Sonic (S) is at present experiencing sturdy bullish momentum, with its worth up practically 15% within the final 24 hours and 53% over the previous seven days. Its market cap now stands at $2.6 billion, reflecting rising investor curiosity and heightened buying and selling exercise.

Technical indicators present that Sonic’s ADX is at 51.6, confirming the energy of the continuing uptrend. Its RSI of 78.4 suggests that purchasing stress stays intense, though overbought situations might result in short-term pullbacks. Sonic might take a look at resistance ranges at $0.849 and doubtlessly $1.06.

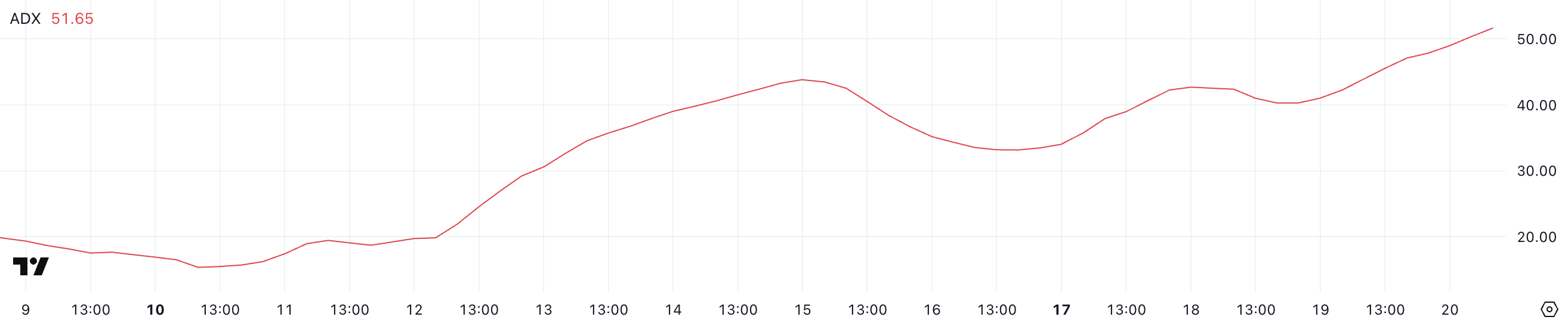

Sonic ADX Reveals the Present Uptrend Is Robust

Sonic, previously Fantom (FMT), ADX is at present at 51.6, exhibiting a major improve from 34 simply three days in the past and an much more dramatic rise from 19.8 eight days in the past.

The rising ADX signifies a strengthening development, reflecting rising market momentum. This speedy upward motion means that Sonic is experiencing elevated volatility and directional energy, which might be indicative of heightened shopping for curiosity or intensified market exercise.

Given the present uptrend, this surge in ADX might be interpreted as a affirmation of the continuing bullish momentum, signaling that the value motion is gaining energy and should proceed in the identical route.

The Common Directional Index (ADX) is a momentum indicator used to measure the energy of a development, no matter its route. It doesn’t point out whether or not the development is bullish or bearish, solely its depth.

Sometimes, an ADX beneath 20 suggests a weak or non-existent development. Between 20 and 40 signifies a rising development, whereas values above 40 signify a powerful development. With Sonic ADX at 51.6, the market is exhibiting a robust development, supporting the present uptrend.

This Sonic sturdy momentum might result in additional worth appreciation because it suggests sustained shopping for stress. Nevertheless, merchants ought to look ahead to potential overextension or reversal alerts because the development matures.

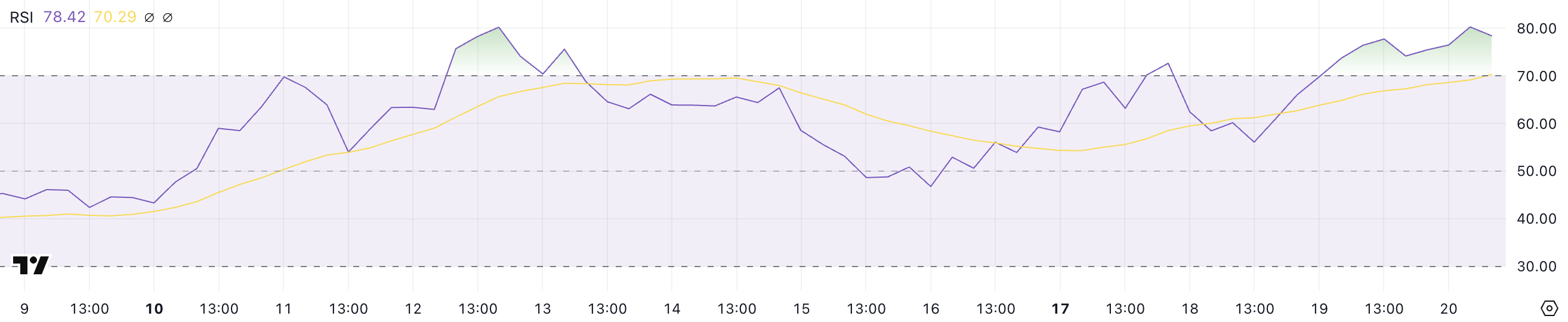

S RSI Has Been Overbought For Extra Than a Day

Sonic’s RSI is at present at 78.4, a major improve from 56 simply two days in the past. It has remained above 70 for greater than a day, indicating sturdy upward momentum.

The speedy rise in RSI displays heightened shopping for exercise, suggesting that the bullish sentiment is intensifying. An RSI above 70 usually alerts overbought situations, implying that the asset could also be overvalued within the quick time period.

Given the present uptrend, this elevated RSI might point out continued shopping for curiosity; nonetheless, it additionally raises the potential of a worth pullback or consolidation as merchants could start to take earnings.

The Relative Power Index (RSI) is a momentum oscillator that measures the pace and alter of worth actions. It ranges from 0 to 100 and helps determine overbought or oversold situations.

Typically, an RSI above 70 suggests the asset is overbought and might be due for a correction, whereas an RSI beneath 30 signifies oversold situations, doubtlessly signaling a shopping for alternative. With Sonic’s RSI at 78.4, the asset is clearly within the overbought territory, which might result in a short-term pullback or consolidation as merchants capitalize on latest positive factors.

Nevertheless, in sturdy uptrends, RSI can stay overbought for an prolonged interval. This means that Sonic bullish momentum could proceed earlier than any vital correction happens.

Will Sonic Break Above $1 In February?

Sonic’s EMA traces have not too long ago shaped two golden crosses, signaling sturdy bullish momentum. A golden cross happens when a shorter-term EMA crosses above a longer-term EMA, usually indicating the beginning of an uptrend. If this bullish momentum continues, Sonic might take a look at the resistance at $0.849.

Ought to it break via this stage, the subsequent worth goal for Sonic can be $1.06. That will mark its highest worth for the reason that finish of December 2024. This might verify the continuing uptrend and will appeal to extra shopping for curiosity, pushing Sonic costs greater as bullish sentiment strengthens.

Nevertheless, if the development reverses, Sonic might face vital draw back dangers. The primary help ranges lie at $0.65 and $0.58, which, if breached, might open the door to additional declines.

On this bearish situation, Sonic would possibly drop as little as $0.47. Within the worst case, it might attain $0.37, representing a correction of over 50%.

Disclaimer

In step with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.