Este artículo también está disponible en español.

Altering macroeconomic situations and massive funding exercise are driving Bitcoin close to the essential $97,000 resistance level. At the moment promoting at about $96,209, probably the most beneficial cryptocurrency is inflicting each expectation and concern as market gamers await a breakthrough.

Associated Studying

Whale Accumulation Indicators Sturdy Confidence

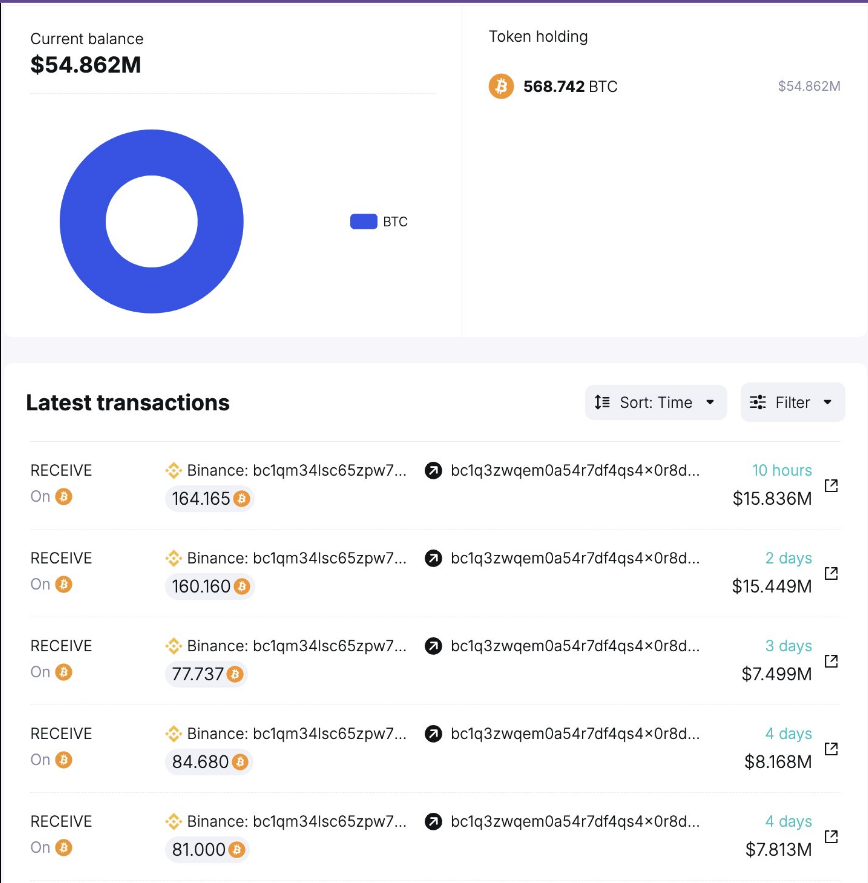

Whales aren’t sitting on the sidelines. From Binance, at a median worth of $96,400, a freshly authorised pockets not too long ago pulled out 568 BTC, or round $55 million, information from Spot On Chain exhibits. These high-value withdrawals often point out long-term belief as buyers migrate their cash from exchanges to protected custody.

Previous whale conduct has additionally hinted notable worth fluctuations. If this tempo of accumulation retains on, it could counsel a big enhance reaching $99,500. The query now’s whether or not or not retail buyers will undertake this strategy.

Contemporary #Bitcoin Accumulation Noticed!

A newly created pockets (4 days outdated) has already withdrawn 568.74 $BTC from #Binance at a median worth of $96,769 (est. price: ~$55.04M).

Is that this a bullish sign for $BTC? Observe @spotonchain and observe this whale dwell at… pic.twitter.com/dnRZl8Yok8

— Spot On Chain (@spotonchain) February 17, 2025

Sluggish Dollar May Give Bitcoin A Enhance

In the meantime, the US Greenback Index (DXY) begins to point out indicators of weak point, based on a crypto analyst. On its MACD (Shifting Common Convergence Divergence), an opposed crossover means that the greenback may very well be shedding power. Primarily based on historic figures, Bitcoin tends to carry out effectively when the US foreign money weakens, as buyers search for different shops of worth.

Ought to the DXY downswing persist, it’d present BTC the required impetus to exceed the $97,000 barrier and search new highs. Nonetheless, the robust comeback of the greenback may maybe decelerate Bitcoin’s motion, subsequently preserving it inside its present buying and selling vary.

Worth Consolidation Earlier than The Subsequent Huge Transfer

Bitcoin continues to be in a consolidation part, regardless of the euphoric sentiment. The resistance at $97,000 has been a big impediment, obstructing an easy breakout. Merchants are at the moment monitoring whether or not the flagship crypto can preserve upward momentum or if one other rejection will lead to a return to decrease assist ranges.

On-chain information signifies that there’s a tug-of-war between clients and sellers. Some short-term speculators could also be taking income, which may very well be contributing to the market’s volatility, whereas whales proceed to build up. A decisive transfer above $99,500 may appeal to further purchasers, whereas a failure to interrupt by way of could lead to one other decline.

Associated Studying

The Street Forward For Bitcoin

The charts are the only focus of consideration. The subsequent psychological goal may very well be $100,000 if BTC surpasses $97,000, a degree that might reignite mainstream enthusiasm. In distinction, Bitcoin could retreat to assist ranges round $95,000 earlier than making an attempt one other rally if resistance stays sturdy.

Featured picture from Gemini Imagen, chart from TradingView