Hedera (HBAR) worth is trying to recuperate after a steep 40% correction within the final 30 days. Whereas the downtrend stays intact, indicators recommend that promoting stress could also be easing.

The Ichimoku Cloud and EMA strains nonetheless present bearish indicators, however key resistance ranges might set off a breakout if shopping for momentum strengthens. If HBAR can reclaim misplaced floor, it might check $0.248 quickly, whereas additional draw back stays attainable if assist at $0.21 is misplaced.

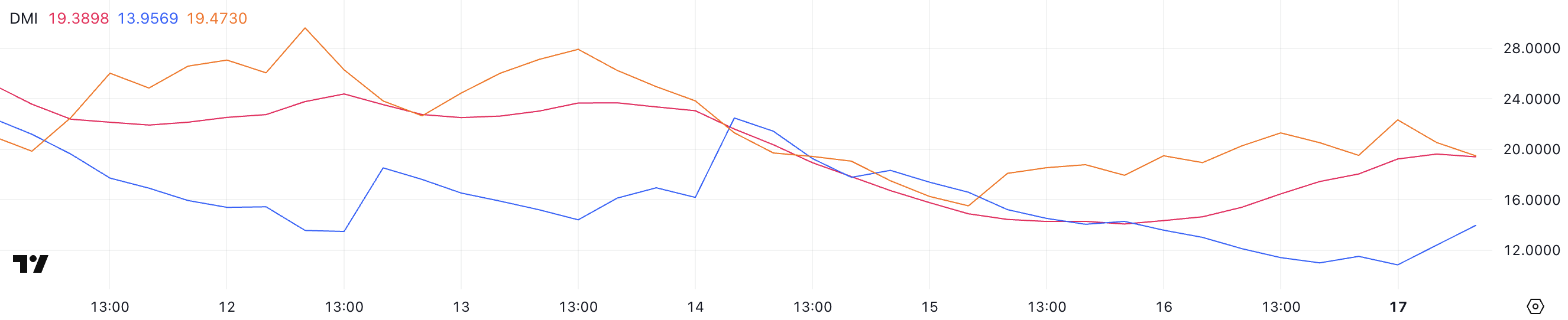

HBAR DMI Exhibits the Downtrend May Be Easing

HBAR DMI chart reveals its ADX has risen to 19.3 from 14.2 within the final two days, indicating a strengthening pattern. The ADX (Common Directional Index) measures pattern power on a scale from 0 to 100, with values beneath 20 signaling a weak pattern and above 25 indicating a stronger one.

Since ADX remains to be beneath 20 however rising, it means that Hedera downtrend might be stabilizing, although it hasn’t confirmed a robust directional transfer but.

Wanting on the directional indicators, +DI has risen to 13.9 from 10.9 after falling from 22.4 three days in the past, whereas -DI has declined to 19.4 from 22.3. This means that promoting stress is easing whereas shopping for momentum is slowly recovering.

Nonetheless, with -DI nonetheless above +DI, the downtrend stays intact. If +DI continues rising and crosses above -DI, it might sign a pattern reversal, however for now, HBAR wants stronger shopping for momentum to shift out of its bearish part.

Hedera Ichimoku Cloud Exhibits an Ongoing Bearish Setup

The Ichimoku Cloud for HBAR reveals the worth at the moment buying and selling beneath the cloud, indicating a bearish pattern. The cloud itself is pink and projected ahead, signaling potential resistance forward.

The baseline (Kijun-sen) and conversion line (Tenkan-sen) are each flat, suggesting weak momentum. For a pattern reversal, the worth would wish to interrupt above the cloud, which at the moment sits round $0.23.

The lagging span (Chikou Span) remains to be beneath the worth motion, confirming that bearish momentum is undamaged. Nonetheless, a slight worth rebound suggests an try and regain power.

If Hedera breaks above the Tenkan-sen and Kijun-sen, it might problem the decrease fringe of the cloud. A rejection at this degree might result in additional draw back, whereas a profitable breakout above the cloud can be a robust bullish sign.

HBAR Value Prediction: Will Hedera Fall Beneath $0.2?

Hedera worth chart reveals its short-term EMA strains buying and selling beneath the long-term ones, confirming a bearish pattern. If the downtrend continues, HBAR might check the $0.21 assist degree, and dropping that would push it additional right down to $0.179.

Promoting stress stays dominant, making these ranges essential for bulls to defend.

On the upside, if HBAR worth can reverse its pattern, the following resistance to observe is $0.248. A breakout above this degree might strengthen bullish momentum, doubtlessly sending the worth towards $0.32, its highest degree since late January.

Nonetheless, for this to occur, HBAR wants a robust shift in momentum and elevated shopping for stress.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.