Mantle (MNT) is down greater than 10% following the Bybit hack, the place roughly $174 million of cmETH – a Mantle-based coin offering liquidity for ETH within the MNT ecosystem – was stolen. The hack, linked to the North Korean Lazarus Group, triggered panic promoting, inflicting MNT’s Relative Energy Index (RSI) to plummet to oversold ranges.

Though MNT’s RSI has since rebounded to 39.9, it stays in bearish territory, reflecting cautious sentiment. Moreover, MNT’s Chaikin Cash Move (CMF) is making an attempt to get better however remains to be deeply destructive, whereas its Exponential Transferring Common (EMA) traces recommend persistent downward momentum.

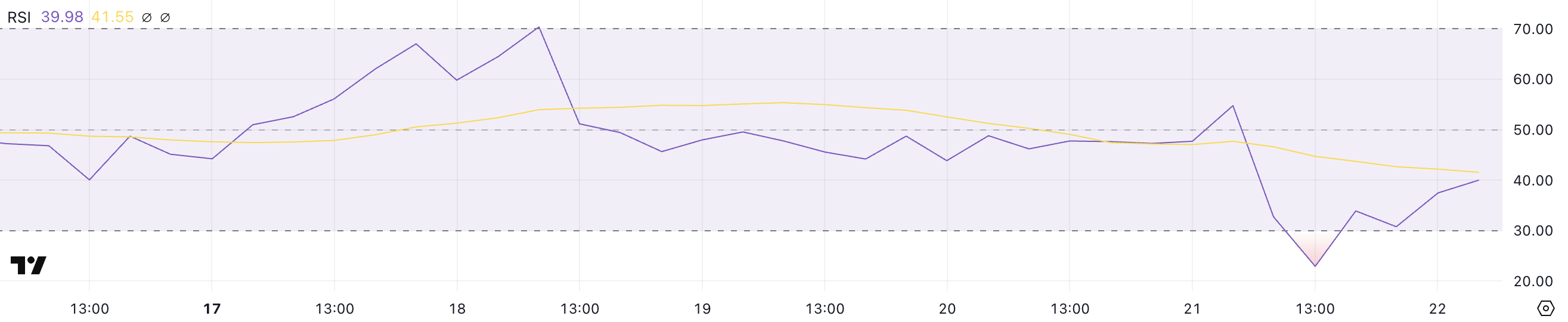

MNT RSI Touched Robust Oversold Ranges After Bybit’s Hack

Mantle’s RSI dropped sharply from 54.7 to 22.9 inside just a few hours following the Bybit hack, the place the North Korean hacking group Lazarus stole $1.5 billion, making it the largest crypto hack ever. Among the many belongings stolen was cmETH, a Mantle-based coin offering liquidity for ETH within the MNT ecosystem.

This large outflow of funds triggered panic promoting, resulting in a major decline in MNT’s Relative Energy Index (RSI). RSI is a momentum oscillator that measures the velocity and alter of value actions, sometimes starting from 0 to 100.

It’s generally used to determine overbought or oversold circumstances, with values above 70 indicating overbought circumstances and under 30 suggesting oversold territory. Mantle’s RSI plummeting to 22.9 signaled excessive overselling, reflecting intense bearish sentiment amid the fallout from the hack.

Following this sharp decline, Mantle’s RSI has rebounded to 39.9, displaying indicators of restoration in the previous couple of hours. An RSI under 30 usually signifies that an asset is oversold and may very well be due for a value bounce as promoting strain wanes.

Now, with RSI approaching the impartial zone (30-50 vary), it means that the intense promoting momentum has eased, probably attracting bargain-hunters or bottom-fishers. If RSI continues to rise, it might point out rising bullish momentum and a doable reversal in MNT’s value pattern.

Nevertheless, if RSI fails to interrupt above the 50 threshold, it might signify continued uncertainty and an absence of shopping for energy, leaving MNT susceptible to additional draw back threat.

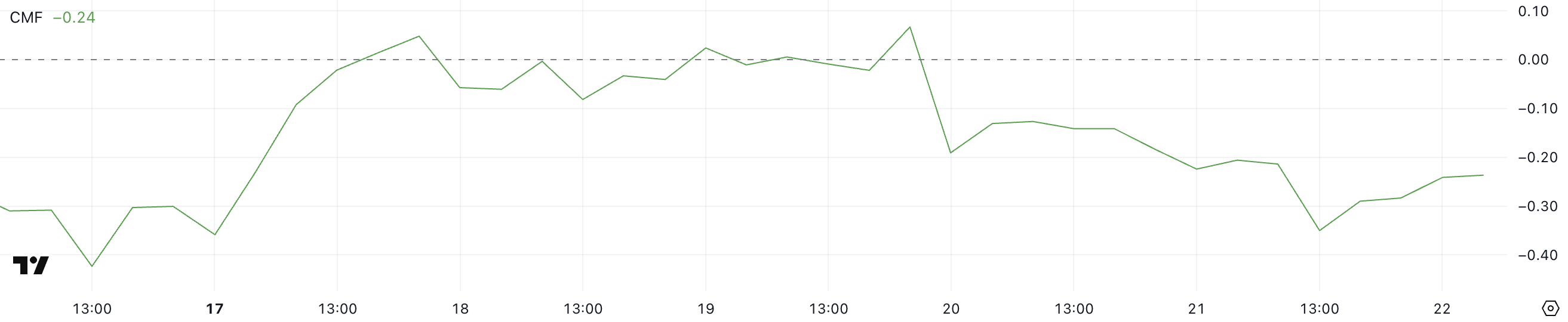

Mantle CMF Is Making an attempt to Get well, However It’s Nonetheless Very Destructive

MNT’s Chaikin Cash Move (CMF) was already in destructive territory earlier than the Bybit hack, reflecting a bearish pattern and promoting strain. Nevertheless, following the hack, MNT’s CMF plunged even additional, reaching a destructive peak of -0.35 yesterday.

CMF is an indicator that measures the volume-weighted common of accumulation and distribution over a set interval. It ranges from -1 to 1, with constructive values suggesting shopping for strain and accumulation, whereas destructive values point out promoting strain and distribution.

The sharp decline to -0.35 signaled intense outflows from Mantle. That confirms vital promoting momentum amid the heightened market concern and uncertainty triggered by the hack.

After reaching this destructive peak, MNT’s CMF has began to get better, presently sitting at -0.24. Though nonetheless removed from turning constructive, this upward motion means that promoting strain is progressively easing.

A rising CMF, even whereas destructive, can point out that bearish momentum is shedding steam. If shopping for quantity continues to extend, that would probably pave the way in which for a value stabilization or perhaps a reversal. Nevertheless, so long as CMF stays in destructive territory, MNT value is more likely to face resistance.

A shift to constructive CMF can be a extra convincing signal of bullish sentiment returning. That might sign a stronger chance of a value restoration.

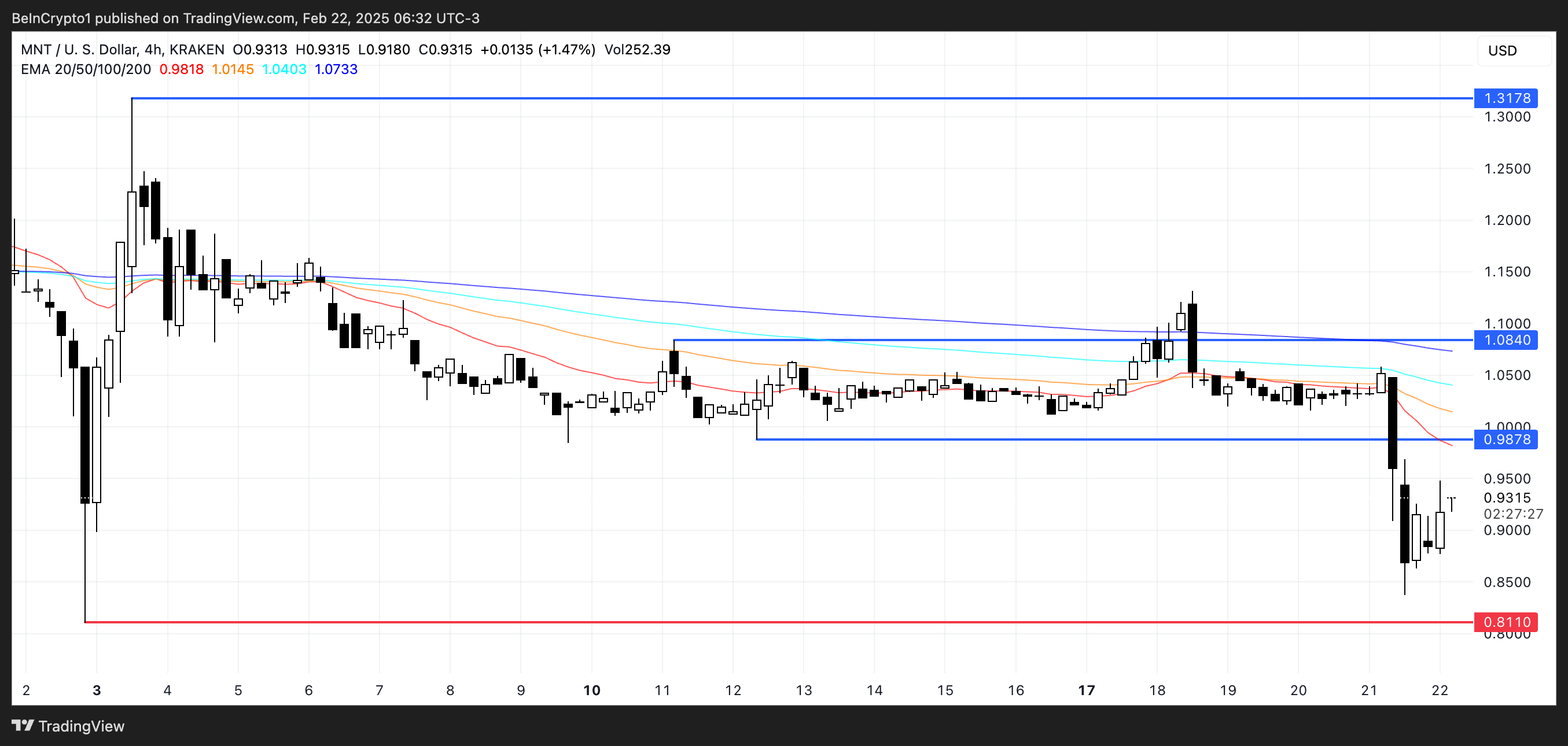

Mantle Dropped Beneath $1 For the First Time Since Early February

MNT’s Exponential Transferring Common (EMA) traces are presently very bearish, with all short-term EMAs under the long-term ones. This setup signifies robust downward momentum, as current costs are weaker in comparison with historic traits.

If this bearish pattern continues, MNT might check the help at $0.81.

However, if Mantle begins to get better from the current drop, it might check the resistance at $0.98. If this stage is damaged, the following goal can be $1.08.

A powerful uptrend might push MNT to $1.31, representing a possible 41% upside. Nevertheless, for this bullish situation to unfold, short-term EMAs would want to cross above long-term ones, signaling renewed shopping for momentum.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.