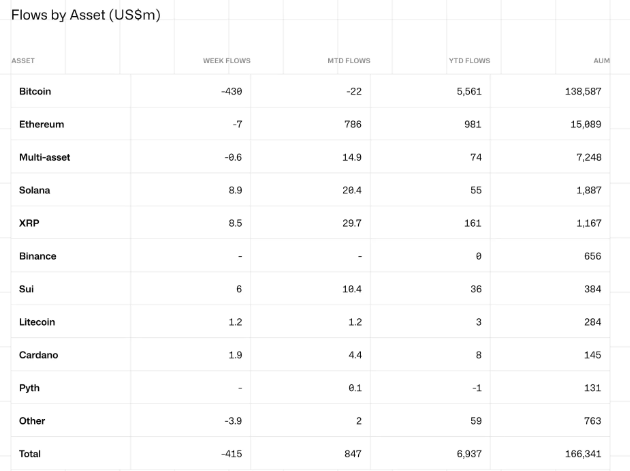

Crypto outflows totaled $415 million final week, marking a pointy reversal from a streak of web constructive flows because the starting of the yr.

This downturn is essentially attributed to Federal Reserve Chair Jerome Powell’s current hawkish remarks and higher-than-expected US inflation knowledge.

Bitcoin Succumbs As Crypto Outflows Hit $415 Million

The most recent CoinShares report signifies that crypto outflows amounted to $430 million final week. Bitcoin (BTC), recognized for its sensitivity to rate of interest expectations, bore the brunt of the investor retreat, indicating a broader risk-off sentiment within the crypto market.

The destructive flows come after the US Federal Reserve (Fed) indicated that inflation climbed to three% year-on-year (YoY) in January, successfully beating expectations. Equally, core inflation reached 3.3%, elevating market issues.

As BeInCrypto reported, crypto buyers reacted negatively, with the general market cap falling by 5% and Bitcoin slipping under $95,000 instantly. Nonetheless, the primary concern was remarks from Fed chair Jerome Powell, who hinted that he was not hurrying to chop rates of interest.

Throughout his testimony to Congress, Powell emphasised the necessity to hold rates of interest elevated for an prolonged interval to fight inflation. This dashed investor hopes for early price cuts, rattling crypto markets, as larger rates of interest typically weigh on speculative belongings.

“A little bit of reverse wealth impact stands out as the prime issue to alleviate inflation, which implies extremely speculative crypto’s on the forefront… It could be foolish to anticipate inflation to drop till danger belongings do,” wrote analyst Mike McGlone.

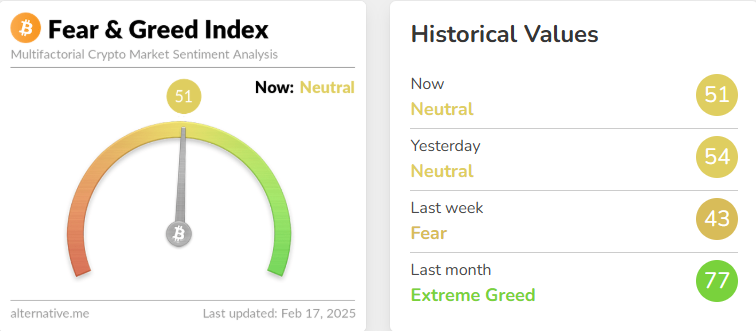

Not forgetting that the market was already reeling from US President Donald Trump’s tariffs on Canada, Mexico, and China, Powell’s stance weighed heavy on risk-on belongings. Bitcoin’s Concern and Greed Index, a broadly adopted measure of market sentiment, dropped into ‘Concern’ territory following the CPI launch.

Notably, it has since resorted to impartial territory, reflecting continued investor uncertainty forward of FOMC minutes this week.

Towards this backdrop, most of final week’s crypto outflows, totaling $464 million, originated from the US. In accordance with CoinShares researcher James Butterfill, US-based buyers reacted strongly to home financial indicators.

“We consider these outflows had been triggered by the Congressional assembly with Fed Chair Jerome Powell, who signaled a extra hawkish financial coverage stance, coupled with US inflation knowledge exceeding expectations…The vast majority of outflows originated within the US…most different international locations remained largely unaffected by the information,” an excerpt within the report learn.

First Internet Crypto Outflows in 2025

In the meantime, the $415 million crypto outflow marks the primary web withdrawal from digital asset funding merchandise in 2025, disrupting a streak of constructive flows. Every week earlier, crypto inflows had reached $1.3 billion, highlighting the speedy sentiment shift in response to macroeconomic situations.

Earlier than this pullback, the crypto market had additionally seen a sequence of sturdy inflows, extending the constructive flows because the first week of the yr. Particularly, the primary week of January noticed $585 million in inflows, signaling early-year investor confidence, whereas inflows soared to $2.2 billion later within the month amid optimism surrounding President Trump’s inauguration. Nonetheless, in early February, inflows slowed to $527 million as China’s DeepSeek drained liquidity.

These figures illustrate how briskly investor sentiment can shift in response to financial knowledge and coverage indicators.

Additionally it is price noting that the impression of inflation knowledge was notably evident in Bitcoin ETF (exchange-traded funds) outflows. As BeInCrypto reported, Bitcoin ETF outflows stretched from $56.76 million to $243 million as inflation and Powell’s stance on price cuts shook investor confidence.

Nonetheless, Ethereum ETFs confirmed better resilience, avoiding comparable capital flight. The most recent CoinShares report additionally signifies that the impression was extra pronounced on Bitcoin than Ethereum. This means that buyers could reassess their digital asset allocations in gentle of shifting macroeconomic situations.

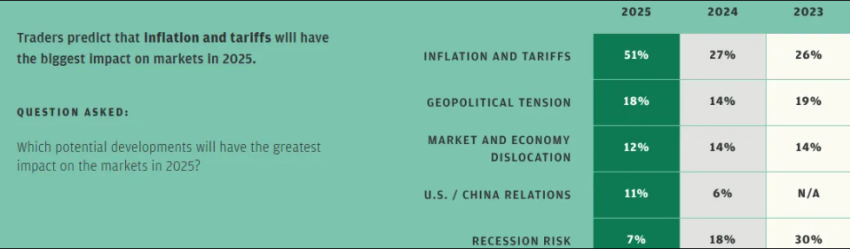

This aligns with a current JPMorgan survey, which established that 51% of merchants view tariffs and inflation as essentially the most influential market components in 2025.

Moreover, 41% of respondents expressed heightened issues about volatility, notably in response to unpredictable political developments.

Primarily based on this outlook, the minutes of the FOMC (Federal Open Market Committee) assembly later may have a bearing on crypto inflows or outflows this week.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.