Blockchain analysts have uncovered hyperlinks between the LIBRA meme coin and different questionable crypto tasks, together with the official token of Melania Trump.

These findings have raised additional considerations on LIBRA notably after its transient endorsement by Argentina’s President Javier Milei.

Suspicious Connections Between LIBRA And MELANIA

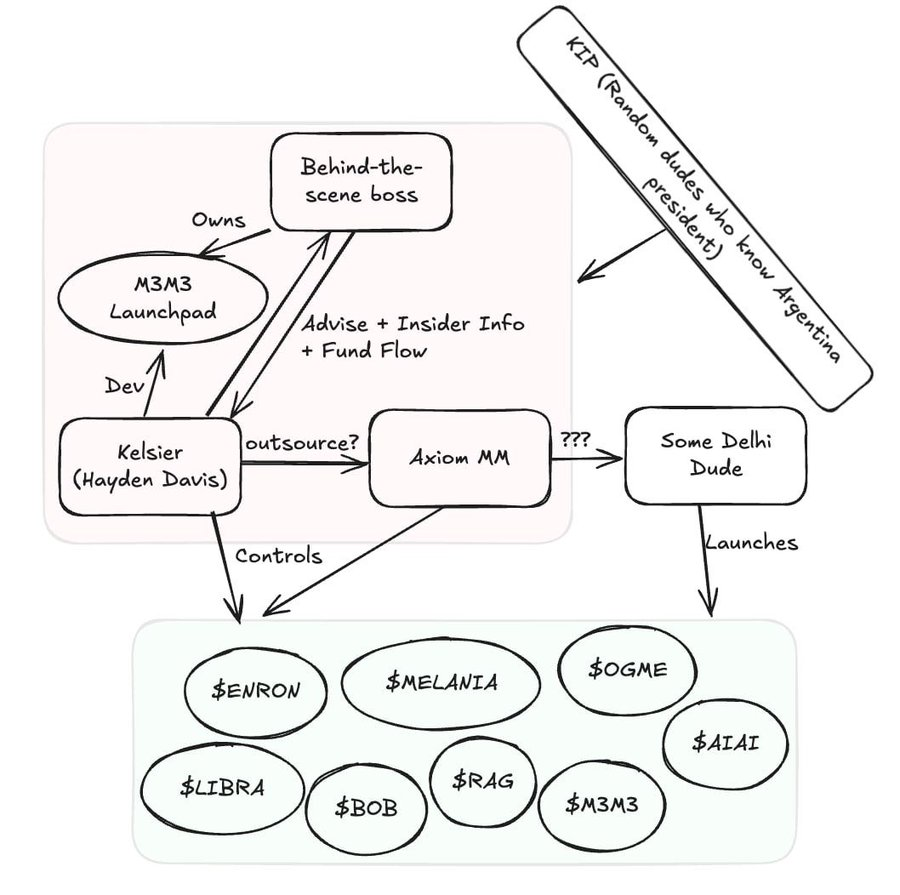

On February 16, Chaofan Shou, co-founder of Fuzzland, alleged that LIBRA’s market maker operates from Delhi and was additionally concerned within the MELANIA meme coin.

Shou shared pockets knowledge suggesting that the identical entity managed each tasks, fueling suspicions of coordinated insider exercise. He additional linked the LIBRA group to tokens like Enron and OGME, which adopted an analogous sample of value manipulation.

These tasks skilled fast value will increase pushed by insider buying and selling and automatic bots, adopted by sudden sell-offs that left retail traders with losses. This sample resembles pump-and-dump schemes designed to use merchants.

The MELANIA token, launched simply earlier than Donald Trump’s second-term inauguration, briefly surged to a $2 billion market cap earlier than crashing under $200 million.

LIBRA adopted an analogous trajectory. After receiving public assist from President Milei, the token noticed a surge in investments. Nonetheless, insiders reportedly withdrew $107 million quickly after, resulting in its collapse.

Following the fallout, Milei distanced himself from the mission, triggering accusations of market manipulation. Some critics have even referred to as for his impeachment, citing the incident as a monetary and political scandal.

LIBRA Insiders Reject Fraud Accusations

Regardless of the controversy, KIP Protocol, an entity linked to LIBRA, has denied any wrongdoing.

Julian Peh, KIP’s CEO, said that each one funds stay on-chain and accounted for. He additionally clarified that KIP had no position within the token’s launch, attributing accountability to Kelsier, the mission’s market maker.

“KIP has taken on alot of FUD at this time, together with with threats to me and my workers, however we weren’t concerned within the launch, we didn’t deal with any tokens or SOL. KIP publicly acknowledged its position within the mission (although not within the token issuance) as a result of we had been already listed on the web site and believed within the initiative’s potential,” KIP stated.

In the meantime, Hayden Davis of Kelsier blamed President Milei and his group for traders’ losses. He argued that meme coin investments rely closely on belief and endorsements.

When Milei’s group deleted their promotional posts, panic promoting ensued, resulting in a pointy market decline.

However, he said that his group nonetheless believes within the mission and plans to reinvest $100 million in it. So, as an alternative of transferring the property to President Milei’s associates or KIP, Kelsier plans to reinvest the funds into LIBRA and burn all acquired tokens.

“I’m proposing to reinvest 100% of the funds below my management, as a lot as $100 million, again into the Libra Token and burn all purchased provide. Until a extra viable various is offered, I intend to start the method of executing on this plan throughout the subsequent 48 hours,” Davis said.

The LIBRA controversy highlights the dangers related to speculative meme cash, particularly these tied to high-profile figures. Whereas supporters insist the mission stays viable, investigators proceed to look at its connections to potential market manipulations.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.