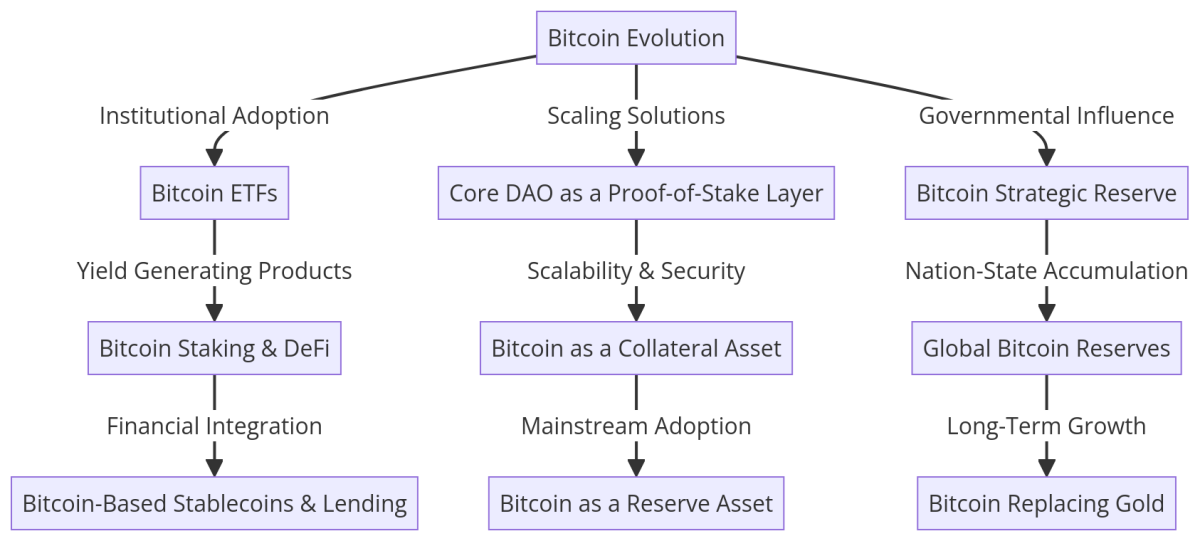

Bitcoin’s evolution from an obscure digital forex to a world monetary pressure has been nothing wanting extraordinary. As Bitcoin enters a brand new period, establishments, governments, and builders are working to unlock its full potential. Matt Crosby, Bitcoin Journal Professional’s lead market analyst, sat down with Wealthy Rines, contributor at Core DAO, to debate Bitcoin’s subsequent section of development, the rise of Bitcoin DeFi, and its potential as a world reserve asset. Watch the total interview right here: The Future Of Bitcoin – That includes Wealthy Rines

Bitcoin’s Evolution & Institutional Adoption

Wealthy Rines has been within the Bitcoin area since 2013, having witnessed firsthand its transformation from an experimental know-how to a globally acknowledged monetary instrument.

“By the 2017 cycle, I used to be fairly decided that that is what I used to be going to spend the remainder of my profession on.”

The dialog delves into Bitcoin’s rising function in institutional portfolios, with spot Bitcoin ETFs already surpassing $41 billion in inflows. Rines believes the institutionalization of Bitcoin will proceed to reshape world finance, notably with the rise of yield-generating merchandise that attraction to Wall Road traders.

“Each asset supervisor on the planet can now purchase Bitcoin with ETFs, and that basically modifications the market.”

What’s Core DAO?

Core DAO is an progressive blockchain ecosystem designed to reinforce Bitcoin’s performance by way of a proof-of-stake (PoS) mechanism. In contrast to conventional Bitcoin scaling options, Core DAO leverages a decentralized PoS construction to enhance scalability, programmability, and interoperability whereas sustaining Bitcoin’s safety and decentralization.

At its core, Core DAO acts as a Bitcoin-aligned Layer-1 blockchain, that means it extends Bitcoin’s capabilities with out altering its base layer. This allows a spread of DeFi functions, sensible contracts, and staking alternatives for Bitcoin holders.

“Core is the main Bitcoin scaling resolution, and the best way to consider it’s actually the proof-of-stake layer for Bitcoin.”

By securing 75% of the Bitcoin hash charge, Core DAO ensures that Bitcoin’s safety rules stay intact whereas providing better performance for builders and customers. With a rising ecosystem of over 150+ initiatives, Core DAO is paving the best way for the following section of Bitcoin’s monetary growth.

Core: Bitcoin’s Proof-of-Stake Layer & DeFi Growth

One of many largest challenges dealing with Bitcoin is scalability. The Bitcoin community’s excessive charges and sluggish transaction speeds make it a robust settlement layer however restrict its utility for day-to-day transactions. That is the place Core DAO is available in.

“Bitcoin lacks scalability, programmability. It’s too costly. All these items that make it an awesome settlement layer is strictly the rationale that we’d like an answer like Core to increase these capabilities.”

Core DAO capabilities as a proof-of-stake layer for Bitcoin, permitting customers to generate yield with out third-party danger. It gives an ecosystem the place Bitcoin holders can take part in DeFi functions with out compromising on safety.

“We’re going to see Bitcoin DeFi dwarf Ethereum DeFi throughout the subsequent three years as a result of Bitcoin is a superior collateral asset.”

Bitcoin as a Strategic Reserve Asset

Governments and sovereign wealth funds are starting to view Bitcoin not as a forex however as a strategic reserve asset. The potential for a U.S. Bitcoin strategic reserve, in addition to broader world adoption on the nation-state stage, might create a brand new monetary paradigm.

“Individuals are speaking about constructing strategic Bitcoin reserves for the primary time.”

The concept of Bitcoin changing gold as a major retailer of worth is changing into extra tangible. Rines asserts that Bitcoin’s shortage and decentralization make it a superior different to gold.

“I feel throughout the subsequent decade, Bitcoin will grow to be the worldwide reserve asset, changing gold.”

Bitcoin Privateness: The Ultimate Frontier

Whereas Bitcoin is commonly hailed as a decentralized and censorship-resistant asset, privateness stays a major problem. In contrast to money transactions, Bitcoin’s public ledger exposes all transactions to anybody with entry to the blockchain.

Rines believes that bettering Bitcoin privateness can be a important step in its evolution.

“I’ve wished non-public Bitcoin transactions for a very very long time. I’m fairly bearish on it ever taking place on the bottom layer, however there’s potential in scaling options.”

Whereas options like CoinJoin and the Lightning Community supply some privateness enhancements, full-scale anonymity stays elusive. Core is exploring improvements that might allow confidential transactions with out sacrificing Bitcoin’s safety and transparency.

“On Core, we’re working with groups on doubtlessly having confidential transactions—the place you may inform {that a} transaction is going on, however not the quantity or counterparties concerned.”

As governments proceed to extend scrutiny over digital monetary exercise, the necessity for enhanced Bitcoin privateness options will solely develop. Whether or not by way of native protocol upgrades or second-layer options, the way forward for Bitcoin privateness stays an important space of improvement.

The Way forward for Bitcoin: A Trillion-Greenback Market within the Making

Because the interview progresses, Rines outlines how Bitcoin’s financial framework is increasing past hypothesis and into productive monetary devices. He predicts that inside a decade, Bitcoin will command a $10 trillion market cap, with DeFi functions changing into a good portion of its financial ecosystem.

“The Bitcoin DeFi market is a trillion-dollar alternative, and we’re simply getting began.”

His perspective aligns with a broader business development the place Bitcoin isn’t solely used as a retailer of worth but additionally as an lively monetary asset inside decentralized networks.

Wealthy Rines Roadmap for Bitcoin’s Future

Ultimate Ideas

The dialog between Matt Crosby and Wealthy Rines gives a compelling glimpse into the way forward for Bitcoin. With institutional adoption accelerating, Bitcoin DeFi increasing, and the rising recognition of Bitcoin as a strategic reserve, it’s clear that Bitcoin’s greatest years are forward.

As Rines places it:

“Constructing on Bitcoin is among the most enjoyable alternatives on the planet. There’s a trillion-dollar market ready to be unlocked.”

For traders, builders, and policymakers, the important thing takeaway is evident: Bitcoin is not only a speculative asset—it’s the basis of a brand new monetary system.

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, customized indicator alerts, and in-depth business reviews, try Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.