Metaplanet, a Japanese funding agency, has as soon as once more prolonged its Bitcoin portfolio, marking a big milestone in its aggressive accumulation strategy.

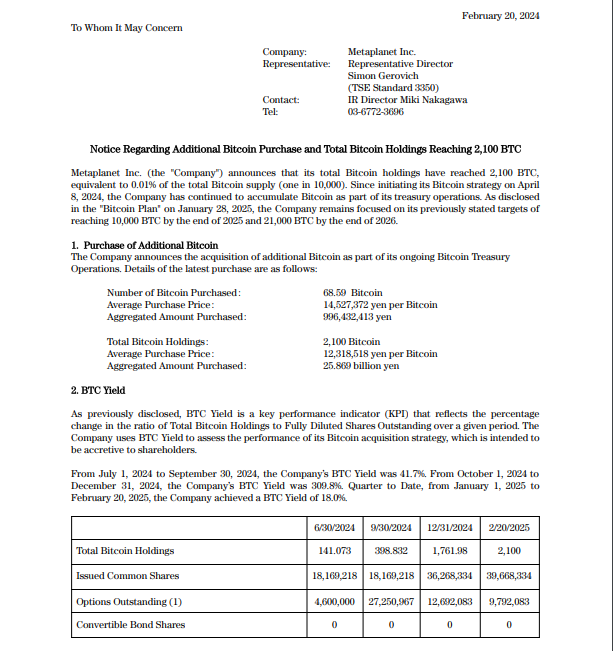

The corporate, which is usually likened to MicroStrategy (now Technique) for its Bitcoin-focused blueprint, not too long ago acquired a further 68.59 BTC, bringing its whole holdings to 2,100 BTC. This latest buy, at nearly $6.6 million, was made at a mean value of $96,335 per Bitcoin.

Aiming For A Large Bitcoin Stash

Metaplanet has set an bold goal of buying 10,000 BTC by the top of 2025, with a fair loftier aim of 21,000 BTC by 2026. To assist this enlargement, the corporate will use inner money and lift capital by fairness and debt presents.

With Bitcoin being considered as a hedge in opposition to financial volatility, Metaplanet is positioning itself as a significant participant in company cryptocurrency adoption.

Supply: Metaplanet

Inventory Value Sees Quick Response

Metaplanet’s inventory value registered a 2.78% improve after the corporate’s Bitcoin shopping for spree. Though the rise wasn’t exceptional, it nonetheless reveals that buyers are eager about placing cash within the firm, particularly in its Bitcoin technique.

METAPLANET CONTINUES BITCOIN ACCUMULATION, PLANS TO HOLD 10,000 BTC BY YEAR END

Metaplanet has expanded its bitcoin holdings with a brand new buy of 68 BTC for $6.6 million, reinforcing its place as a significant company bitcoin holder.

The corporate now holds 2,100 BTC, securing… pic.twitter.com/v8hKrFaymq

— IBC Group Official (@ibcgroupio) February 20, 2025

The transfer follows that of Technique, which has of late been buying a large quantity of Bitcoin. The constructive response from buyers signifies that they view Metaplanet’s crypto holdings as a long-term worth proposition.

Following Technique’s Path

Metaplanet’s idea is kind of much like Technique. The US-based firm has turn into a big institutional Bitcoin holder, amassing roughly 480,000 BTC. Technique has revealed plans to boost a further $2 billion in convertible bonds to spice up its Bitcoin reserves. Metaplanet seems to be pursuing the same path, however on a smaller scale for the time being.

Bitcoin market cap at the moment at $1.95 trillion. Chart: TradingView.com

Bitcoin Adoption Amongst Firms Grows

For corporations like Metaplanet, altering guidelines and the value fluctuation of Bitcoin current main hurdles. However corporations attempting to offset inflation and devaluation of currencies discover enchantment in Bitcoin’s restricted availability. Adoption of company Bitcoin is thus rising as companies search for substitute reserve property.

All eyes can be on Metaplanet’s potential to achieve 10,000 BTC by 2025 as Bitcoin accumulation intensifies. The corporate’s newest buy reveals its dedication to Bitcoin, however solely time will inform how this aggressive plan will pan out.

Featured picture from Gemini Imagen, chart from TradingView

Supply: Metaplanet

Supply: Metaplanet