Information reveals the weekly volatility of Bitcoin has plunged just lately, one thing that has traditionally led to a violent decompression for the asset.

Bitcoin 1-Week Realized Volatility Has Hit A Low Degree Just lately

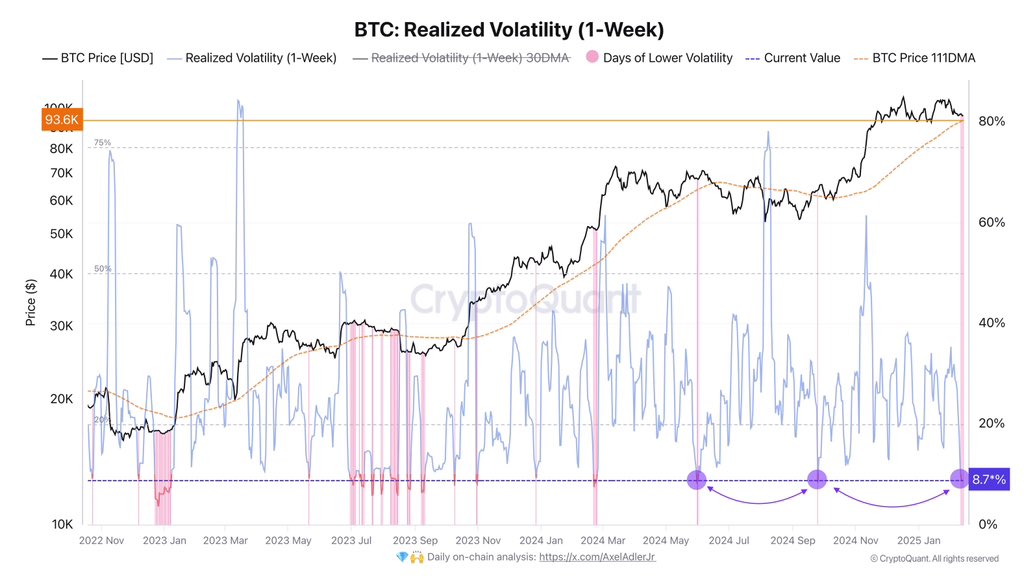

In a brand new put up on X, CryptoQuant creator Axel Adler Jr has mentioned in regards to the pattern within the Realized Volatility for Bitcoin. The “Realized Volatility” right here refers to an indicator that calculates how ‘risky’ BTC has been utilizing its proportion returns throughout a particular window of time.

Within the context of the present subject, the window is of 1 week. Thus, this model of the Realized Volatility tells us in regards to the proportion distinction between the value excessive and low in the course of the previous week.

Beneath is the chart for the indicator shared by the analyst, that reveals the pattern in its worth throughout the previous couple of years.

Appears like the worth of the metric has plunged in latest days | Supply: @AxelAdlerJr on X

As is seen within the above graph, the Bitcoin 1-week Realized Volatility has just lately seen a pointy decline to the 8.7% mark. This can be a low degree for this cycle, because the metric has solely gone under it on just a few events.

Within the chart, the analyst has highlighted all of the cases the place the indicator touched this line or fell beneath it. Curiously, the volatility of the cryptocurrency compressing to this diploma has typically led right into a violent transfer for its value.

There isn’t a specific sample associated as to if the transfer following a low volatility interval can be bearish or bullish, although, as BTC has seen each forms of developments throughout the previous couple of years.

The final time that the 1-week Realized Volatility declined to the extent, for instance, led right into a bull rally for Bitcoin. The occasion earlier than that, alternatively, resulted in bearish motion for the coin.

Adler Jr has additionally identified that BTC is at the moment buying and selling close to its 111-day shifting common (MA), a degree that has been necessary for it over time. “If circumstances don’t enhance, the subsequent transfer may very well be a drop to $92K, under the 111DMA,” notes the analyst.

In another information, the Bitcoin Web Taker Quantity, a metric that measures the distinction between the taker purchase and taker promote volumes of BTC, has dipped into the unfavorable zone just lately, as CryptoQuant group analyst Maartunn has defined in an X put up.

The worth of the metric appears to have been pink in the course of the previous day | Supply: @JA_Maartun on X

The indicator’s dip into the pink territory means the quick quantity is outpacing the lengthy one, so a bearish sentiment is shared by the derivatives merchants. Curiously, because the analyst has highlighted within the above graph, this sample has persistently signaled an area backside for Bitcoin in the course of the latest part of consolidation.

BTC Worth

On the time of writing, Bitcoin is floating round $97,400, up round 1% within the final 24 hours.

The worth of the coin seems to have been shifting flat just lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com