On-chain knowledge exhibits the retail buyers have been liquidating their Bitcoin wallets not too long ago, however shopping for into XRP and Ethereum.

Complete Quantity Of Holders Up For XRP & Ethereum, However Down For Bitcoin

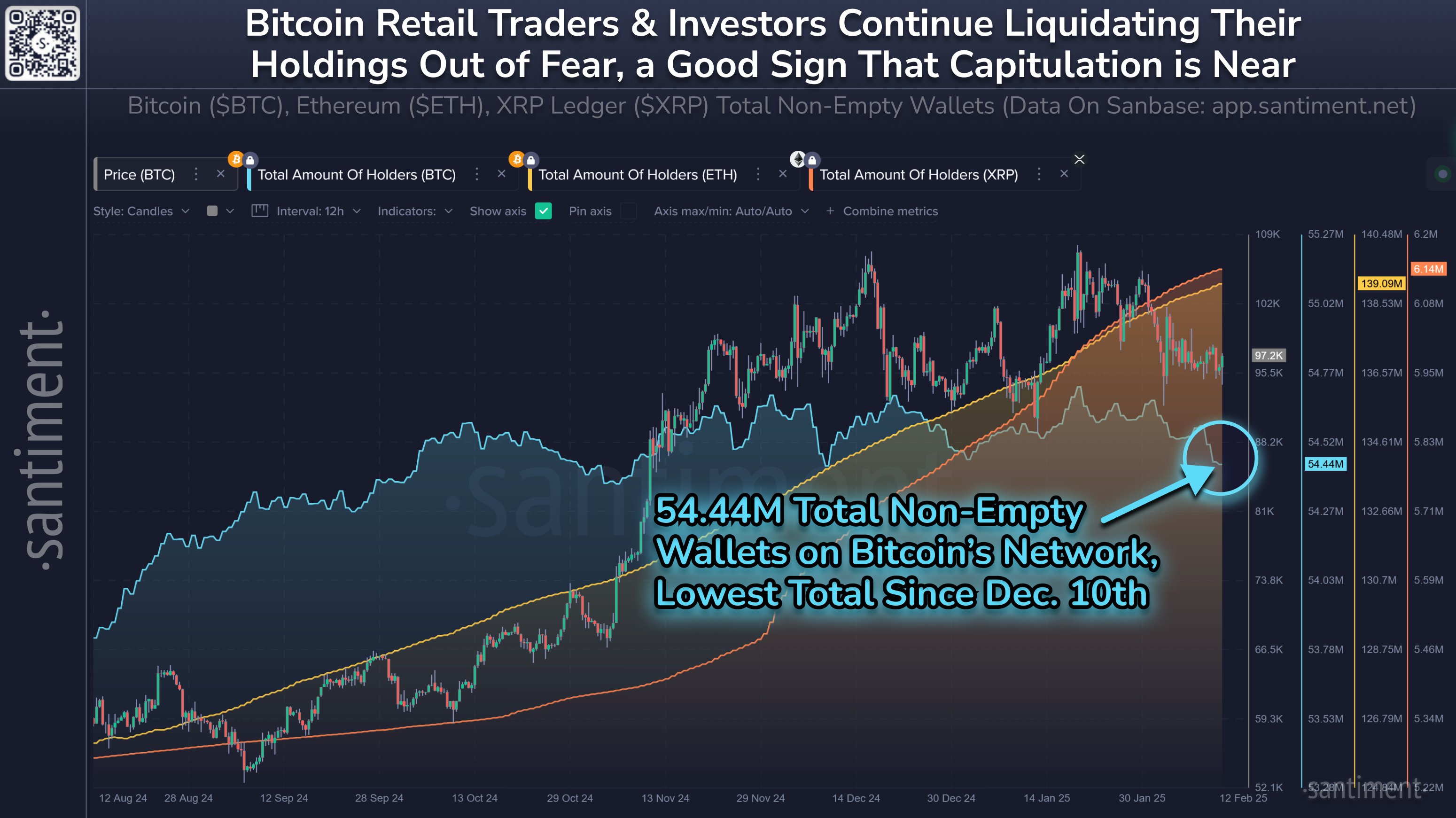

In a brand new publish on X, the on-chain analytics agency Santiment has mentioned in regards to the newest development within the Complete Quantity of Holders for the highest three belongings within the cryptocurrency sector. The “Complete Quantity of Holders” right here refers to a metric that measures, as its title already suggests, the overall variety of addresses which can be carrying some non-zero steadiness on a given community.

When the worth of this indicator goes up, it means new buyers are becoming a member of the blockchain and/or previous ones who had offered earlier are investing again into the asset.

The development may also come up when present customers distribute their holdings throughout new addresses for a function like privateness. Basically, all three of those may be assumed to be in motion concurrently every time the metric registers a rise.

As such, a leap within the Complete Quantity of Holders may be thought-about as a sign that some web adoption of the cryptocurrency is happening.

However, the metric witnessing a decline implies among the buyers have determined to filter out their wallets, doubtlessly as a result of they wish to fully exit from the coin.

Now, right here is the chart shared by the analytics agency that exhibits the development within the Complete Quantity of Holders for Bitcoin, Ethereum, and XRP over the previous few months:

The worth of the metric seems to have diverged for BTC in current weeks | Supply: Santiment on X

As is seen within the above graph, the Complete Quantity of Holders for XRP has been following an upward trajectory for XRP and Ethereum for some time now, implying new buyers have always been becoming a member of these networks. Out of the 2, the previous is the one at present observing adoption at a quicker price.

Whereas these cash have been having fun with an inflow of holders, Bitcoin has been totally different. The primary cryptocurrency was seeing its Complete Quantity of Holders transfer sideways earlier, however not too long ago, the metric has began to see an outright decline, that means buyers at the moment are actively exiting the community.

In comparison with three weeks in the past, the variety of non-empty addresses on the BTC blockchain has decreased by round 277,240, which is a notable quantity. Whales are usually few in quantity, so any giant decline within the Complete Quantity of Holders normally displays the outgoing of retail entities.

The exodus of retail buyers is probably not so dangerous for Bitcoin, nevertheless, as Santiment has defined,

Traditionally, these declines in retail perception are a constructive signal for mid to long run worth performances. When cash are shed by small merchants, whales and sharks accumulate them and use their capital to drive up markets when crowd FUD is at its highest.

BTC Value

Bitcoin has been unable to amass collectively any lasting bullish momentum not too long ago as its worth has taken to sideways motion. At current, BTC is buying and selling round $95,800.

Seems to be like the worth of the coin has been heading down over the past couple of weeks | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com