Bitcoin’s short-term value course stays unsure, as analysts and buyers are divided on whether or not BTC will break into a brand new all-time excessive (ATH) or face promoting stress into decrease costs. The value has been trapped in a slim vary for the previous twelve days, holding above $94K and under the $100K mark, with neither bulls nor bears in a position to take full management of the market.

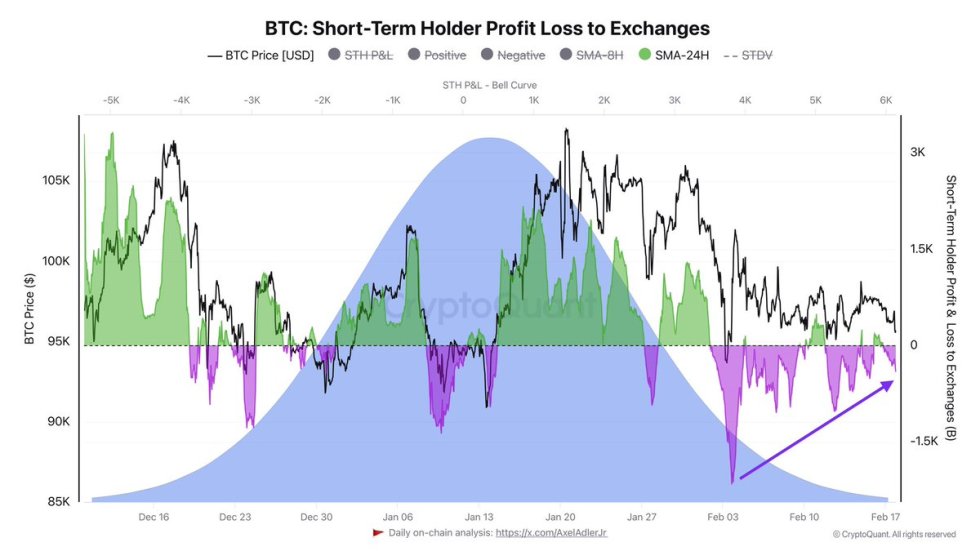

This era of sideways buying and selling has created hypothesis about an imminent main transfer, as Bitcoin continues to consolidate inside these key ranges. CryptoQuant knowledge reveals that on the present ranges, the variety of sellers keen to promote at a loss has dropped to a minimal, a sign that market contributors are holding their BTC as an alternative of panic-selling. Traditionally, such situations point out that value volatility is on the horizon, as provide stays tight whereas demand is predicted to extend.

With sentiment cut up between a breakout or a deeper correction, merchants carefully watch the $100K resistance and the $94K assist to find out the subsequent huge transfer. If BTC pushes above the $100K mark, a rally into value discovery may observe. Nevertheless, a breakdown under $94K may set off additional promoting stress.

Bitcoin Metrics Recommend A Massive Transfer Is Coming

Bitcoin’s value motion has remained stagnant over the previous two weeks, buying and selling inside a slim vary between $94K and $100K. Nevertheless, a constructive outlook means that BTC is gearing up for an enormous transfer into new all-time highs (ATH). Analysts speculate that this current consolidation part is the calm earlier than the storm, setting the stage for the subsequent main breakout.

Regardless of short-term uncertainty, Bitcoin stays structurally bullish, holding above key assist ranges and sustaining its long-term uptrend. Whereas buyers are divided on whether or not BTC will break greater or face one other correction, on-chain knowledge hints at a tightening provide.

CryptoQuant analyst Axel Adler shared an evaluation on X suggesting that on the present ranges, the variety of sellers keen to promote at a loss has dropped to a minimal. This means that holders are refusing to half with their BTC, signaling confidence in greater costs forward. Adler provides that, at this stage, there’s nothing to do however watch for BTC’s subsequent transfer—suggesting {that a} breakout or breakdown is imminent.

With market situations tightening and volatility anticipated to return quickly, this week will probably be essential in figuring out Bitcoin’s short-term course. If BTC pushes above $100K, an enormous rally into value discovery may observe. Nevertheless, if it breaks under $94K, additional promoting stress could emerge.

BTC Consolidates Above Key Demand

Bitcoin is buying and selling at $95,600, sustaining a sideways pattern for practically two weeks, fluctuating between $94K and $100K. This slim vary has led to uncertainty, as neither bulls nor bears have taken management of the value motion.

The $95K stage stays a essential assist, serving as a key demand zone the place consumers have persistently stepped in to forestall additional draw back. Holding above this stage would sign power and create a chance for BTC to check greater provide ranges. Nevertheless, bulls face a serious problem, as they have to reclaim $98K and finally push above $100K to verify a breakout into new highs.

If BTC fails to interrupt above resistance, the market may proceed to expertise uneven value motion, delaying the subsequent main transfer. A breakdown under $95K may lead to a retest of decrease demand zones, with potential draw back towards $91K–$93K.

Merchants are looking forward to a decisive transfer in both course, as volatility is predicted to return. The following few days will probably be essential in figuring out whether or not BTC can regain bullish momentum or if a deeper correction is on the horizon.

Featured picture from Dall-E, chart from TradingView