Hyperliquid (HYPE) value has dropped greater than 6% within the final 24 hours, regardless of the launch of HyperEVM, which goals to broaden the platform’s DeFi capabilities. The combination of Ethereum Digital Machine (EVM) performance is predicted to convey programmability to Hyperliquid’s buying and selling ecosystem.

Nevertheless, technical indicators present indicators of weak point, with momentum fading and bearish alerts rising. Whether or not HyperEVM can drive renewed shopping for strain or if the continued downtrend continues can be essential in figuring out HYPE value subsequent main transfer.

Hyperliquid Rolls Out HyperEVM, as It Continues To Make Hundreds of thousands of {Dollars} Per Day

Hyperliquid has launched HyperEVM, marking a serious step towards integrating sensible contract performance into its high-speed monetary system. The improve brings Ethereum Digital Machine (EVM) compatibility, permitting for decentralized purposes whereas sustaining the platform’s buying and selling expertise.

The preliminary mainnet launch contains safety backed by HyperBFT consensus, seamless transfers between native HYPE and HyperEVM HYPE, and a canonical WHYPE system contract to facilitate DeFi exercise.

Hyperliquid continues to solidify its place as one of the vital related gamers in crypto proper now, rating among the many high 20 highest-earning purposes prior to now week.

The platform generated over $8.5 million in income within the final seven days, surpassing notable tasks like Ethena and Marinade, whereas closing in on Maker, BullX, and Ethereum.

Hyperliquid Indicators Counsel Bullish Strain Is Not Dominant

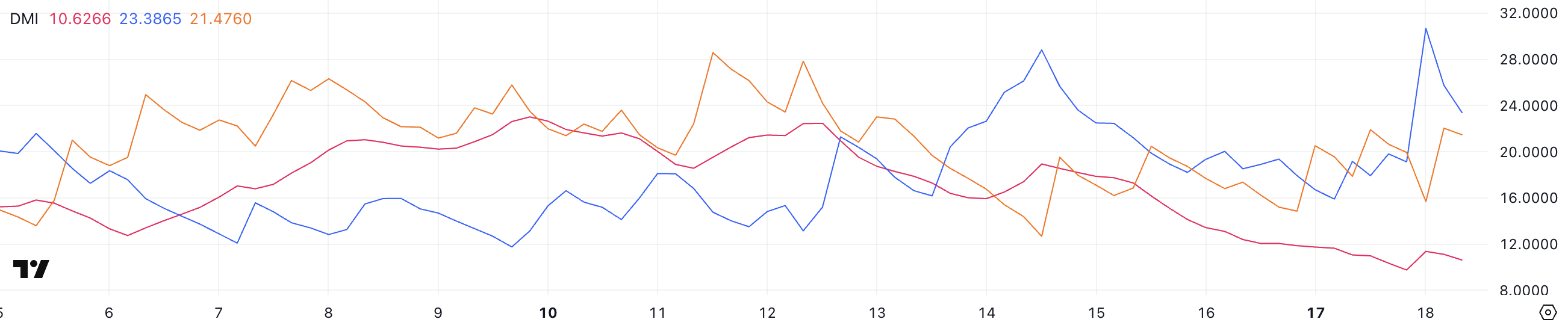

HYPE DMI exhibits that its ADX has dropped to 10.6, down from 18.9 4 days in the past, signaling a weakening development. An ADX studying under 20 sometimes suggests a scarcity of robust directional momentum, that means the present market motion lacks conviction.

In the meantime, +DI (23.3) stays barely above -DI (21.4), indicating that bullish strain continues to be current however not dominant.

Nevertheless, with short-term EMA strains trending downward regardless of being above long-term EMAs, the market might be liable to additional weak point. If the short-term EMAs proceed declining, a bearish crossover might type, reinforcing draw back strain.

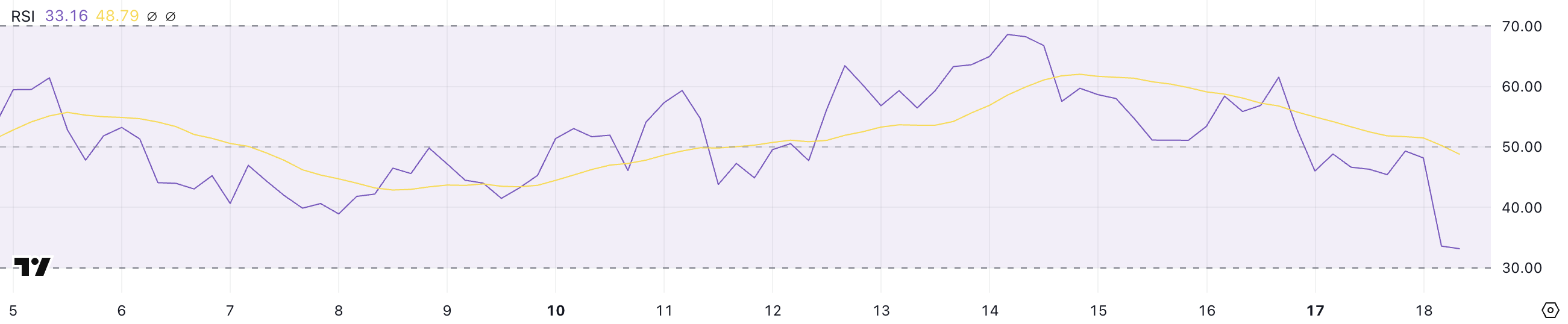

HYPE’s RSI has additionally dropped considerably, falling to 33.1 from 68 in simply 4 days, reflecting a fast lack of bullish momentum. Whereas the present studying stays above the 30 threshold for oversold situations, the sharp decline means that sellers have been in management.

If RSI continues falling, HYPE value might enter oversold territory, probably triggering a bounce if patrons step in. Nevertheless, if bearish momentum persists, it might sign additional draw back earlier than any significant restoration happens.

The mixture of weakening development energy and falling RSI means that HYPE is in a fragile place, with merchants watching carefully for indicators of stabilization or additional decline.

HYPE Value Prediction: Will Hyperliquid Rise Above $30?

HYPE’s EMA strains point out {that a} loss of life cross might be forming quickly, as short-term EMAs are trending downward and approaching a crossover under long-term EMAs.

That is sometimes a bearish sign that means weakening momentum and the potential for additional draw back. If the downtrend continues, HYPE value might check assist at $22.5. If that stage fails, the worth could drop additional to $20 and even $18.89, marking the primary time it has fallen under $20 since late January.

A confirmed loss of life cross would reinforce promoting strain, making a restoration harder within the brief time period.

Nevertheless, if the launch of HyperEVM sparks renewed shopping for curiosity, Hyperliquid might regain bullish momentum and push towards $27.4 as the primary main resistance.

A breakout above that stage might result in a check of $28.3, and if sustained bullish momentum follows, HYPE value might rise previous $30, a stage not seen since December 2024.

The market’s response to HyperEVM’s launch can be key in figuring out whether or not HYPE breaks out of its present downtrend or continues going through strain.

Disclaimer

In keeping with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.