SUI has gained some momentum within the final 24 hours, with its market cap now at $10.5 billion. Nevertheless, it’s nonetheless attempting to get better from a 26% decline over the previous 30 days. Technical indicators at the moment present blended indicators. The CMF is at -0.06, reflecting easing promoting stress however nonetheless indicating cautious market sentiment.

In the meantime, the Ichimoku Cloud suggests consolidation with the opportunity of a bullish breakout. The EMA traces are exhibiting early indicators of a possible golden cross. If momentum continues, this might result in a check of resistance at $3.73 and probably an increase above $4.25.

SUI CMF Is Nonetheless Unfavorable, However Displaying Potential Restoration

SUI’s CMF is at the moment at -0.06, exhibiting a notable restoration from -0.35 two days in the past, though it has remained in damaging territory for the previous 4 days.

The rising CMF signifies that promoting stress is easing, suggesting that purchasing curiosity could also be progressively returning. Regardless of this enchancment, the damaging worth displays that outflows are nonetheless outweighing inflows, indicating a cautious market sentiment.

This lingering negativity means that sellers nonetheless keep some management of the SUI blockchain, however the upward motion hints at a possible shift in momentum if shopping for stress continues to develop.

The Chaikin Cash Circulate (CMF) is a volume-based indicator that measures shopping for and promoting stress by analyzing value and quantity information.

It ranges from -1 to +1, with optimistic values indicating shopping for stress and damaging values indicating promoting stress. Sometimes, a CMF above zero indicators accumulation and bullish sentiment, whereas a CMF beneath zero signifies distribution and bearish sentiment.

With its CMF at -0.06, the market continues to be leaning bearish, however the restoration from -0.35 means that SUI promoting stress is weakening. If CMF can cross above zero, it might sign a bullish reversal. Nevertheless, if it stays damaging or turns downward once more, it might point out a continuation of the bearish pattern.

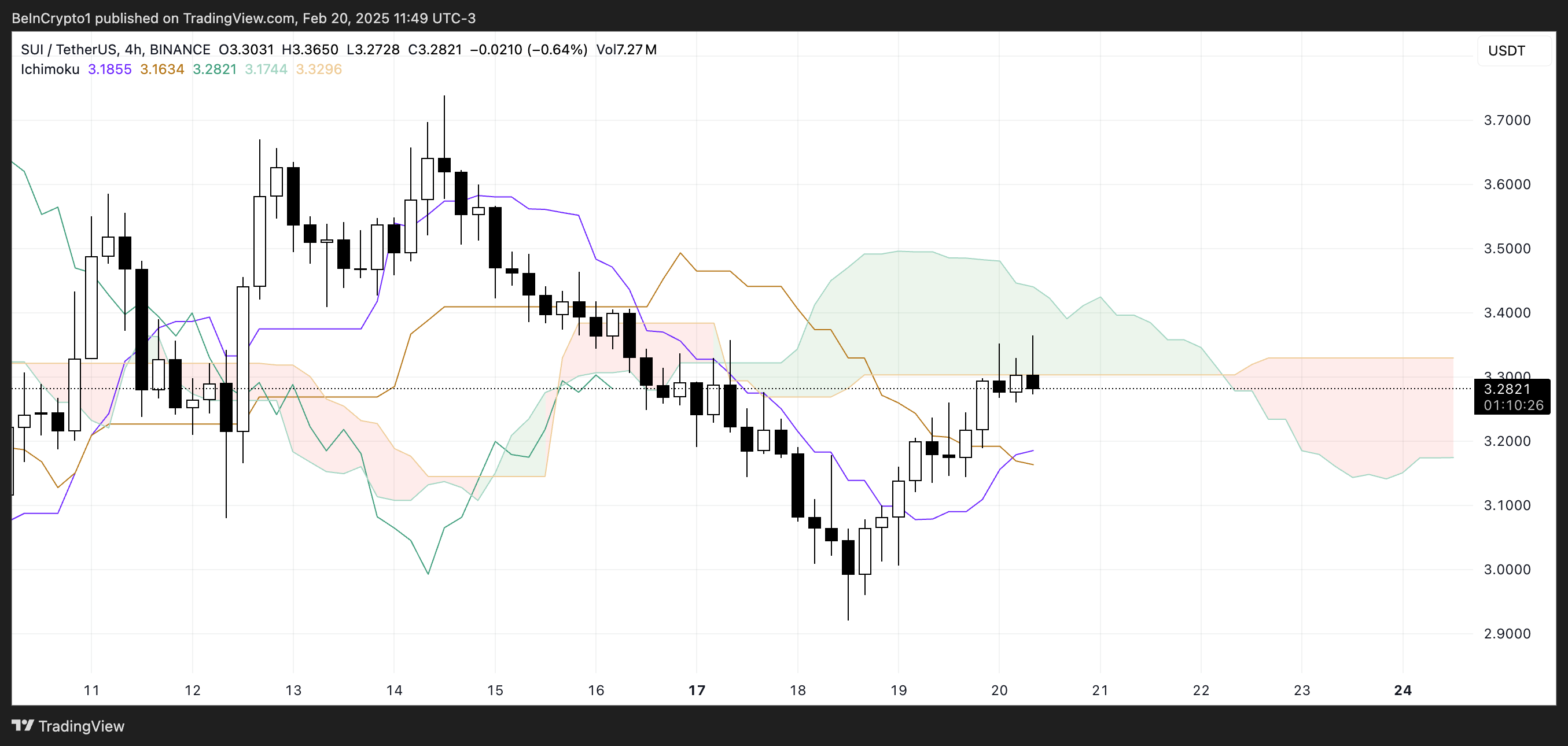

SUI Ichimoku Cloud Exhibits Cautious Optimism

The Ichimoku Cloud for SUI exhibits a blended outlook with indicators of potential consolidation. The present cloud’s Main Span A (inexperienced line) is above the Main Span B (orange line), indicating a bullish sentiment for the close to future.

Nevertheless, the worth is at the moment buying and selling throughout the cloud, suggesting indecision and an absence of clear pattern course. When costs are throughout the cloud, it usually signifies consolidation or a interval of uncertainty, as neither consumers nor sellers have full management.

The inexperienced cloud forward displays slight bullish momentum, however its thinness suggests a weak pattern that would simply be reversed.

The purple Tenkan-sen line is beneath the orange Kijun-sen line, which usually indicators bearish momentum. Nevertheless, the hole between them is narrowing, suggesting a possible bullish crossover if SUI value continues to rise.

This crossover might point out a shift in momentum towards the bulls. The Chikou Span (inexperienced line) is positioned above the worth motion, reinforcing the present bullish sentiment, however its shut proximity to the candles means that momentum just isn’t robust.

Total, the Ichimoku setup exhibits cautious optimism, with the opportunity of a bullish breakout if the worth can transfer above the cloud. Nevertheless, if it fails to take action and breaks beneath the cloud, bearish stress might resume.

SUI May Reclaim $4 Ranges Quickly

Though SUI value has been up within the final 24 hours, its EMA traces are at the moment in a bearish state, with short-term EMAs positioned beneath long-term EMAs. This alignment displays a prevailing bearish pattern, suggesting that sellers nonetheless keep management.

Nevertheless, the short-term EMAs are exhibiting an upward trajectory, indicating a possible shift in momentum. If these short-term EMAs cross above the long-term ones, forming a golden cross, SUI might check the resistance at $3.73.

Ought to it break by means of this degree, SUI might proceed rising till $4.25, marking a big breakout above $4 for the primary time because the finish of January. This bullish crossover would possible entice extra shopping for curiosity, confirming a reversal of the bearish pattern.

Then again, if the upward momentum fades and the short-term EMAs fail to cross above the long-term ones, the bearish pattern might proceed. On this situation, SUI might retest assist zones round $3.08 and $2.86.

If these ranges are breached, SUI might decline additional, probably dropping as little as $2.39.

Disclaimer

Consistent with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.