On-chain information reveals the Toncoin buyers are holding a big quantity of unrealized revenue even after the latest bearish motion within the asset’s value.

Toncoin Is Nonetheless Buying and selling A Notable Distance Above Its Realized Worth

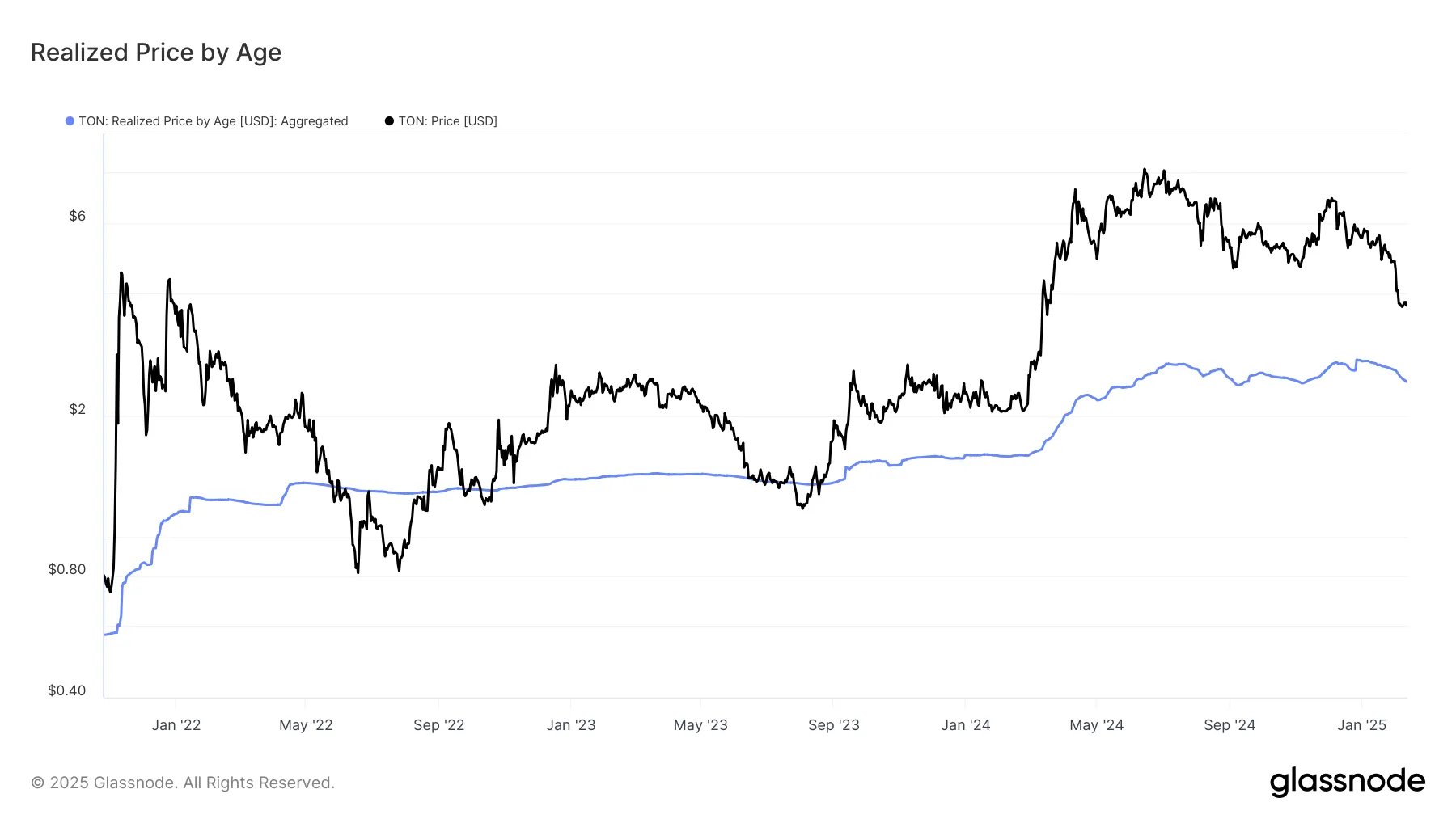

In a brand new submit on X, the on-chain analytics agency Glassnode has mentioned in regards to the newest development in a number of indicators associated to Toncoin. The primary metric of relevance is the “Realized Worth,” which tells us, in brief, the fee foundation of the common investor on the TON community.

When the spot value of the cryptocurrency is buying and selling above this indicator, it means the holders as a complete will be assumed to be carrying a web quantity of unrealized revenue. Then again, it being underneath the metric implies the dominance of loss out there.

Now, right here is the chart shared by the analytics agency, that reveals the development within the Toncoin Realized Worth over the previous couple of years:

As displayed within the above graph, the Toncoin value has been above the Realized Worth for some time now, which suggests the buyers on the entire have been having fun with good points. This association hasn’t modified even after the drawdown that the coin has witnessed just lately.

Traditionally, the Realized Worth has acted as a help stage for the asset. The rationale behind that is the truth that buyers will be prone to react to dips to their price foundation by shopping for extra, if the temper out there is bullish.

At current, the metric has a worth of $2.43, which is considerably underneath the spot value. Based mostly on the historic sample, Glassnode notes that the extent “stays a vital stage for potential shopping for strain.”

The subsequent indicator shared by the analytics agency is the Market Worth to Realized Worth (MVRV) Ratio. This metric retains observe of the ratio between the spot value and Realized Worth of Toncoin.

From the chart, it’s obvious that the ratio has gone down just lately and has reached a worth of round 1.54. “Because of this, on common, buyers are sitting at ~54% unrealized revenue,” explains Glassnode.

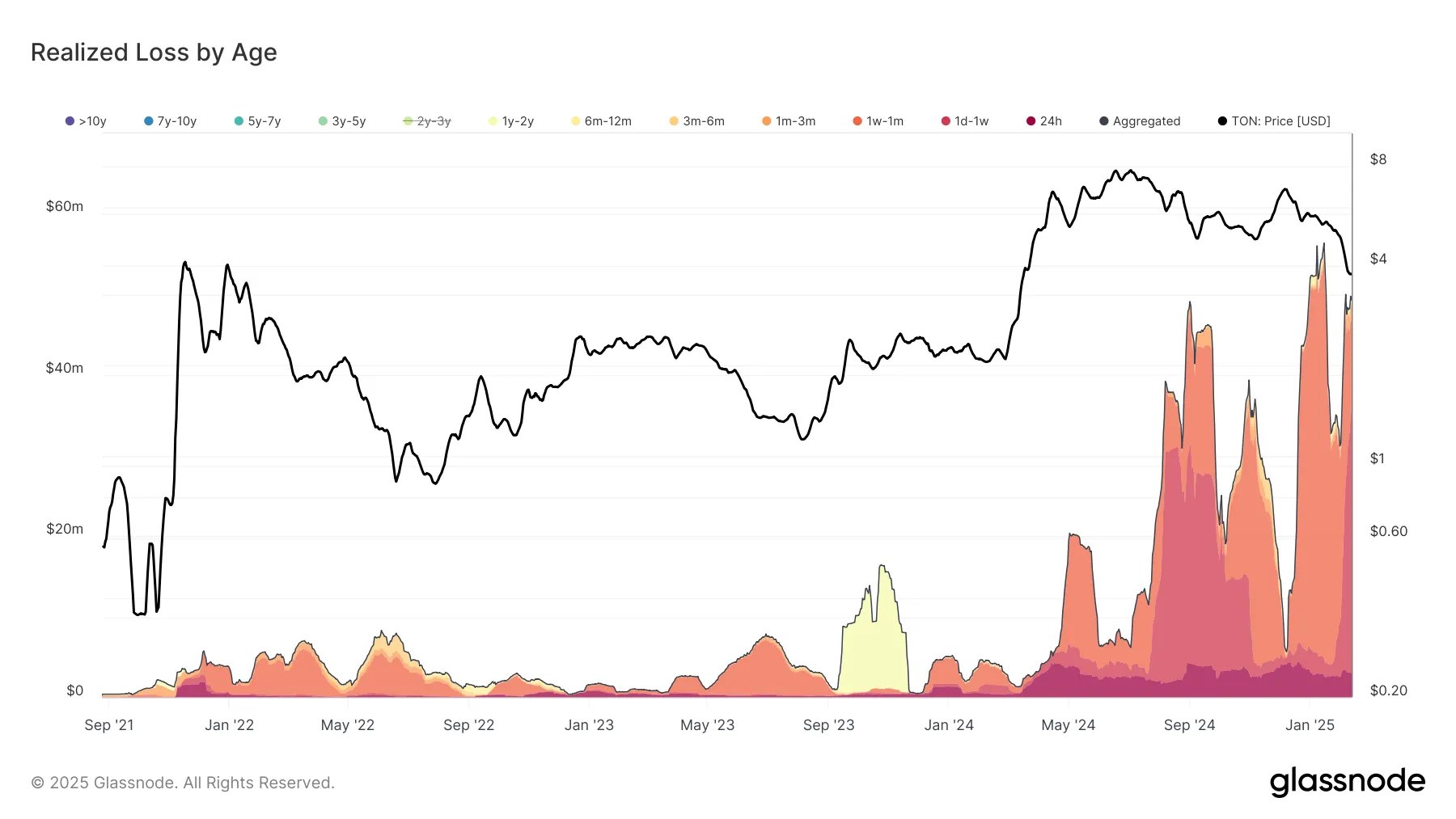

Whereas the general market has been in a position to face up to the latest downturn, it doesn’t imply that there was no panic loss promoting in any respect for Toncoin. Because the beneath chart for the Realized Loss reveals, the patrons who received in through the prime ended up realizing a large quantity of loss within the value plunge.

TON Worth

On the time of writing, Toncoin is buying and selling round $3.77, up virtually 3% within the final 24 hours.