The co-founders of market intelligence agency Glassnode say that Bitcoin (BTC) is all of the sudden trying much less bearish primarily based on a key metric.

In a brand new thread on the social media platform X, Jan Happel and Yann Alleman – who go by the deal with Negentropic – say that Bitcoin’s Threat Sign is flashing bullishness.

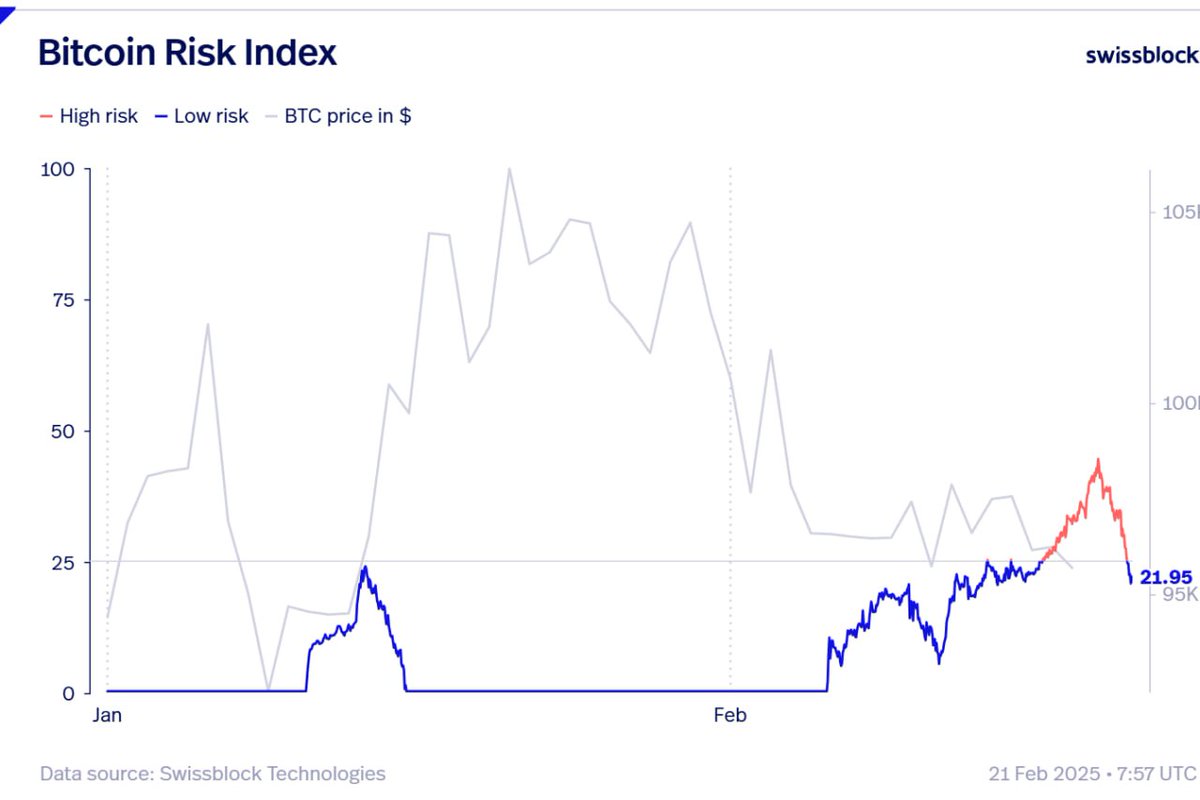

The Bitcoin Threat Sign, primarily based on a “set of proprietary indicators, together with Bitcoin value knowledge, on-chain knowledge and a choice of different buying and selling metrics,” gauges whether or not BTC is prone to a significant drawdown in value.

Nevertheless, the 2 analysts say that earlier than a bullish development reversal is confirmed, Bitcoin must flip $100,000 into help.

“Excellent news and unhealthy information – which one would you like first?

Good: the Threat Index has dropped under 25, which means bearish stress has considerably eased.

Unhealthy (or perhaps not so unhealthy): the BTC futures-to-spot ratio exhibits the next improve in futures than spot, indicating this restoration is futures-driven. In the meantime, shorts are piling up above $99,000-$100,000, which might gasoline a squeeze.

With BTC reclaiming $97,200-$98,500, holding this degree is essential – however till $100,000 is damaged, we are able to’t affirm a development reversal.”

The analysts additionally say that Bitcoin wants spot buying and selling quantity to extend to carry increased value ranges as help.

“Every rebound is weaker, signaling an absence of spot quantity for a stronger transfer…

Till $97,000-$98,500 is recovered, $92,000 stays the important thing draw back degree to observe.”

Bitcoin is buying and selling for $98,336 at time of writing, flat on the day.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney