Este artículo también está disponible en español.

The US Securities and Change Fee (SEC) has formally acknowledged the receipt of Grayscale Investments’ 19b-4 submitting to transform its XRP Belief right into a spot exchange-traded fund (ETF). The company’s affirmation—disclosed by Bloomberg ETF analyst James Seyffart on 14th February—indicators the beginning of the formal assessment course of that might finally determine whether or not the product is cleared for public itemizing.

James Seyffart, who reported the information through his X account, acknowledged: “There it’s — The SEC simply acknowledged Grayscale & NYSE’s 19b-4 submitting to listing an XRP ETF (this was largely anticipated however formally means the clock will begin quickly for this and Dogecoin).”

Why This Is An ‘Monumental Message’ For Ripple

The SEC’s acknowledgment kicks off a regulatory timetable, opening a window for public commentary and a number of rounds of decision-making. The company is anticipated to observe this step-by-step process to both approve, reject, or request further data in regards to the proposed XRP ETF.

Associated Studying

Though formal acknowledgment doesn’t assure an approval additional down the road, it underscores that the SEC is sufficiently engaged to place the submitting on the official docket. Nate Geraci, President of the ETF Retailer and Co-Founding father of the ETF Institute, underlined the importance of this motion within the context of the SEC’s ongoing authorized dispute with Ripple.

He remarked: “SEC has acknowledged NYSE’s 19b-4 submitting to listing & commerce Grayscale XRP ETF… Clearly a probably enormous assertion re: SEC’s case vs Ripple.” Geraci additional elaborated on what he perceives as a outstanding growth: “Shocked extra folks aren’t speaking about SEC accepting XRP ETF submitting… They’ve open litigation w/ Ripple. In the meantime, they only acknowledged submitting of ETF holding asset in dispute (they simply might have rejected this submitting). Monumental message IMO.”

Associated Studying

These statements spotlight how the SEC’s willingness to provoke the assessment course of—relatively than dismissing it outright—might point out the SEC’s openness to settle or drop the Ripple case which is presently on the Courtroom of Appeals.

Fox Enterprise journalist Eleanor Terrett offered further context on why the acknowledgment alone is noteworthy: “As a result of it means this SEC is being extra open-minded and never flat out refusing to think about these merchandise. Recall, exchanges pulled the SOL 19b-4 functions in December when the Gensler SEC signaled it could not interact with them. […] Subsequent up, the SEC ought to acknowledge the XRP ETF functions from issuers that filed later than Grayscale — together with Bitwise, 21Shares, Canary Funds, Knowledge Tree. The 240-day window for Grayscale’s approval begins when it will get posted to the federal register which must be in a few days from now.”

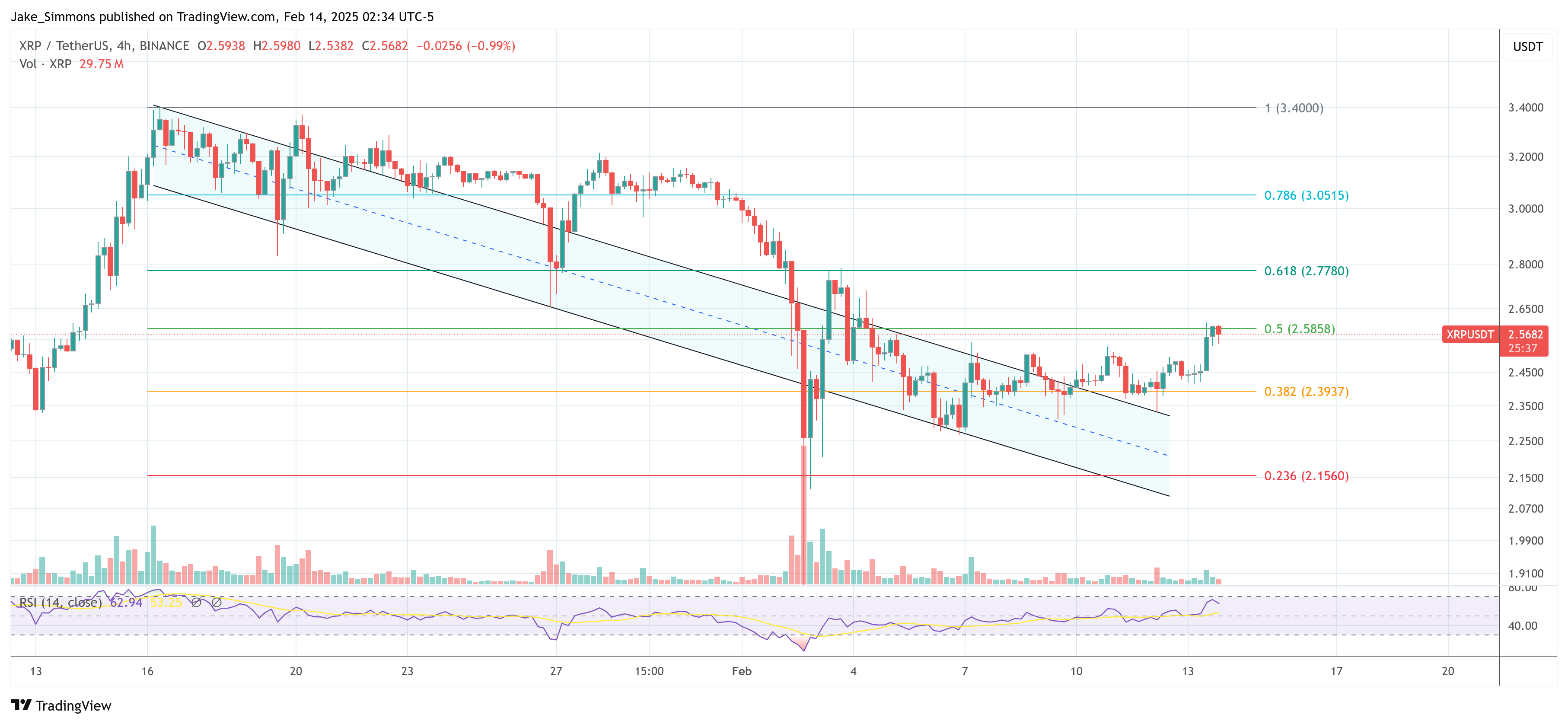

Following the announcement, XRP’s value rose by over 5% in a comparatively muted total market. Nevertheless, technical evaluation of the XRP/USDT 4-hour chart signifies that as of press time, the token failed to interrupt by way of a serious resistance stage. The rejection occurred on the 0.5 Fibonacci retracement (Fib) round $2.58. If consumers handle to push XRP above this threshold, the subsequent important resistance is close to $2.77 (the 0.618 Fib). A sustained rally past that time might see the token retest its January 25 excessive at $3.40.

Featured picture created with DALL.E, chart from TradingView.com