Crypto market members, together with merchants and traders, ought to brace for a number of US financial knowledge this week, which might have an effect on their portfolios. Key occasions this week might drive volatility after the US CPI (client worth knowledge) final week.

In the meantime, Monday’s US President’s Day will hold markets closed, however Bitcoin (BTC) shall be out there for buying and selling all through.

US Financial Occasions on the Crypto Calendar This Week

Because the affect of US financial knowledge on crypto markets stays obvious, merchants and traders should be careful for the next knowledge this week.

January FOMC Minutes

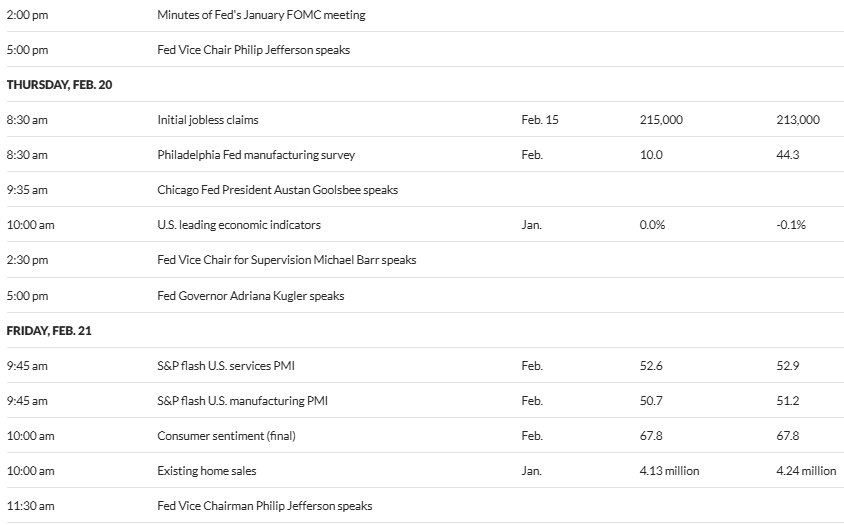

The Federal Reserve (Fed) will launch minutes from January’s FOMC (Federal Open Market Committee) assembly on Wednesday, February 19. This is without doubt one of the most necessary US financial knowledge this week, as what policymakers say might assist markets additional gauge the Fed’s rate of interest outlook.

The minutes come after latest experiences indicated CPI inflation jumped month over month. This successfully marked dangerous information within the quick time period, with crypto markets displaying detrimental sentiment. Nevertheless, there are not any main indicators of inflation re-acceleration.

The Fed chair, Jerome Powell, advised a Senate Banking Committee that he’s not in a rush to chop rates of interest. President Donald Trump pressed for greater fee cuts to counter excessive inflation, however Powell held agency.

Market members now brace for additional changes as they await further coverage updates. The January FOMC minutes might present some perception into this matter, particularly addressing whether or not fee cuts are incoming or that policymakers lean towards extra hawkish alerts.

“The minutes are broadly anticipated to reflect Fed’s Powell testimony on financial situations towards the Senate final week,” monetary market analyst Atif Ismael shared.

Preliminary Jobless Claims

Past the January FOMC minutes, the crypto market will even watch the preliminary jobless claims on Thursday, offering perception into the US labor market. For the week ending February 15, US residents submitting new purposes for unemployment insurance coverage was 213,000.

This print missed preliminary estimates and was decrease than the earlier week’s revised tally of 220,000. In line with the US Division of Labor (DoL), the report highlighted a seasonally adjusted insured unemployment fee of 1.2%. MarketWatch knowledge exhibits a median forecast of 215,000 for this week’s preliminary jobless claims.

Increased preliminary jobless claims within the Thursday report counsel growing financial hardship and a weakening labor market, which might result in decreased client spending. This slowdown prompted the Fed to think about fee cuts to stimulate the financial system.

As charges lower, borrowing turns into cheaper, doubtlessly boosting spending and funding. This state of affairs favors Bitcoin, as decrease charges can enhance demand for various belongings.

Shopper Sentiment

The US Shopper Sentiment Index, particularly the preliminary report, displays shoppers’ general confidence and optimism relating to the financial system. The College of Michigan will launch this knowledge on Friday.

A constructive studying on Friday can enhance optimism in monetary markets, together with cryptocurrency. This might end in greater demand for Bitcoin as traders search belongings with development potential.

Equally, if client sentiment is powerful, it could point out that customers are extra keen to spend and take dangers. This constructive outlook can translate into elevated threat urge for food amongst traders, doubtlessly main them to allocate extra funds to cryptocurrencies like Bitcoin.

However, it’s not possible to disregard that client sentiment knowledge typically contains info on inflation expectations. Due to this fact, the FOMC minutes on Wednesday shall be essential. If shoppers anticipate greater inflation, they might search for various shops of worth to guard their wealth. Bitcoin, typically known as “digital gold,” might profit from elevated curiosity as a hedge towards inflation.

Nevertheless, earlier than the financial knowledge, Bitcoin (BTC) was traded at $95,984, down by 1.58% since Monday’s session opened.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.