Ethereum (ETH) has been struggling to regain bullish momentum after briefly turning optimistic amid the Solana meme coin controversy. Whereas that preliminary push hinted at a stronger uptrend, it failed to achieve traction, leaving ETH caught in a consolidation section.

Now, Ethereum is trying to reclaim the $3,000 stage because it recovers from an almost 18% drop during the last 30 days. With technical indicators nonetheless displaying blended alerts, ETH stays at a pivotal level the place a decisive breakout or breakdown may form its subsequent main transfer.

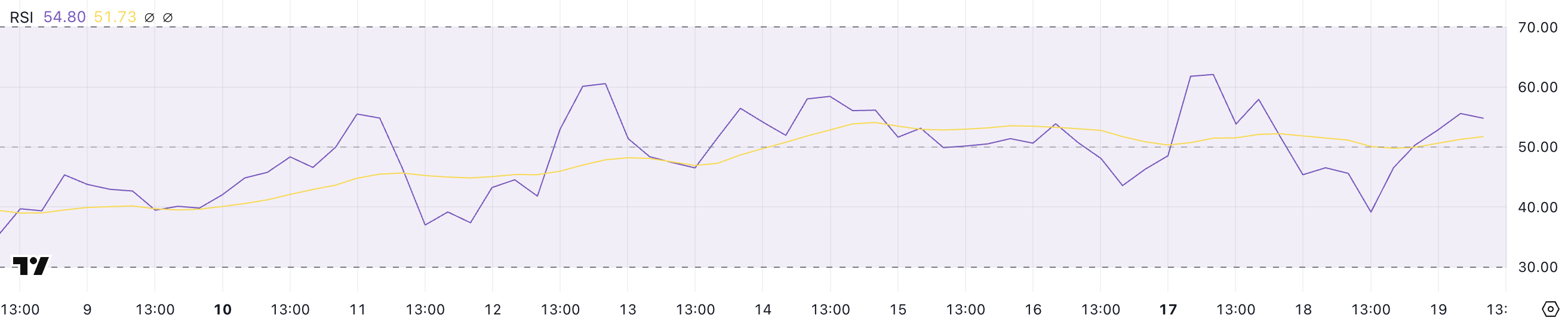

ETH RSI Has Been Impartial For 16 Days

ETH RSI is presently at 54.8 after reaching a excessive of 62 and dropping to 39.1 between yesterday and as we speak. This motion displays a interval of elevated volatility, the place worth momentum briefly accelerated earlier than pulling again.

Regardless of this fluctuation, RSI has now stabilized at a mid-range stage, suggesting that neither robust shopping for nor promoting strain is presently dominant.

This comes after a sequence of impartial readings over the previous few weeks, reinforcing the concept that ETH has been missing a transparent directional pattern.

RSI, or the Relative Energy Index, is a momentum indicator that measures the pace and magnitude of latest worth actions on a scale from 0 to 100.

Readings above 70 sometimes sign overbought circumstances, which may point out that an asset is due for a pullback, whereas readings under 30 counsel oversold circumstances, usually previous a possible rebound. Ethereum RSI at 54.8 locations it squarely in impartial territory, a place it has maintained since February 3.

The final time it reached overbought ranges above 70 was on January 6 – almost a month and a half in the past – suggesting that ETH has struggled to generate the sort of sustained bullish momentum wanted for a breakout.

Except RSI strikes decisively above 60 or under 40, ETH’s worth is prone to stay range-bound with out a robust directional bias.

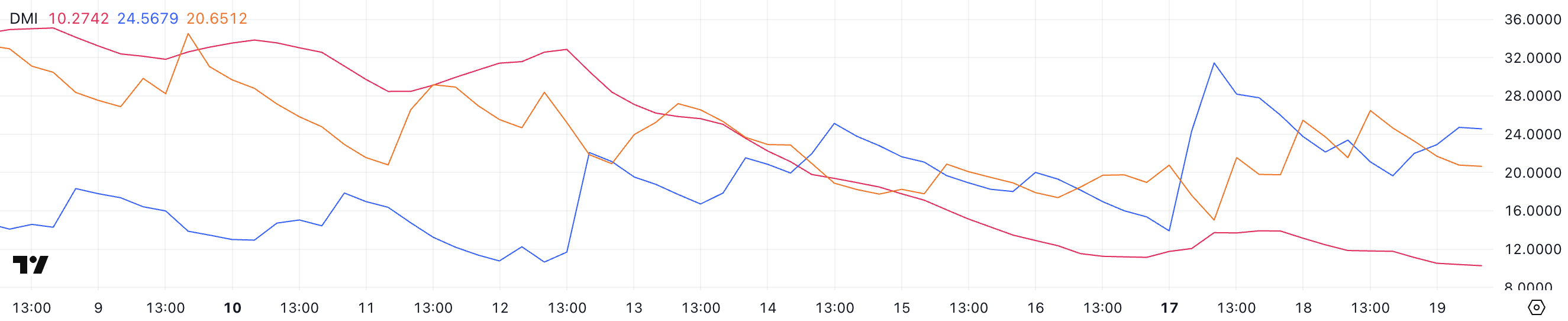

Ethereum DMI Reveals the Uptrend Is Nonetheless Making an attempt to Get Traction

Ethereum’s DMI chart signifies that its ADX is presently at 10.2, declining from 13.7 yesterday and considerably down from 32.8 one week in the past.

This sharp drop suggests a weakening pattern energy, as ADX measures the general momentum of a worth motion moderately than its path.

A decrease ADX studying sometimes alerts that the market is in a interval of consolidation or indecision, with neither bulls nor bears gaining clear management. Provided that ADX has now fallen to a low stage, ETH latest worth motion seems to lack robust conviction in both path.

The Common Directional Index (ADX) is a key part of the Directional Motion Index (DMI) and is used to evaluate the energy of a pattern on a scale from 0 to 100.

Readings above 25 point out a powerful pattern, whereas values under 20 counsel weak or range-bound worth motion. At present, Ethereum’s +DI sits at 24.5, down from 31.2 two days in the past, reflecting waning bullish momentum following a short rally that coincided with the Solana meme coin controversy.

In the meantime, DI has risen to twenty.6 from 15, indicating growing bearish strain. The mix of a falling ADX and converging DI strains means that Ethereum’s bullish momentum is fading. With out a renewed breakout in both path, worth motion might proceed to consolidate moderately than pattern decisively upward or downward.

Will Ethereum Fall Under $2,200?

Ethereum’s short-term EMA strains are presently very shut to one another and nonetheless positioned under the long-term EMAs, signaling a scarcity of robust momentum in both path.

If the worth of Ethereum can set up a sustained uptrend, it may problem the resistance at $3,020, marking the primary time it trades above $3,000 since February 2.

A profitable breakout above this stage may open the door for additional features, with the subsequent main resistance sitting at $3,442. Nonetheless, the convergence of short-term EMAs means that ETH nonetheless wants stronger shopping for strain to verify a bullish shift.

On the draw back, if Ethereum fails to construct upward momentum and a downtrend emerges, it may take a look at the important thing assist stage at $2,551.

A breakdown under this stage would expose ETH to additional losses, with the subsequent crucial assist at $2,160. A transfer under $2,300 could be vital, as ETH has not traded at these ranges since September 2024 – 5 months in the past.

With EMAs nonetheless signaling indecision, ETH stays at a crossroads. A breakout in both path is prone to set the subsequent main pattern.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.