PinLink (PIN) value has been gaining momentum, surging 15% within the final 24 hours because it nears a $90 million market cap. Technical indicators present combined alerts, with the RSI cooling down from near-overbought ranges whereas the ADX suggests the uptrend remains to be sturdy however probably stabilizing.

A latest golden cross within the EMA traces signifies that if bullish momentum continues, PIN might take a look at resistance at $1.17 and probably push towards $1.41 and even $2 if AI, DePIN, and RWA narratives regain traction. Nevertheless, if the uptrend loses energy, PIN might retest assist at $0.70, with a deeper correction all the way down to $0.51 nonetheless on the desk.

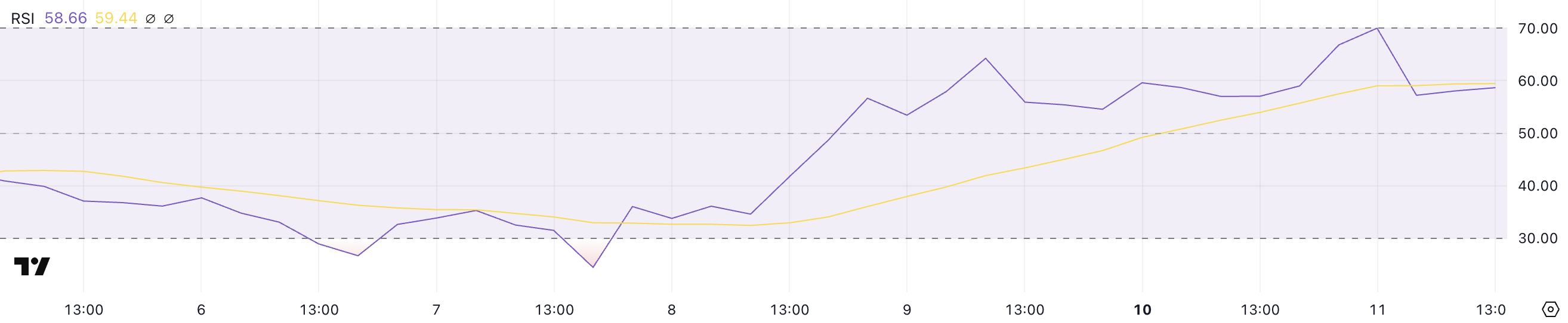

PinLink RSI Is Nonetheless Impartial After Virtually Touching Overbought Zone

PinLink defines itself as the primary RWA-tokenized DePIN market. It goals to scale back prices for synthetic intelligence builders whereas enabling new income streams for DePIN asset house owners.

By integrating real-world belongings (RWA) with decentralized bodily infrastructure networks (DePIN), PinLink goals to supply an environment friendly market for builders to entry AI-related assets at decrease prices.

On the identical time, asset house owners can monetize their infrastructure, making a extra decentralized and cost-effective ecosystem.

At the moment, PIN’s RSI is at 58.6 after briefly touching 69.98 a couple of hours in the past, surging from simply 24.4 4 days in the past. The Relative Power Index (RSI) is a momentum indicator that measures whether or not an asset is overbought or oversold, starting from 0 to 100.

Readings above 70 recommend overbought circumstances and a possible pullback, whereas values under 30 point out oversold circumstances and the potential for a rebound.

With PIN’s RSI rising sharply in a brief interval however now cooling down from overbought territory, it suggests that purchasing strain has been sturdy however is now stabilizing.

If RSI continues to carry above 50, PIN might keep bullish momentum, but when it declines additional, it might point out weakening demand, rising the danger of a short-term correction.

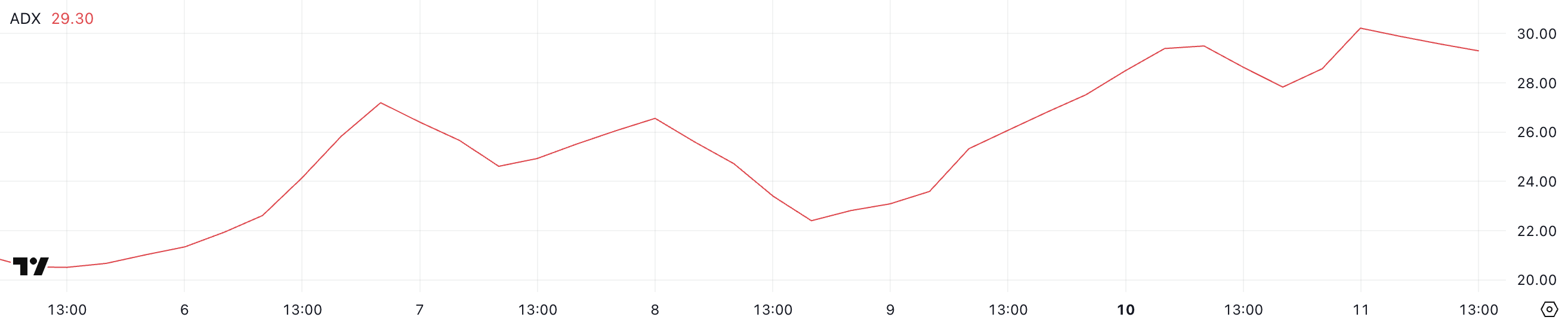

PIN ADX Exhibits the Uptrend Is Nonetheless Robust, However Might be Easing

PinLink ADX is presently at 29.3, barely down from 30.2 a couple of hours in the past, after surging from 22.4 simply three days in the past. The Common Directional Index (ADX) is a key indicator used to measure the energy of a pattern somewhat than its route.

Readings above 25 usually point out a powerful pattern, whereas values under 20 recommend weak or nonexistent pattern momentum. A rising ADX alerts {that a} pattern – whether or not bullish or bearish – is gaining energy, whereas a declining ADX can point out fading momentum or potential consolidation.

With PIN’s ADX presently at 29.3, the indicator means that the uptrend remains to be holding energy however could also be slowing barely. The latest enhance from 22.4 confirms that PIN has been constructing a stronger pattern over the previous few days, reinforcing bullish momentum.

Nevertheless, the small dip from 30.2 might point out that pattern energy is stabilizing somewhat than accelerating.

If ADX stays above 25 and continues rising, it might verify that the altcoins’ uptrend is gaining traction, but when it begins dropping towards 20, it might sign that the bullish momentum is weakening, leaving room for potential consolidation or a shift available in the market route.

PIN Value Prediction: Can PinLink Attain $2 In February?

PinLink EMA traces point out a bullish sign, as a short-term shifting common has simply crossed above one other short-term line, forming a golden cross. If this uptrend stays sturdy, PIN, which relies on Ethereum, might take a look at its subsequent resistance at $1.17, and a breakout above this stage might push the worth towards $1.41.

Moreover, if narratives round AI, DePIN, and RWA regain momentum, PinLink may gain advantage from renewed market curiosity, probably driving its value towards the $2 mark.

On the draw back, if PIN fails to maintain its present bullish momentum and the pattern reverses, it might face a retest of the $0.70 assist stage.

A break under this stage might speed up promoting strain, resulting in a deeper decline towards $0.51 – a possible 50% correction from present ranges.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.