After months of ready, the FTX repayments to collectors have lastly begun. Nonetheless, regardless of widespread beliefs that this might be a bullish sign, crypto markets are within the purple right this moment.

The alternate’s defunct FTT token briefly spiked, persevering with to achieve alongside main reimbursement bulletins. Nonetheless, it fell laborious as analysts struggled to make a transparent prediction for the long run.

FTX Repayments Start At Final

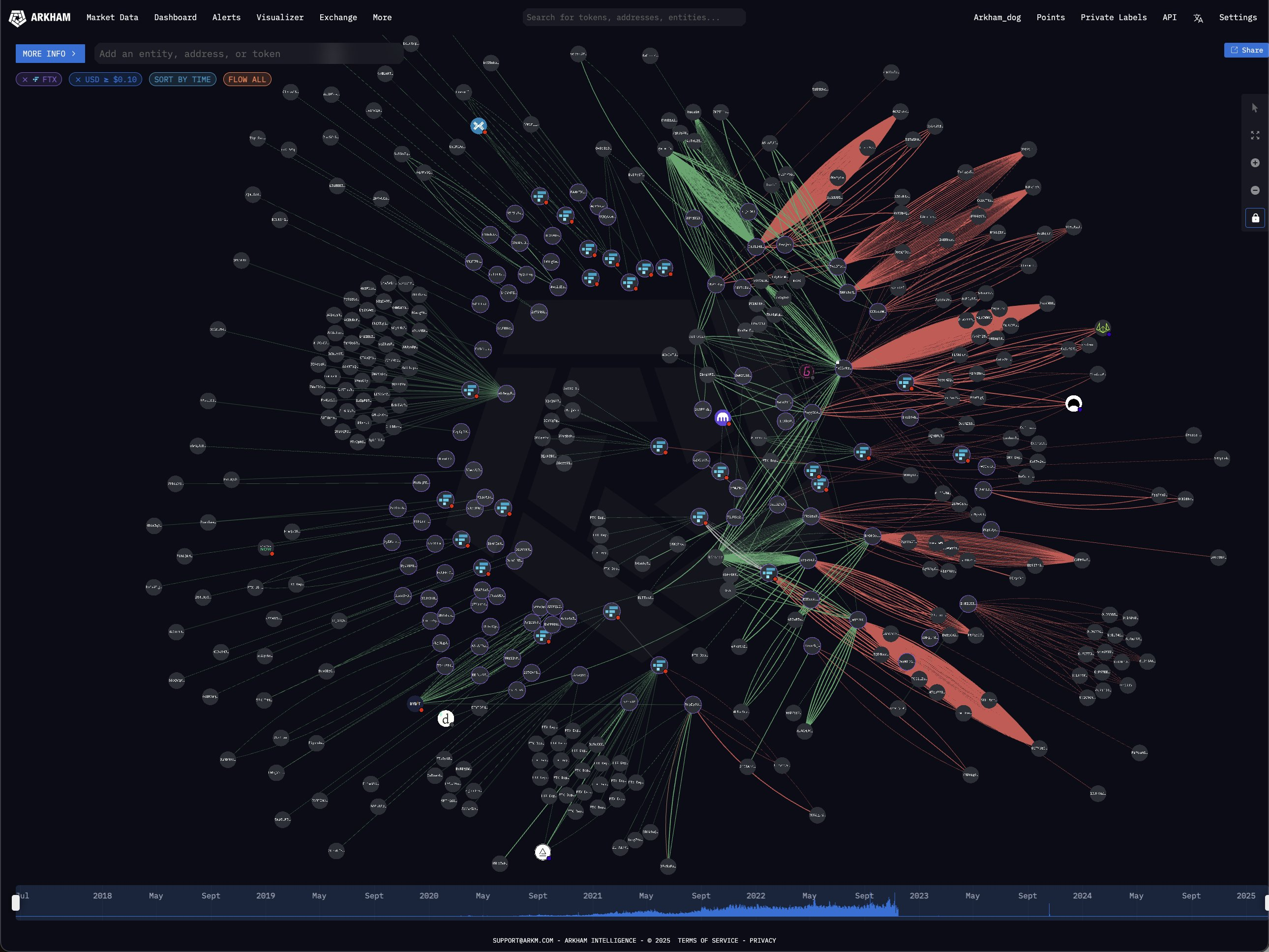

When main crypto alternate FTX collapsed in 2022, it despatched enormous shockwaves by way of the whole business. The fallout from the crash itself has largely subsided, however one key problem remained: reimbursements for collectors.

After years of stagnation, progress has been constructing for a number of months, and former FTX customers have begun reporting that their repayments are lastly coming in.

Nonetheless, a regarding development has developed within the markets right this moment. After FTX started the street to issuing repayments, a lot of the group assumed that this might function a bullish incentive.

In essence, this preliminary reimbursement section would inject $1.2 billion of liquidity into the market immediately by way of the palms of veteran merchants. Certainly, prevailing thought went, this might enormously juice asset costs.

The FTX repayments have begun, nonetheless, and it’s wanting something however bullish. The platform’s defunct token, FTT, just lately bucked the market by gaining whereas the biggest belongings declined.

FTT briefly spiked in accordance with this development, nevertheless it already sank again down. In the meantime, the biggest cryptoassets are posting uniformly damaging returns.

A number of outstanding business analysts have already reacted with alarm. Theoretically, the FTX repayments had been purported to herald an altcoin season.

Customers had been repaid based mostly on the worth of their tokens in 2022, with an connected rate of interest. This may typically be decrease than their fee of development, encouraging future funding. Nonetheless, this hasn’t occurred.

“These are a few of the trickiest circumstances to navigate in a very long time. This feels extra like a paradigm shift than a capitulation backside. The quantity of bullish information we’re getting proper now could be insane. A couple of months in the past we’d be flying on headlines like these. However it could possibly’t even budge markets. Simply reveals how demand has dried up,” analyst Miles Deutscher mentioned by way of social media posts.

A couple of elements may clarify this lack of momentum. Initially, crypto markets are very chaotic in the mean time, and present bearish momentum hasn’t helped something.

Second, meme cash have swallowed a number of altcoin demand, dampening enthusiasm for a lot of token tasks. Traders that will have chosen these altcoins in 2022 produce other plans right this moment.

Above all, nonetheless, we’re in an unprecedented second. Final yr, the Bitcoin ETFs brought about the halving to interrupt traits current in all prior halvings.

Since then, institutional funding in crypto has flown to all-time highs, and we stay in a world of billion-dollar scams. The FTX repayments didn’t trigger the specified impact, and no one is aware of their precise impression. It’s all within the air.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.