An on-chain analyst has identified that the Realized HODL (RHODL) Ratio indicator is on the best way down, an indication that might not be constructive for Bitcoin.

Bitcoin RHODL Has Been Shedding Momentum Just lately

In a brand new submit on X, analyst Checkmate has mentioned concerning the newest pattern within the RHODL Ratio of Bitcoin. The “Realized HODL (RHODL) Ratio” is an on-chain metric that calculates the ratio between any two given RHODL wave bands.

HODL wave bands hold observe of the share of the full BTC provide that was final moved inside a given age vary. The RHODL wave bands are a modified type of these, including a further weighting issue: the Realized Worth.

Put merely, the Realized Worth is the spot worth at which a given token of the cryptocurrency was final transacted on the blockchain. That’s, it’s the coin’s present price foundation.

Because the RHODL wave band multiplies this metric with the quantity of provide current inside a given band, it tells us concerning the sum of price bases of cash in that band. When the worth of the indicator goes up for any specific band, it means the quantity of capital invested into cash falling within the age vary is rising.

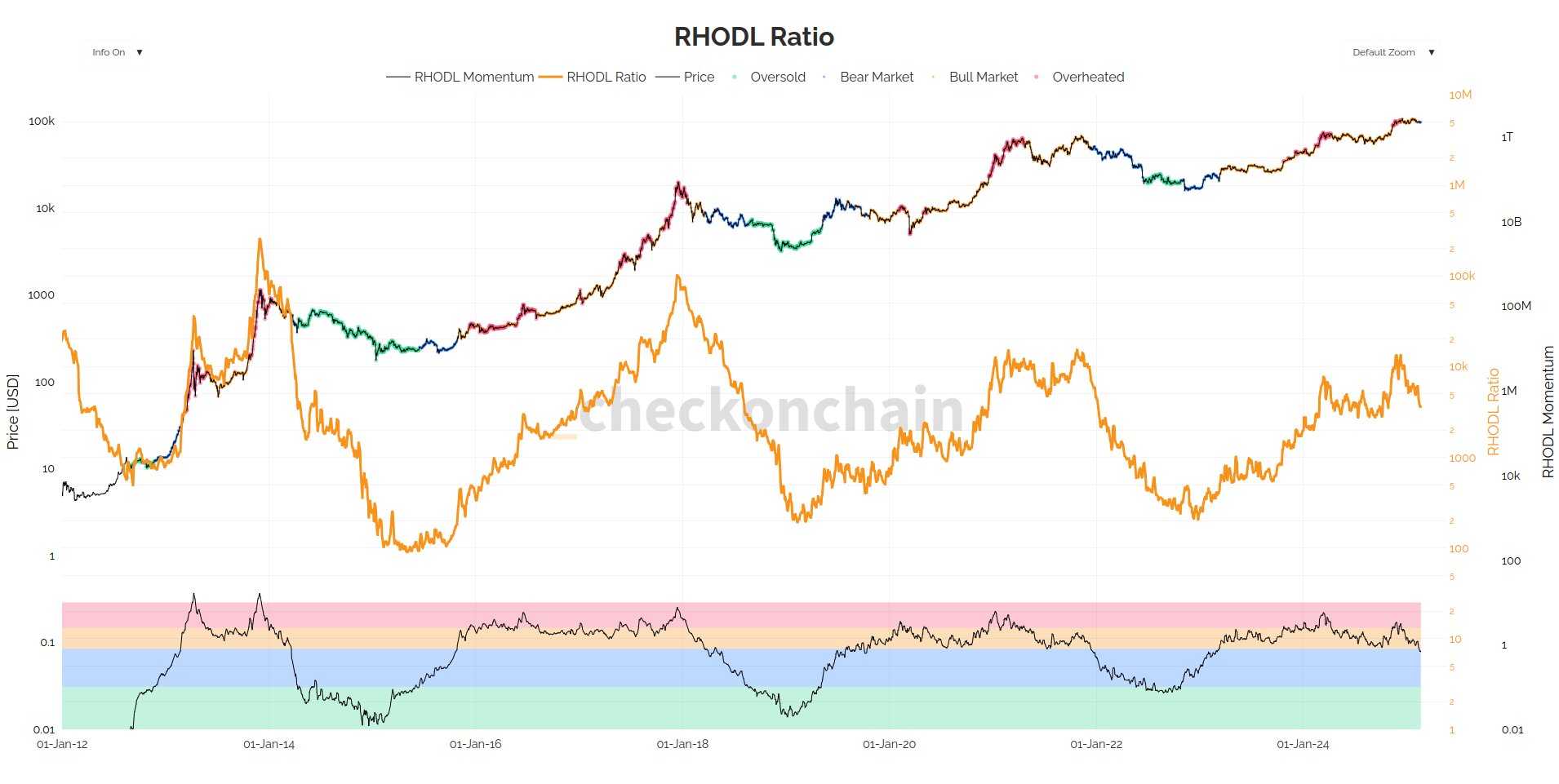

Within the context of the present matter, the RHODL Ratio of the 1 week and 1 to 2 years bands is of relevance. Under is the chart shared by the analyst, that reveals the pattern on this RHODL Ratio over the historical past of Bitcoin.

As displayed within the above graph, the Bitcoin RHODL Ratio for these wave bands shot as much as a excessive stage through the rally past $100,000 that befell final 12 months. Such a pattern implies the 1 week wave band, which corresponds to the contemporary capital coming into the sector, grew giant relative to the veteran 1 12 months to 2 years band.

From the chart, it’s obvious that an excessive rotation of capital into the 1 week wave band has traditionally coincided with bull run tops for the cryptocurrency’s worth.

Since final 12 months’s peak, the metric has been on the best way down, which suggests the brand new demand for the asset is now slowing down. That is additionally seen within the momentum oscillator for the indicator connected by the analyst on the underside, which simply dipped right into a zone that has performed the position of the transition area between bullish and bearish traits up to now.

Contemplating the historic sample, this growth within the RHODL Ratio is actually not the very best for Bitcoin. It now stays to be seen whether or not the metric would proceed its decline within the coming days, doubtlessly signaling a transition away from a bull market, or if it would bounce again up.

BTC Value

Bitcoin made a retest of the $98,000 mark earlier right this moment, but it surely seems the coin ended up discovering rejection as its worth is now right down to $97,000.