The Bybit Hack has shaken the market at the moment, with over $1.46 billion in ETH stolen, marking one of many largest safety breaches in historical past. Because the stolen property are being liquidated, Ethereum’s value dropped by 5% in a straight line, impacting key technical indicators.

Hypothesis is rising about Bybit’s subsequent strikes, with some suggesting a possible market buyback to compensate customers, which may create vital shopping for strain. Nonetheless, it stays unsure how Ethereum’s value will behave within the coming days because the state of affairs continues to unfold.

Will Bybit Hack Result in a Sturdy Buyback?

Earlier at the moment, one of many largest crypto exchanges, Bybit, was hacked. Over $1.46 billion price of Ethereum was stolen from its sizzling wallets, marking one of many largest safety breaches in crypto historical past.

CEO Ben Zhou confirmed that attackers tricked Bybit’s safety system, main pockets signers to unknowingly approve adjustments to the sensible contract logic, giving the hacker management.

The stolen ETH is being liquidated, inflicting Ethereum’s value to drop by over 4%. After the property have been stolen, the hacker’s addresses began to ship cash to dozens of various wallets.

Some customers are speculating about Bybit’s subsequent strikes to get well customers’ funds.

Some analysts declare that if Bybit can’t get well the stolen $1.5 billion, they may market-buy ETH to take care of customers’ funds, doubtlessly creating bullish purchase strain. Nonetheless, nothing ensures this may occur or when, as Bybit’s subsequent steps are nonetheless unfolding.

Just lately, Arkham revealed on X {that a} Bybit Chilly pockets transferred greater than $500 million to a different Bybit pockets, suggesting the change may very well be on the brink of put together funds for consumer reimbursements following the hack.

Indicators Recommend Stolen Property Impacted Ethereum Value

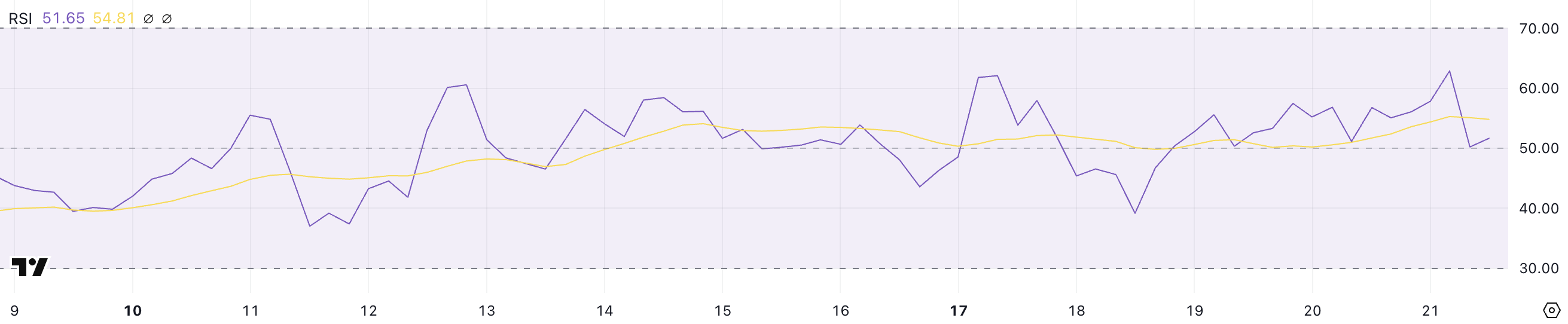

The current hack impacting Bybit brought on Ethereum’s Relative Energy Index (RSI) to drop sharply from 62.8 to 51.6 in only a few hours.

This speedy decline signifies a sudden lack of shopping for momentum, reflecting elevated promoting strain because the stolen ETH was liquidated.

Though the RSI remains to be above the impartial 50 mark, the sharp drop means that bullish sentiment has weakened significantly.

With ETH’s RSI at 51.6, it stays in a impartial zone, displaying balanced shopping for and promoting strain. Notably, ETH’s RSI has been impartial since February 3, reflecting a interval of consolidation and market indecision.

If the RSI drops beneath 50, it may sign bearish momentum, whereas an increase above 60 would point out renewed shopping for curiosity.

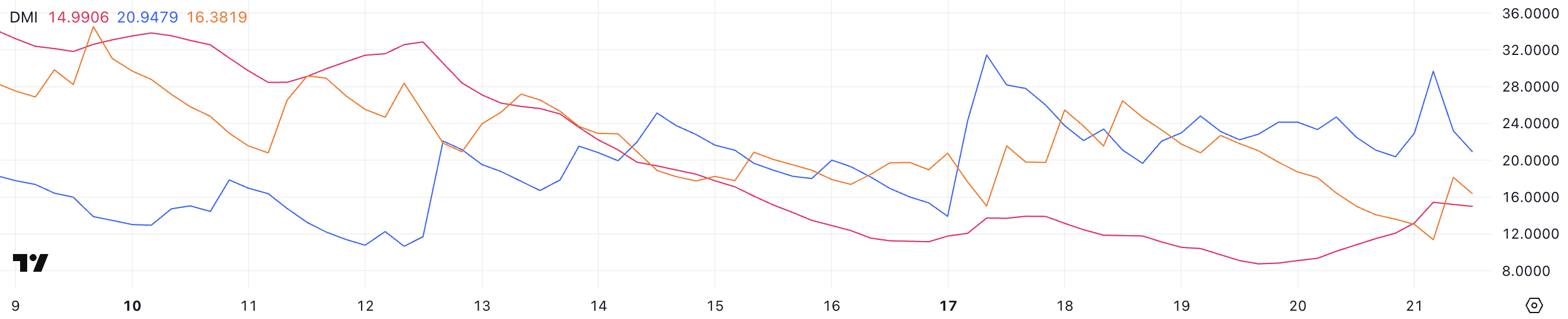

Ethereum’s Directional Motion Index (DMI) chart exhibits that its Common Directional Index (ADX) is presently at 14.9, indicating a weak development.

In the meantime, the +DI has dropped from 29.6 to twenty.94, displaying a decline in shopping for strain because the Bybit hack. Conversely, the -DI has risen from 11.3 to 16.3, demonstrating promoting strain because the stolen Ethereum has been liquidated.

This shift suggests a change in market sentiment, with sellers gaining extra management over the value motion.

The ADX measures development power, with values beneath 20 indicating a weak or non-existent development, no matter route. The decline in +DI and rise in -DI recommend that bullish momentum has weakened whereas bearish strain is growing.

With the ADX nonetheless low, ETH is prone to stay in a consolidation part, missing sturdy directional motion. Nonetheless, if -DI continues to rise above +DI, ETH may face extra promoting strain, doubtlessly resulting in an extra value decline.

How Will Ethereum’s Market Change Following the Hack?

If liquidations proceed or consumer confidence weakens following the Bybit hack, ETH may quickly check the assist at $2,551.

A break beneath this stage may result in a decline towards $2,160, signaling elevated promoting strain.

Conversely, if Bybit manages to get well the stolen property or if vital shopping for strain emerges, ETH value may check the resistance at $3,020. Breaking this stage may push the value larger to $3,442, its highest level because the finish of January.

Disclaimer

According to the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.