On-chain information exhibits that giant Dogecoin transactions have seen a pointy drop just lately, an indication that whales are not energetic on the community.

Dogecoin Whale Exercise Has Plunged Since Mid-November

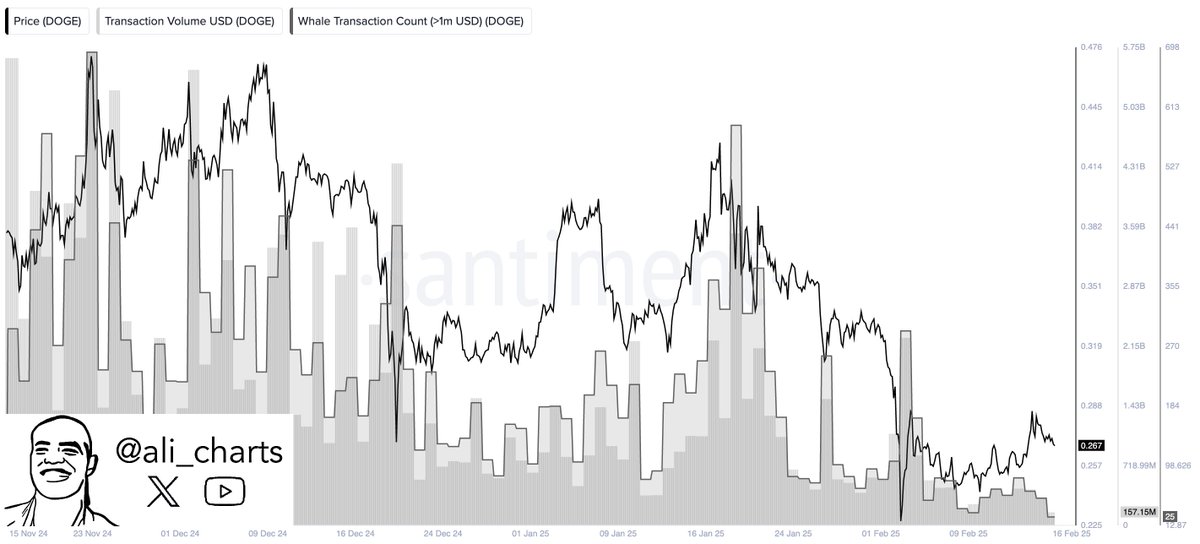

As identified by analyst Ali Martinez in a brand new publish on X, the Whale Transaction Rely has declined for Dogecoin just lately. The “Whale Transaction Rely” right here refers to an indicator created by the on-chain analytics agency Santiment that retains monitor of the full variety of DOGE transfers carrying a price of greater than $1 million.

Typically, solely the whale entities are able to making single-transaction strikes this huge, so the metric’s worth is assumed to correlate to the exercise of this cohort.

When the worth of the Whale Transaction Rely is excessive, it means the whales are making a lot of transfers. Such a pattern suggests these humongous buyers have an energetic curiosity in buying and selling the asset. Then again, the indicator being low implies this group might not be paying a lot consideration to the meme coin as its members aren’t taking part in any notable transaction exercise.

Now, here’s a chart that exhibits the pattern within the Whale Transaction Rely for Dogecoin over the previous few months:

Appears like the worth of the metric has been heading down since some time now | Supply: @ali_charts on X

As is seen within the above graph, the Dogecoin Whale Transaction Rely shot as much as a excessive degree again in November, which means that the community was receiving a excessive quantity of exercise from the whales.

For the reason that peak in mid-November, although, the indicator has been following an total downward trajectory. Right now, the blockchain is witnessing simply 25 every day transactions from the whales, which represents a decline of practically 88% in comparison with the excessive.

Evidently, the current downturn within the meme coin’s value has coincided with this cooldown in whale curiosity. Given this sample, the metric may very well be to regulate within the close to future, as any modifications in it’d indicate a brand new final result for DOGE. Naturally, extended inactivity from the group might imply additional bearish motion for the asset, whereas a surge might result in a rally.

The low Whale Transaction Rely isn’t the one unhealthy signal that Dogecoin has seen just lately, as Martinez has defined in one other X publish that the cryptocurrency has witnessed a dying cross between the MVRV Ratio and its 200-day transferring common (MA).

The metrics seem to have seen a crossover in current days | Supply: @ali_charts on X

The Market Worth to Realized Worth (MVRV) Ratio right here is an on-chain metric that principally tells us in regards to the profit-loss standing of the Dogecoin buyers. As DOGE’s value has declined just lately, investor profitability has dropped, which has resulted in a plunge within the MVRV Ratio.

With this plummet, the indicator has gone below its 200-day MA. “The final two occasions this occurred, costs dropped 26% and 44%,” notes the analyst.

DOGE Value

On the time of writing, Dogecoin is buying and selling at round $0.264, up practically 6% within the final seven days.

The worth of the coin appears to have gone down during the last couple of days | Supply: DOGEUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com