Bitcoin has seen a restoration above $99,000 lately, however the development going down within the Open Curiosity may increase considerations concerning the surge’s longevity.

Bitcoin Open Curiosity Has Spiked Alongside The Newest Rally

In a brand new submit on X, CryptoQuant neighborhood analyst Maartunn talked concerning the development within the Bitcoin Open Curiosity alongside the most recent value rally. The “Open Curiosity” right here refers to an indicator that retains observe of the overall quantity of positions associated to BTC which are at present open on all derivatives exchanges.

When the worth of this metric rises, it means the derivatives customers are opening contemporary positions. Usually, the overall quantity of leverage goes up within the sector as new positions pop up, so this sort of development can result in increased volatility for the asset’s value.

Then again, the indicator’s worth registering a decline implies the holders are both closing up positions of their very own volition or getting liquidated by their platform. The cryptocurrency might act in a extra secure method following such a leverage flushout.

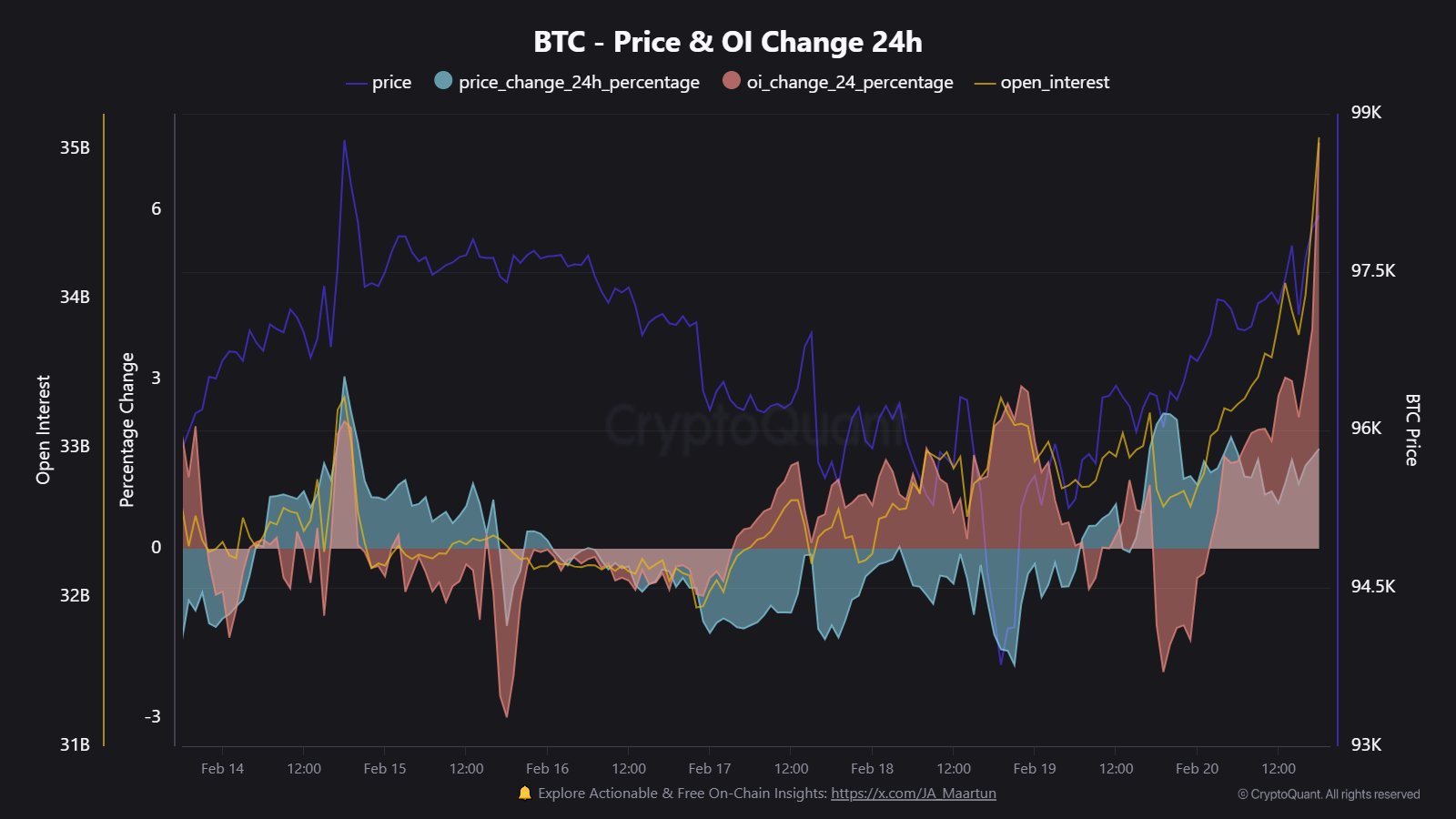

Now, right here is the chart shared by the analyst, that exhibits the development within the Bitcoin Open Curiosity, in addition to its 24-hour share change, over the past week:

The worth of the metric seems to have shot up in the course of the previous day | Supply: @JA_Maartun on X

From the above graph, it’s seen that the Bitcoin Open Curiosity has seen a fast improve alongside the most recent restoration rally within the coin’s value. On the peak, the 24-hour share change hit the 7.2% mark, which is kind of important.

Whereas it’s regular for speculative exercise to observe a pointy transfer within the cryptocurrency, an extra of it may well nonetheless be an alarming signal. It is because in a high-leverage atmosphere, the possibilities of a mass liquidation occasion can grow to be notable.

In concept, the volatility rising out of such derivatives market chaos can take the cryptocurrency in both route, however normally, Open Curiosity spikes that accompany rallies find yourself appearing as an impedance for it. Thus, it’s potential that the most recent Bitcoin rally may additionally unwind in a unstable method.

The development within the Open Curiosity isn’t the one one that means volatility could possibly be coming for the asset, because the analytics agency Glassnode has identified in an X submit.

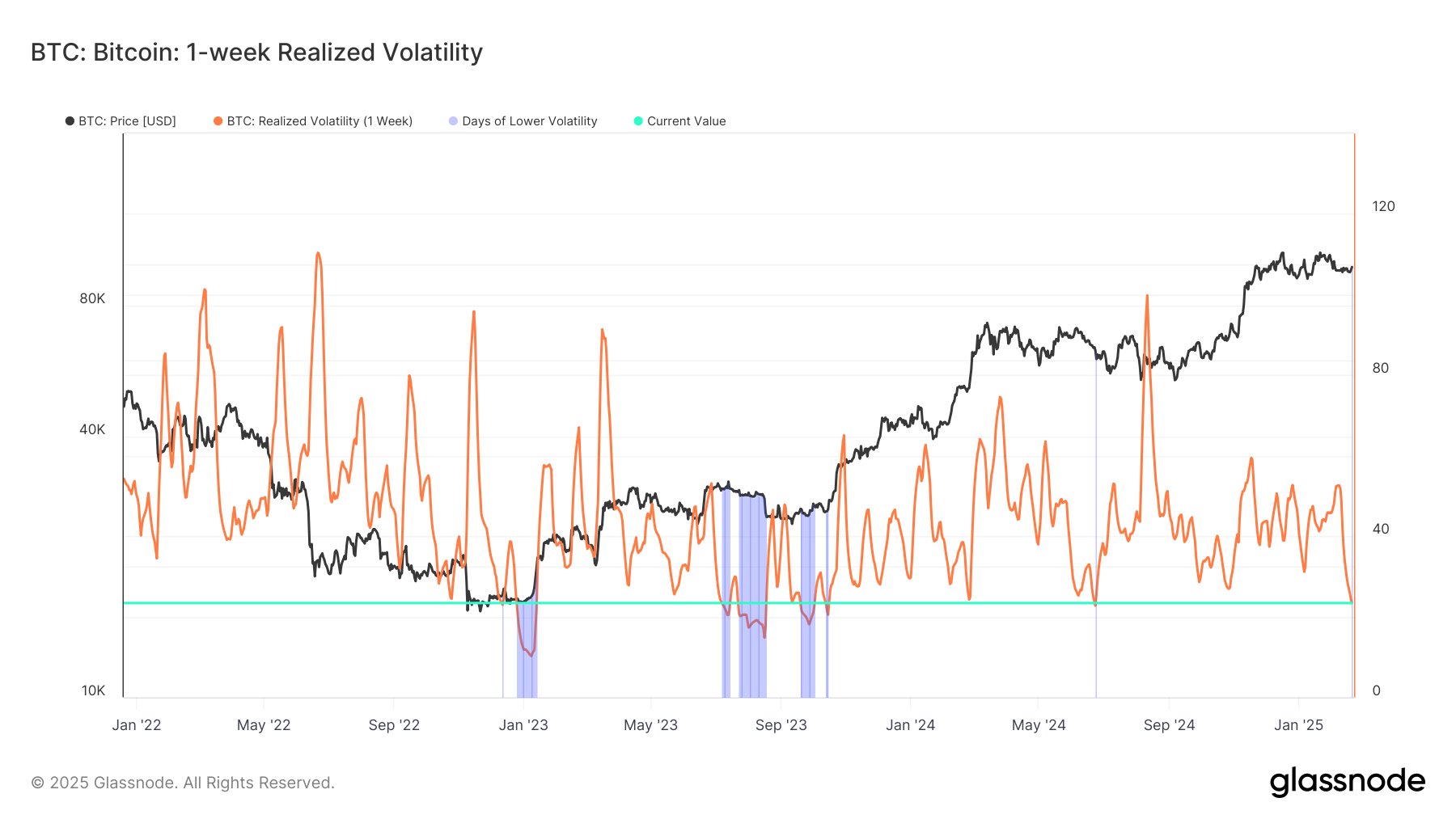

The development within the BTC Realized Volatility over the previous few years | Supply: Glassnode on X

The chart shared by the analytics agency is for the 1-week Realized Volatility, an indicator that tracks the proportion change between the very best and lowest factors within the Bitcoin value recorded over the last seven days.

As displayed within the graph, the metric’s worth has plunged lately, implying the asset has been buying and selling inside a really slim vary. “Prior to now 4 years, it has dipped decrease only some instances – e.g., Oct 2024 (22.88%) & Nov 2023 (21.35%),” explains Glassnode. “Comparable compressions previously led to main market strikes.”

BTC Worth

Following a bounce of round 2% within the final 24 hours, Bitcoin has recovered again above the $99,300 stage.

Appears like the worth of the coin has been marching up in current days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com