Este artículo también está disponible en español.

In a submit shared on X along with his 700,000 followers, market veteran CRYPTO₿IRB (@crypto_birb) outlined what he believes may very well be one in every of Bitcoin’s remaining main pullbacks earlier than an eventual surge to a six-figure value goal. In his personal phrases: “BTC LAST DIPS BEFORE $273K? Right here’s why:” He backed up this declare with a collection of concise bullet factors overlaying market tendencies, technical indicators, and historic knowledge.

Final Likelihood to Purchase Bitcoin Low cost?

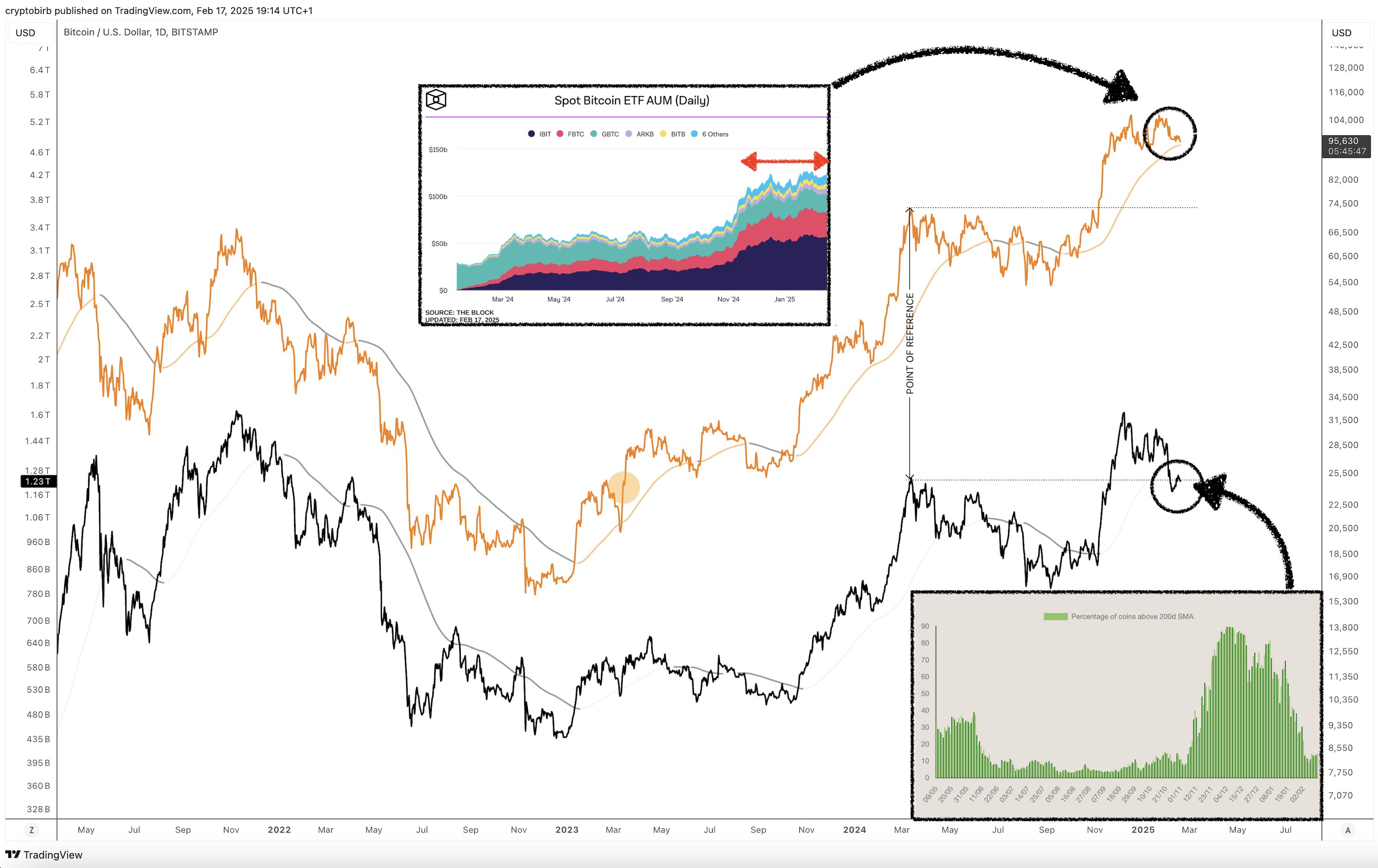

CRYPTO₿IRB’s evaluation begins with an outline of the “Bull Market” setting, noting that each the 200-week and 50-week shifting averages are rising. These long-term tendencies typically replicate a broader shift in market sentiment.

He additionally references the most recent knowledge on Bitcoin exchange-traded funds, pointing to complete belongings underneath administration (AUM) of $121 billion, alongside a considerable buying and selling quantity of $746 billion. One other key metric highlighted is the Internet Unrealized Revenue and Loss (NUPL), which he locations at 0.54, suggesting that extra merchants are in revenue than these at a loss. He observes a seven-week correlation to the S&P 500 at 0.25, signaling solely a reasonable linkage between Bitcoin and the normal fairness market over that interval.

Associated Studying

The analyst then addresses the “Each day Pattern,” indicating that he sees Bitcoin oscillating inside a spread of $90,000 to $110,000 for now. He situates the 200-day Easy Transferring Common at about $80,200 and emphasizes that this determine is trending upward. CRYPTO₿IRB additionally explains that the proprietary 200-day BPRO indicator sits at roughly $94,400, which he views as one other signal of strengthening momentum, regardless of a 50-day RSI at 42. An RSI under 50 typically factors to cooled market momentum, but he notes that volatility seems stalled for the second, with an Common True Vary of $3,360 suggesting that value swings have softened in comparison with earlier intervals.

Turning to his “Commerce Setup,” CRYPTO₿IRB highlights that he sees sure bearish configurations on his 12-hour BPRO CTF and HTF Trailer indicators. He describes market circumstances as uneven, with resistance showing across the $99,700 to $103,100 vary. This means that if Bitcoin fails to interrupt above that resistance stage, short-term pullbacks or sideways exercise may proceed till consumers regain management.

Concerning “Sentiment & Miners,” the analyst factors to a Concern & Greed Index studying of 51, a stage thought-about impartial. He remarks that concern sometimes spikes simply earlier than key breakouts, implying that the absence of maximum concern could point out a extra sustained climb as soon as resistance zones are cleared. He additionally classifies the continued market cycle section as “perception,” suggesting that buyers stay cautiously optimistic with out the euphoria that always indicators main tops. One other essential issue is miners’ profitability, which he estimates stays wholesome above $88,400, a threshold that may discourage extreme miner promoting and assist reinforce value flooring.

Associated Studying

His commentary on “Seasonality” underscores the historic efficiency of Bitcoin. He notes that February has seen a median achieve of 15.85% with constructive returns in seven out of ten years. Total, first quarters are likely to ship round a 25% common achieve. From 2010 to 2024, Bitcoin’s annualized return stands at roughly 145%, reflecting the spectacular long-term development that has characterised its historical past. CRYPTO₿IRB encourages merchants to “BTFD Feb–March,” which is brief for “purchase the dip,” implying that he expects engaging entry factors to emerge earlier than the market probably rallies once more.

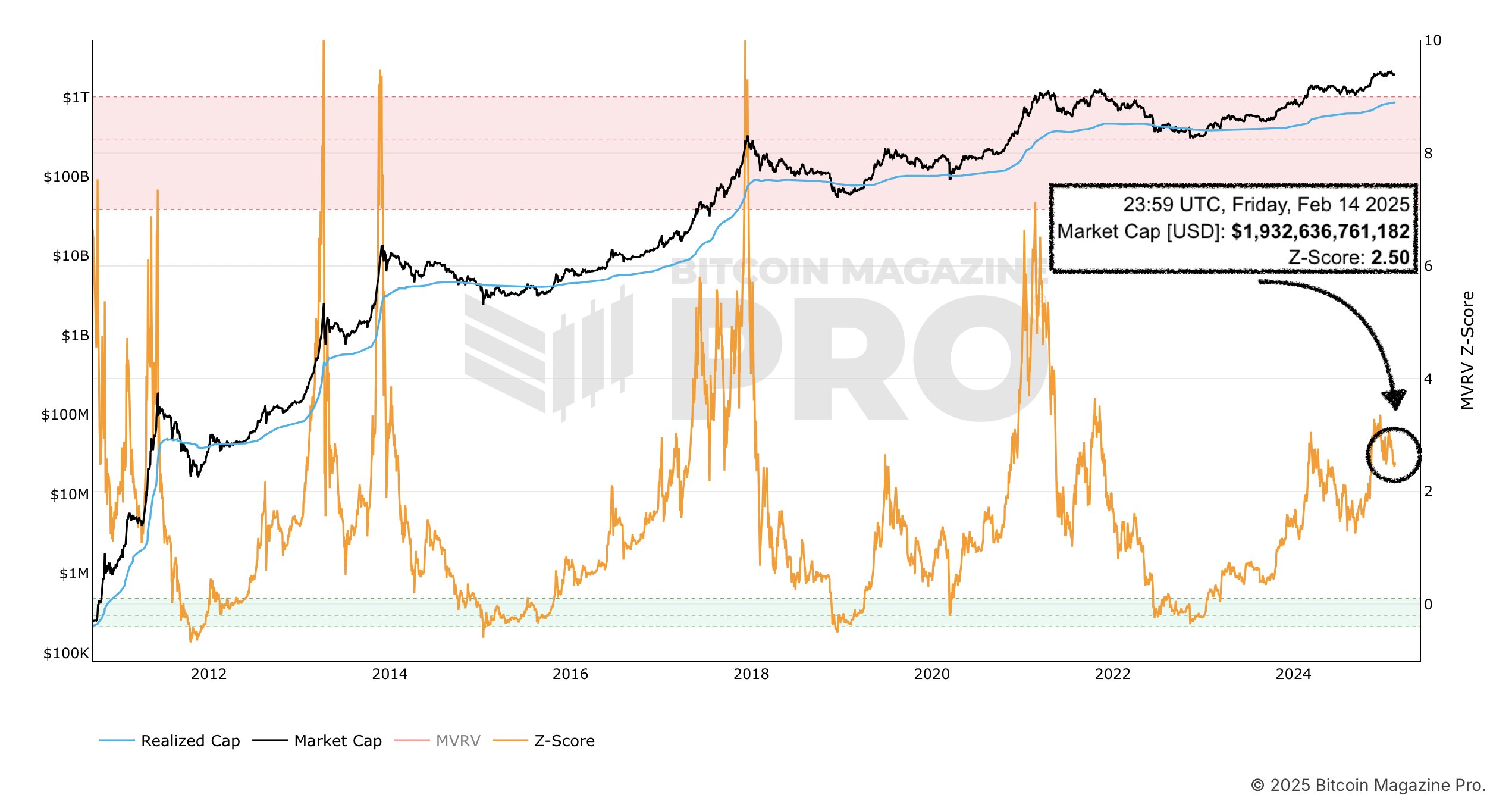

In explaining the “Macro Prime,” he seems to be to the MVRV Z-Rating, a metric that compares market worth to realized worth. He warns that an MVRV Z-Rating above 7.0 historically indicators an overheated market. At the moment at 2.43, the rating stays properly under that hazard zone, which leads him to undertaking a doable peak above $273,000 (2.88x from $95.3k).

He states: “Bitcoin will begin forming high over $273k+. In keeping with MVRV Z-Rating, the market peaked solely when MVRV pushed & stayed for weeks above 7.0 (2.8X from $97.5k). It’s the pre-rich section.”

At press time, BTC traded at $95,553.

Featured picture created with DALL.E, chart from TradingView.com