Distinguished on-chain analytics agency Glassnode says that present metrics are suggesting that Bitcoin (BTC) is nearing the tip of its bull market.

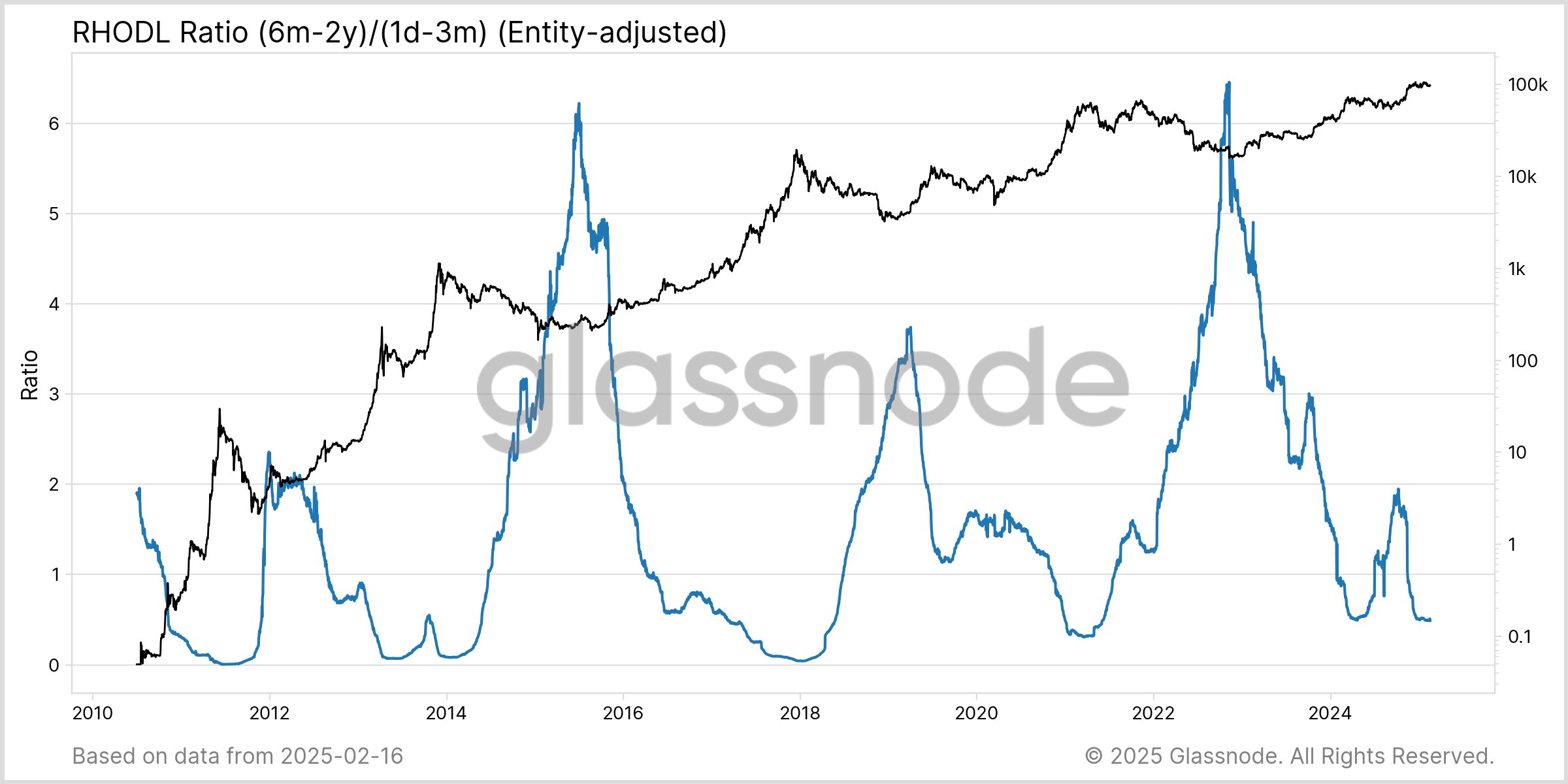

Posting on the social media platform X, Glassnode takes a take a look at the RHODL Ratio, which the agency says helps establish inflection factors in Bitcoin’s market cycle by evaluating the variety of mid-cycle holders – these holding their cash between six months and two years – to new entrants – these holding between sooner or later and three months.

Glassnode says {that a} excessive ratio is seen close to market bottoms whereas a low ratio – or an inflow of recent entrants – corresponds with market cycle tops.

“Proper now, the ratio is declining towards ranges traditionally seen in late-stage bull runs. Whereas not at absolute lows, this means elevated short-term participation – a dynamic typically seen earlier than cycle tops. If the ratio falls additional after which rebounds, it may mark a market turning level.”

Some high analysts are nonetheless assured there’s one other leg but to come back in BTC’s bull run.

In a current technique session, pseudonymous analyst DonAlt informed his 65,700 YouTube subscribers that BTC bears had many probabilities to drive costs decrease up to now weeks after President Donald Trump restarted commerce battle talks and regarded buying different nations.

Based on the strategist, any of these headlines may have catalyzed a deeper Bitcoin correction. However DonAlt says the truth that BTC continues to be buying and selling above $90,000 regardless of an onslaught of bearish information makes him imagine that Bitcoin is gearing up for a lot increased costs.

“I’m not bearish. My intestine feeling is that this resolves to the upside, however I additionally acknowledge that so long as we’re buying and selling beneath $101,000 or beneath the weekly mid-range [around $98,000], TA (technical evaluation)-wise barely leaning bearish.

I simply don’t essentially assume it’s very conclusive, particularly given how sturdy the uptrend has been and the way weak the sell-off has been contemplating that Trump has mainly been throwing round tariffs, been speaking about annexing Canada [and] Greenland…

You can also make a listing and in case you threw any of this stuff on that record at me two or three years in the past, and also you requested me, ‘Hey, how are markets wanting?’ I’d be like ‘Every little thing is useless, you recognize.’

[But] then nothing has occurred. It’s barely led to any sell-off, so it’s exhausting for me to be too bearish. I feel simply usually, it is smart to be both impartial and anticipate the momentum or be bullish regardless that the TA just isn’t essentially too bullish proper now.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses chances are you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/Monarch Artwork/WhiteBarbie