Chainlink (LINK) has struggled to keep up momentum after a failed try and breach the $26 resistance stage in the direction of the top of January. This setback triggered a decline, inflicting LINK to fall beneath the $20 mark.

For a significant restoration, Chainlink now depends on the actions of its traders to make the fitting strikes.

Chainlink Buyers Have An Alternative

At present, Chainlink’s energetic addresses have dropped to a two-month low of three,400, a determine not seen since November 2024. This decline in energetic customers signifies a waning curiosity from traders, as fewer individuals are conducting transactions on the community. This means that the sentiment amongst LINK holders is essentially skeptical.

The discount in energetic addresses alerts that many traders are adopting a wait-and-see method, seemingly because of the latest worth struggles. This lack of engagement and hesitance might additional weigh on Chainlink’s worth, as diminished transaction exercise tends to correlate with restricted upward momentum available in the market.

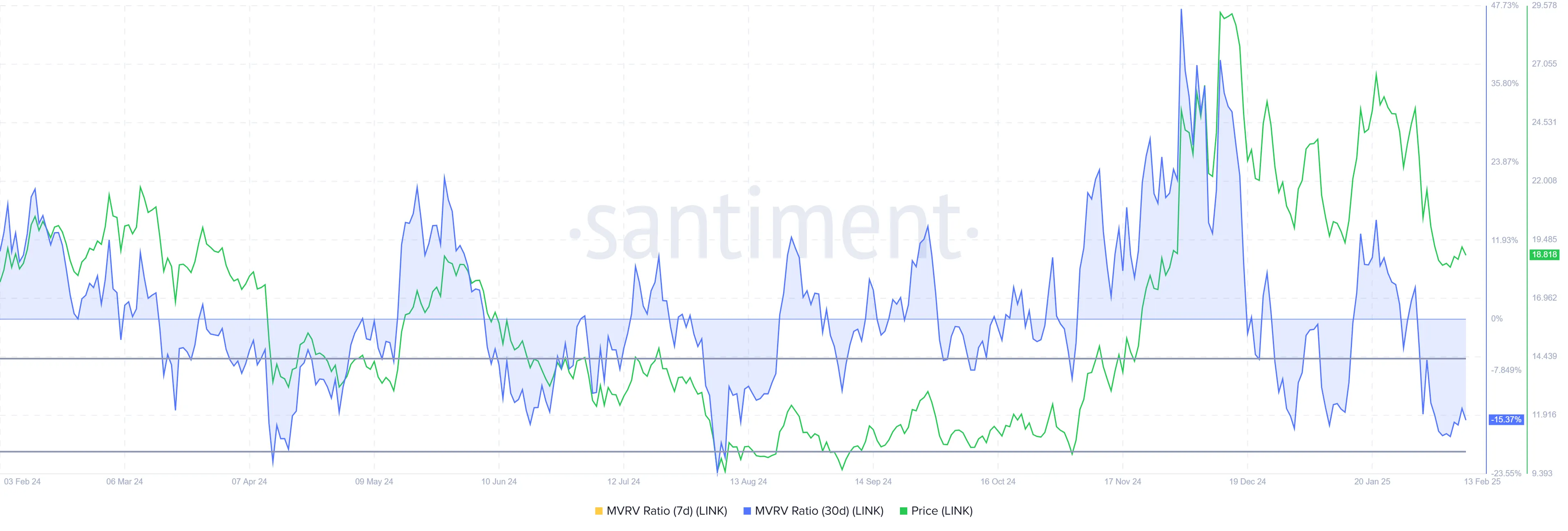

Chainlink’s broader momentum can also be underneath stress, as mirrored by the Market Worth to Realized Worth (MVRV) ratio, which is at the moment at -15%. Because of this those that purchased LINK within the final month are dealing with losses of 15% on common. The MVRV ratio is now within the alternative zone, between -8% and -19%, signaling potential for a reversal.

Traditionally, when the MVRV ratio dips into this vary, it means that traders are halting gross sales and as an alternative selecting to build up at decrease costs. If this sample continues, it might mark a turning level for Chainlink’s worth, as long-term holders might step in to supply assist and drive worth restoration.

LINK Worth Prediction: Bouncing Again

Chainlink’s worth has fallen by 25% because the starting of the month, at the moment buying and selling at $18.84. The altcoin has been struggling to interrupt above the resistance at $19.23 for the previous week, which signifies a vital stage that have to be breached for a possible restoration.

If traders start to build up LINK at these decrease costs, there’s a sturdy risk that the $19.23 resistance might be flipped into assist. This might push Chainlink towards the subsequent barrier at $22.03, offering the momentum wanted for additional worth positive aspects.

Nonetheless, if the breach of $19.23 fails, Chainlink might fall via its downtrend assist line, hitting $17.31. A drop beneath this stage would invalidate the present bullish outlook, signaling a continued bearish development for LINK and probably triggering additional declines.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.