Este artículo también está disponible en español.

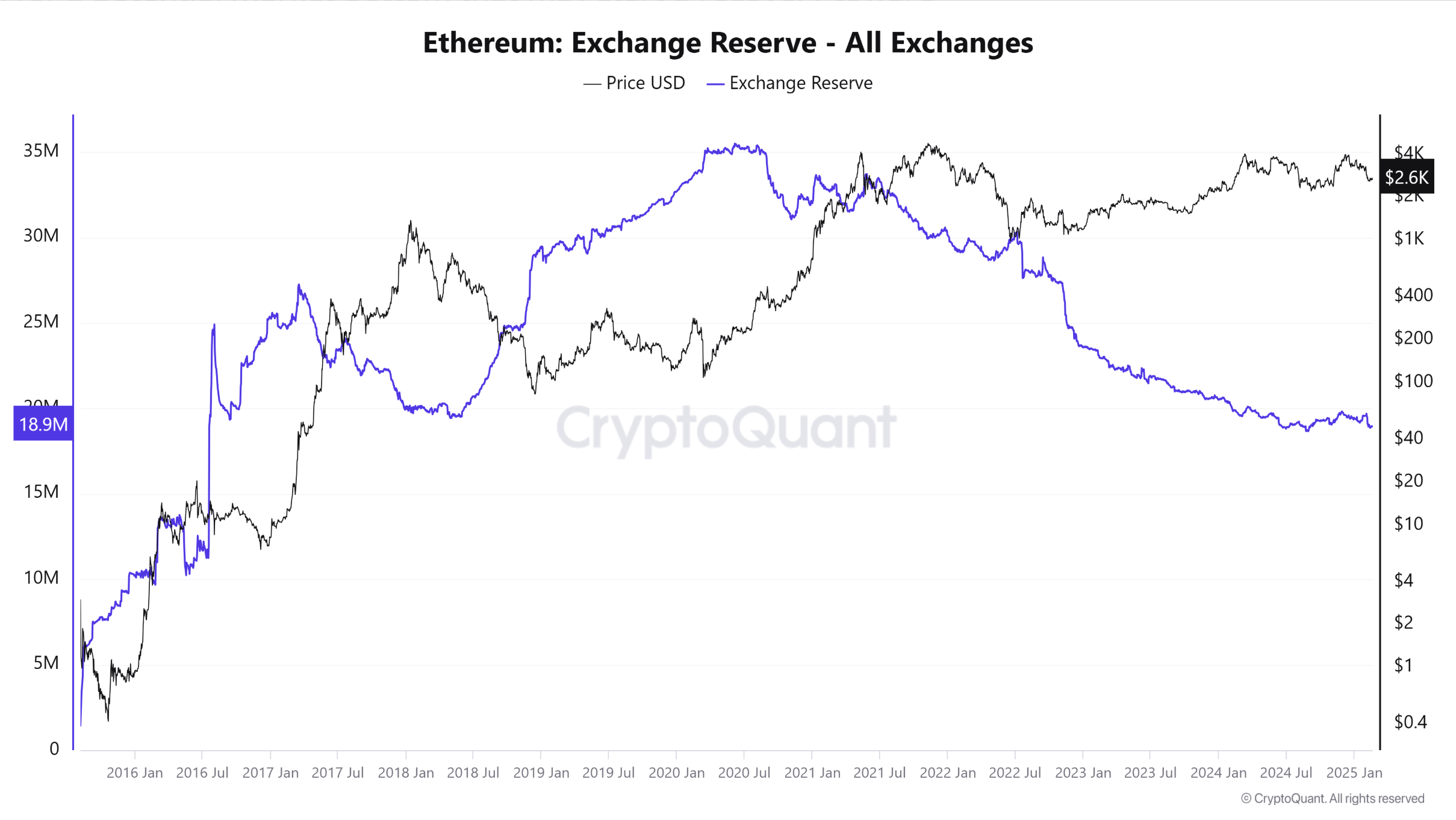

In keeping with current knowledge from CryptoQuant, Ethereum (ETH) reserves on centralized cryptocurrency exchanges have dropped to a nine-year low. Specialists recommend that this dwindling ETH provide may point out an impending ‘provide shock,’ doubtlessly fuelling a big rally within the cryptocurrency.

Ethereum Reserves At 9-12 months Low

Ethereum, the second-largest cryptocurrency by market cap, continues to commerce inside the mid-$2,000 vary, sitting at $2,721 on the time of writing. In contrast to Bitcoin (BTC), ETH has had a comparatively quiet 2024, struggling to interrupt previous its all-time excessive (ATH) of $4,878, recorded in November 2021.

Associated Studying

This lackluster value motion has contributed to waning investor confidence in ETH. Nevertheless, the digital asset lately managed to defend the essential $2,380-$2,460 demand zone, rekindling bullish hopes for a possible breakout above the cussed $3,000 resistance stage.

Extra notably, ETH reserves on centralized exchanges proceed to plummet, which may result in a provide shock – a situation the place demand for the asset surpasses its liquid provide. If this materializes, ETH could expertise speedy value appreciation.

For the uninitiated, a provide shock within the crypto trade happens when the demand for the underlying digital asset exceeds its liquid provide. Because of this, the underlying asset – ETH, on this case – could expertise sharp value appreciation in a short while.

As of immediately, ETH reserves on centralized crypto exchanges have fallen to 18.95 million, a stage final seen in July 2016. Notably, ETH was buying and selling at $14 on the time.

Current evaluation from seasoned crypto analyst Crypto Buddha means that ETH could also be on the verge of a significant value transfer. The analyst highlights how ETH has damaged by a diagonal resistance stage, signalling a possible bullish breakout.

Moreover, Bitcoin (BTC) is exhibiting related value conduct. A profitable BTC breakout may spark a broader crypto market rally, driving vital beneficial properties throughout varied digital belongings. Crypto Buddha famous:

Bitcoin‘s value motion is following the same sample with a triangular convergence, elevating the query of whether or not it may possibly break by efficiently like Ethereum. For the reason that low of $91,000, Bitcoin has been consolidating for 10 days. The market is at an important juncture, and it’s time to choose a route.

Will ETH Traders Lastly Have Their Time?

In contrast to opponents equivalent to Solana (SOL), SUI, and XRP, which have all seen vital value appreciation over the previous yr, ETH has struggled to capitalize on bullish momentum. Bearish sentiment surrounding ETH has been on unprecedented ranges.

Associated Studying

Nevertheless, analysts are assured that ETH could quickly shock the market. Current evaluation by Titan of Crypto emphasizes that ETH could quickly enter its ‘most hated rally,’ resulting in main value appreciation.

That stated, considerations in regards to the Ethereum Basis promoting copious quantities of ETH proceed to hang-out the holders. At press time, ETH trades at $2,721, down 4.7% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and Tradingview.com