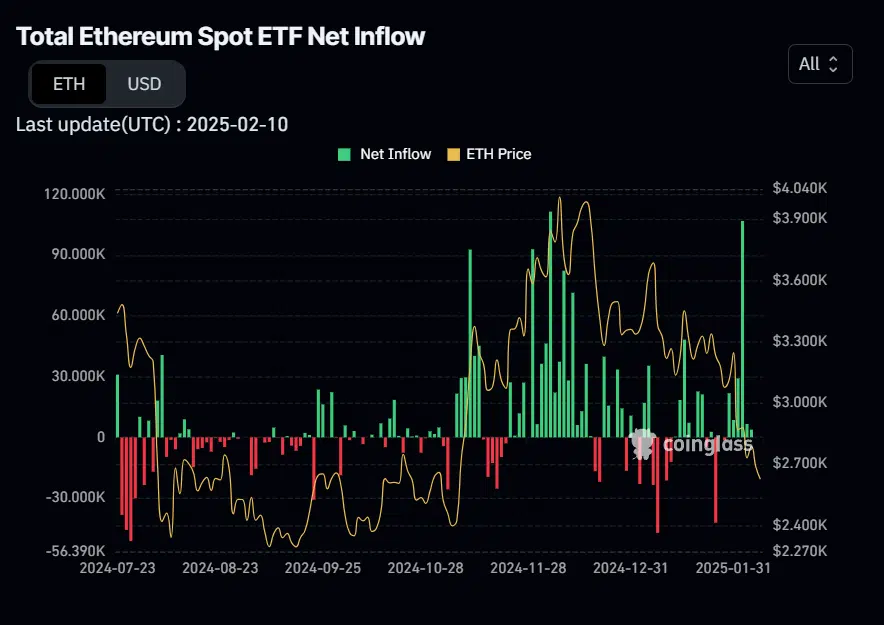

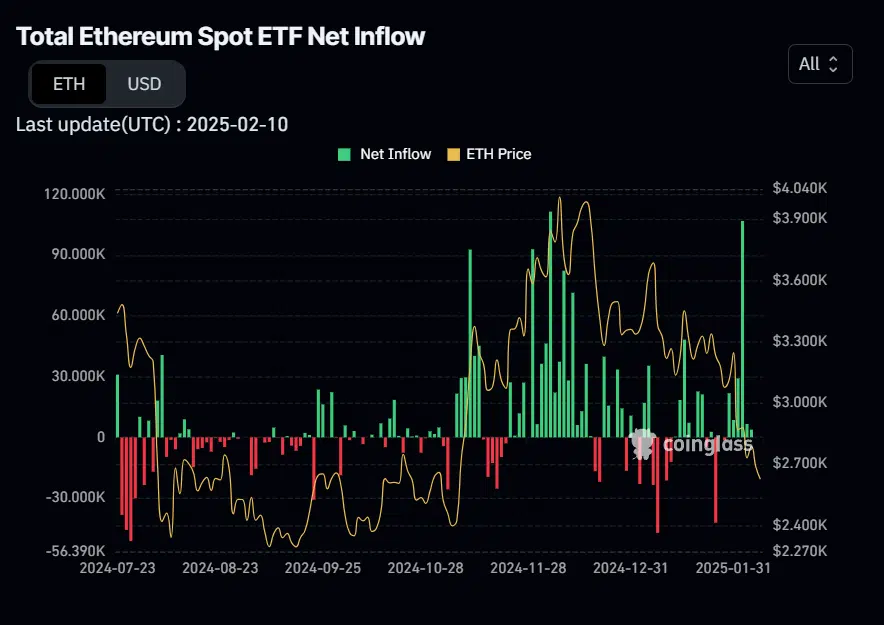

Because the market panorama shifts, a noticeable pattern is rising – Ethereum [ETH] ETFs are seeing a big surge in capital inflows, whereas Bitcoin [BTC] ETFs are experiencing a slight dip. This rising curiosity in Ethereum has sparked hypothesis that an “Ethereum Season” is likely to be on the horizon.

With institutional buyers turning their consideration to ETH, may this be the start of a brand new period the place Ethereum outperforms Bitcoin?

Ethereum ETFs vs. Bitcoin ETFs

Supply: IntoTheBlock

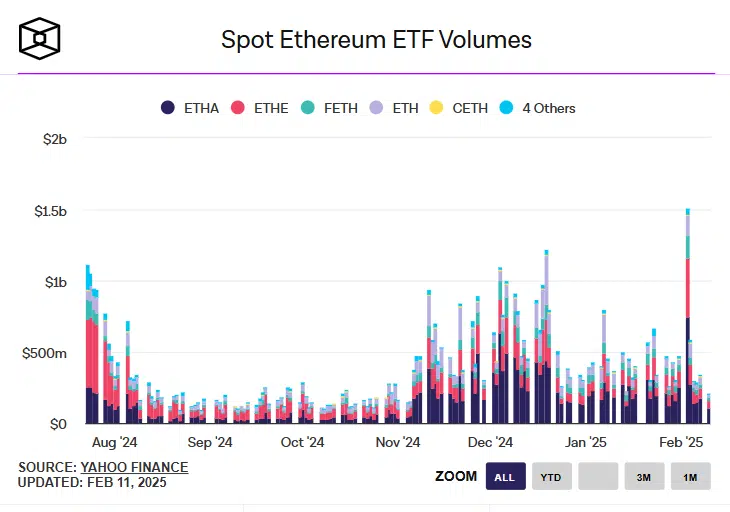

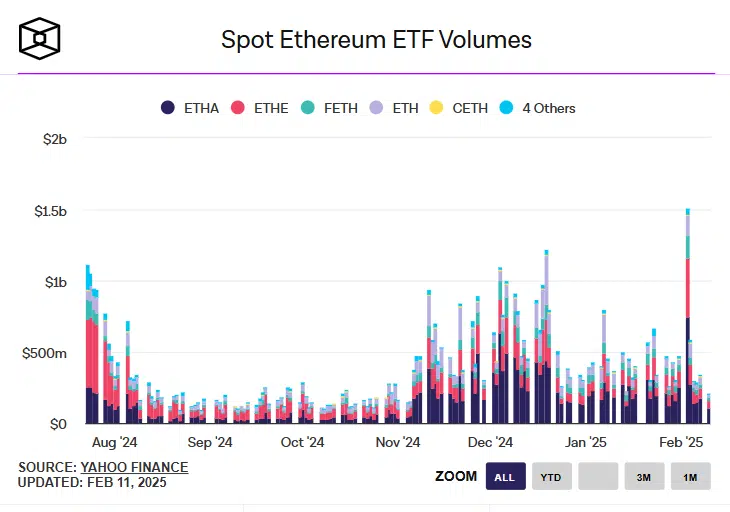

Spot Ethereum ETFs have seen a big hike in quantity, with buying and selling exercise spiking in early 2025. Ethereum ETF volumes surged previous $1.5 billion on sure days, reflecting rising institutional curiosity.

The momentum picked up in late 2024, with sustained larger volumes into the brand new 12 months.

Supply: IntoTheBlock

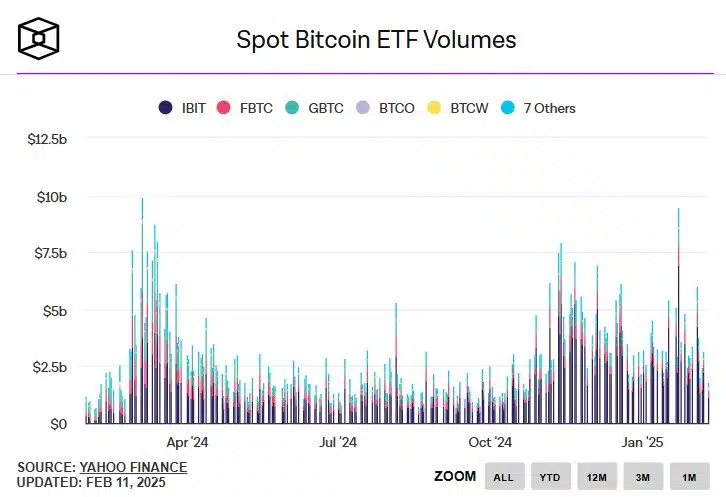

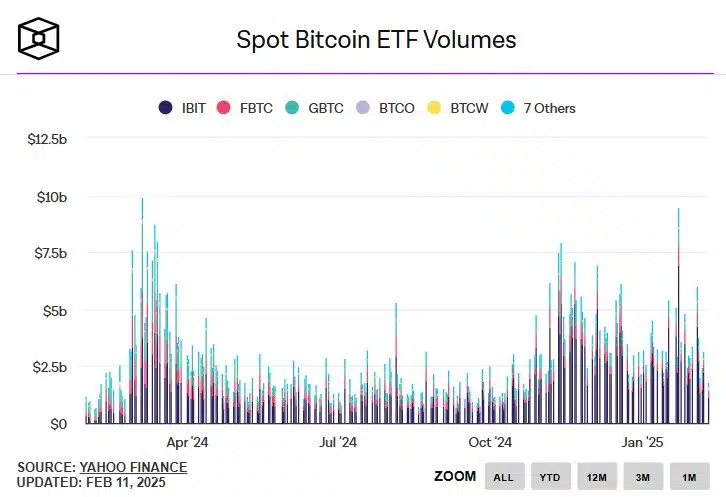

Comparatively, Bitcoin ETFs nonetheless dominate although, persistently reaching $5-10 billion in day by day quantity.

Nevertheless, Ethereum ETFs are carving out a bigger share, signaling a shift in investor sentiment. Whereas Bitcoin ETFs exploded upon launch in early 2024, Ethereum’s regular progress is an indication of a maturing market, somewhat than simply an preliminary hype cycle.

Supply: X

May this be the start of “Ethereum Season?”

Ethereum Season would seek advice from a interval when ETH outperforms Bitcoin in value and market momentum, much like what’s also known as “altseason.” At present, whereas Bitcoin ETFs nonetheless dominate in whole quantity, Ethereum’s rising share could also be an indication of accelerating confidence amongst buyers.

January 2025 noticed a 7% drop in ETH’s value, and the current sell-offs noticed the value fall so far as 27%. And but, historic patterns counsel that accumulation throughout downturns may precede a robust rebound. Key catalysts embrace the upcoming Pectra improve in Q1 2025, which goals to enhance scalability and adoption.

Moreover, regular institutional inflows and DeFi enlargement proceed to bolster Ethereum’s dominance. If this pattern persists, ETH may enter a breakout part, although market volatility stays a essential issue.

Learn Ethereum’s [ETH] Value Prediction 2025–2026

What does the longer term maintain for Ethereum?

Supply: TradingView

Ethereum’s day by day chart highlighted a restoration try from its current lows, with the value at $2,707 (+1.67%). The RSI was weak at 36, pointing to oversold situations however not but confirming sturdy shopping for momentum. The MACD appeared bearish, although the histogram additionally confirmed indicators of lowering downward stress.

On the time of writing, the broader downtrend since early January was intact, however a possible short-term reduction rally may push ETH in direction of $2,900–$3,000 if shopping for quantity will increase.

Nevertheless, the dearth of a transparent bullish crossover in MACD and weak RSI indicated that sustained upside could also be unsure. A rejection at resistance may result in a retest of $2,500.