Bitcoin seems to be on the verge of a significant worth motion, and information means that volatility might return in a giant approach. With Bitcoin’s worth motion stagnating over the previous few weeks, let’s analyze the important thing indicators to know the potential scale and route of the upcoming transfer.

Volatility

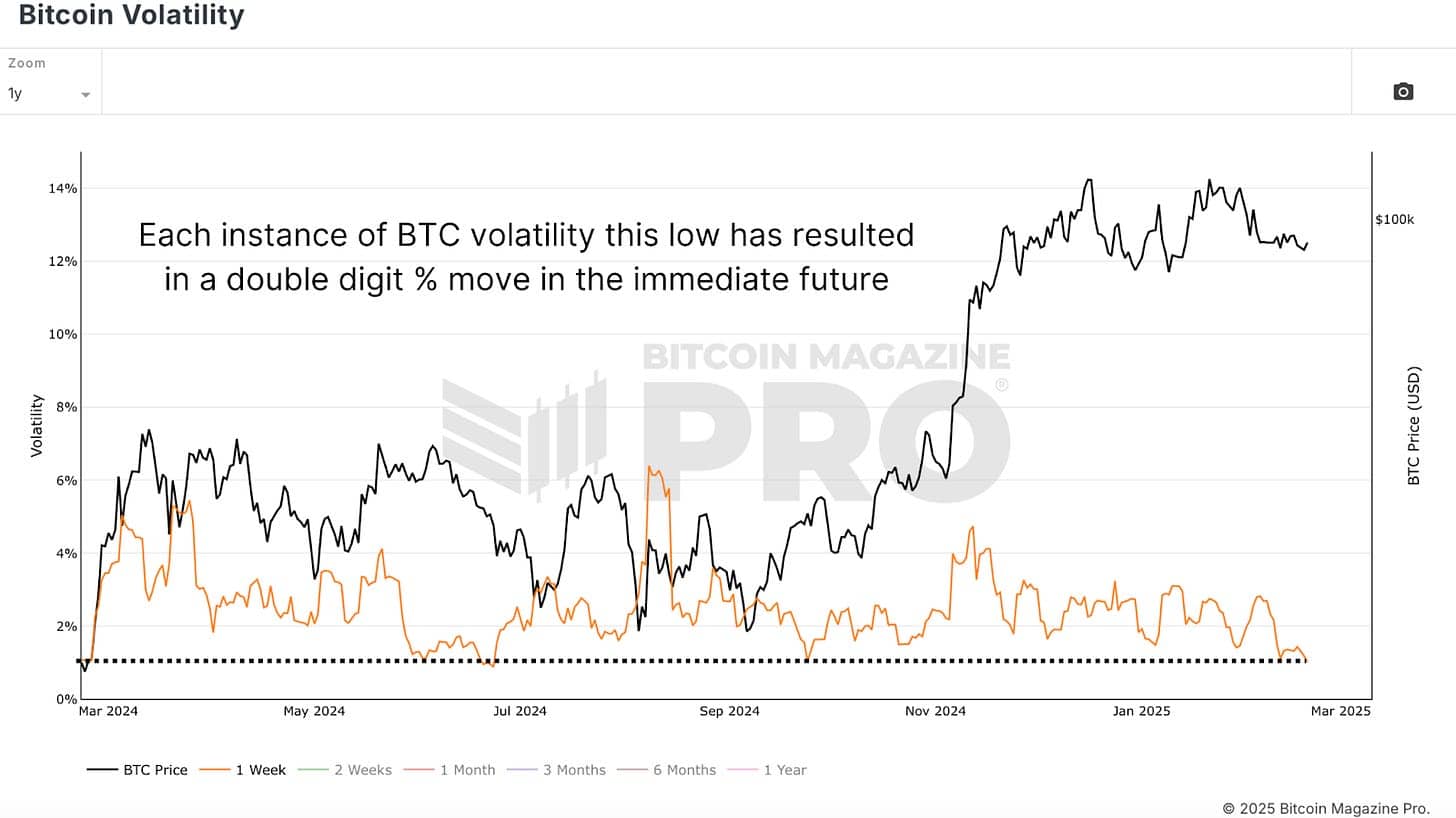

An awesome place to begin is Bitcoin Volatility, which tracks worth motion and volatility over time. By isolating the previous yr’s information and specializing in weekly volatility, we observe that Bitcoin’s worth not too long ago has been comparatively flat, hovering within the $90,000 vary. This extended sideways motion has resulted in a dramatic drop in volatility, which means Bitcoin is experiencing a few of its most steady worth habits in latest historical past.

View Dwell Chart 🔍

Traditionally, such low volatility ranges are uncommon and are typically short-lived. When earlier situations the place volatility was this low, Bitcoin adopted up with vital worth actions:

A rally from $50,000 to a then all-time excessive of $74,000.

A drop from $66,000 to $55,000, adopted by one other surge to $68,000.

A interval of stagnation round $60,000 earlier than a surge to $100,000, its present all-time excessive.

Each time volatility dropped to this degree, Bitcoin skilled a transfer of a minimum of 20-30%, if no more, within the following weeks.

Bollinger Bands

To additional verify this, the Bollinger Bands Width indicator, a device that measures volatility by monitoring worth deviation from a shifting common, additionally alerts that Bitcoin is coiled for a giant transfer. The quarterly bands are at present at their tightest ranges since 2012, which means that worth compression is at an excessive. The final time this occurred, Bitcoin skilled a 200% worth surge inside weeks.

Analyzing earlier occurrences of comparable tight Bollinger Band setups, we discover:

2018: A 50% drop from $6,000 to $3,000.

2020: A breakout from $9,000 to $12,000, organising the eventual rally to $40,000.

2023: A sluggish accumulation section round $25,000 earlier than a speedy soar to $32,000.

Potential Path

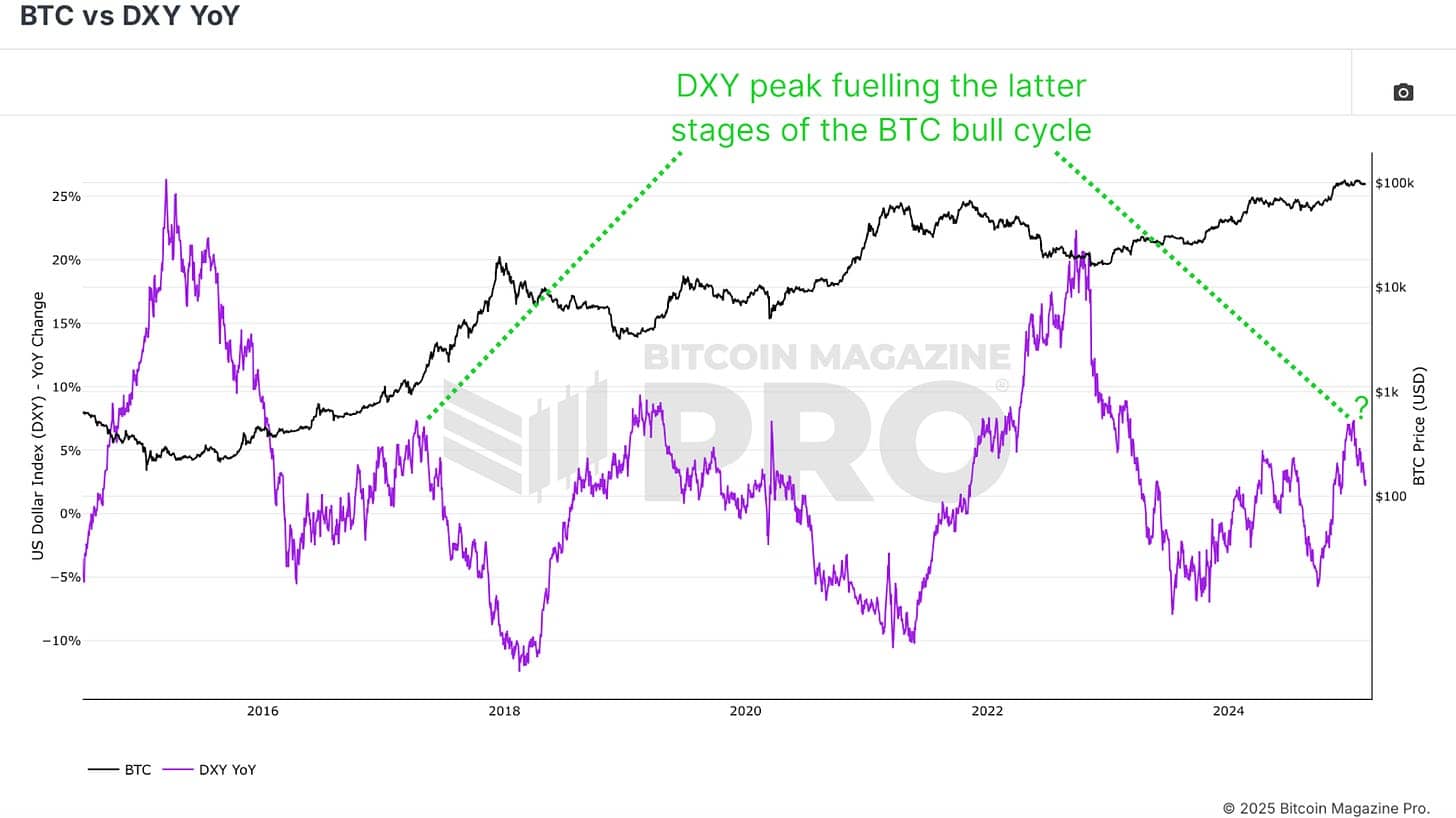

Understanding route is more durable than predicting volatility, however we now have clues. One robust indicator is the US Greenback Energy Index (DXY) YoY, which has traditionally moved inversely to Bitcoin. Lately, the DXY has been rallying exhausting, but Bitcoin has held its floor. This implies Bitcoin has underlying power, even in much less favorable macro situations.

View Dwell Chart 🔍

Moreover, political components might play a task. Traditionally, when Donald Trump took workplace in 2017, the DXY declined, and Bitcoin noticed a large bull run from $1,000 to $20,000. With an identical setup probably unfolding in 2025, we might even see a repeat of this dynamic.

ETF Inflows

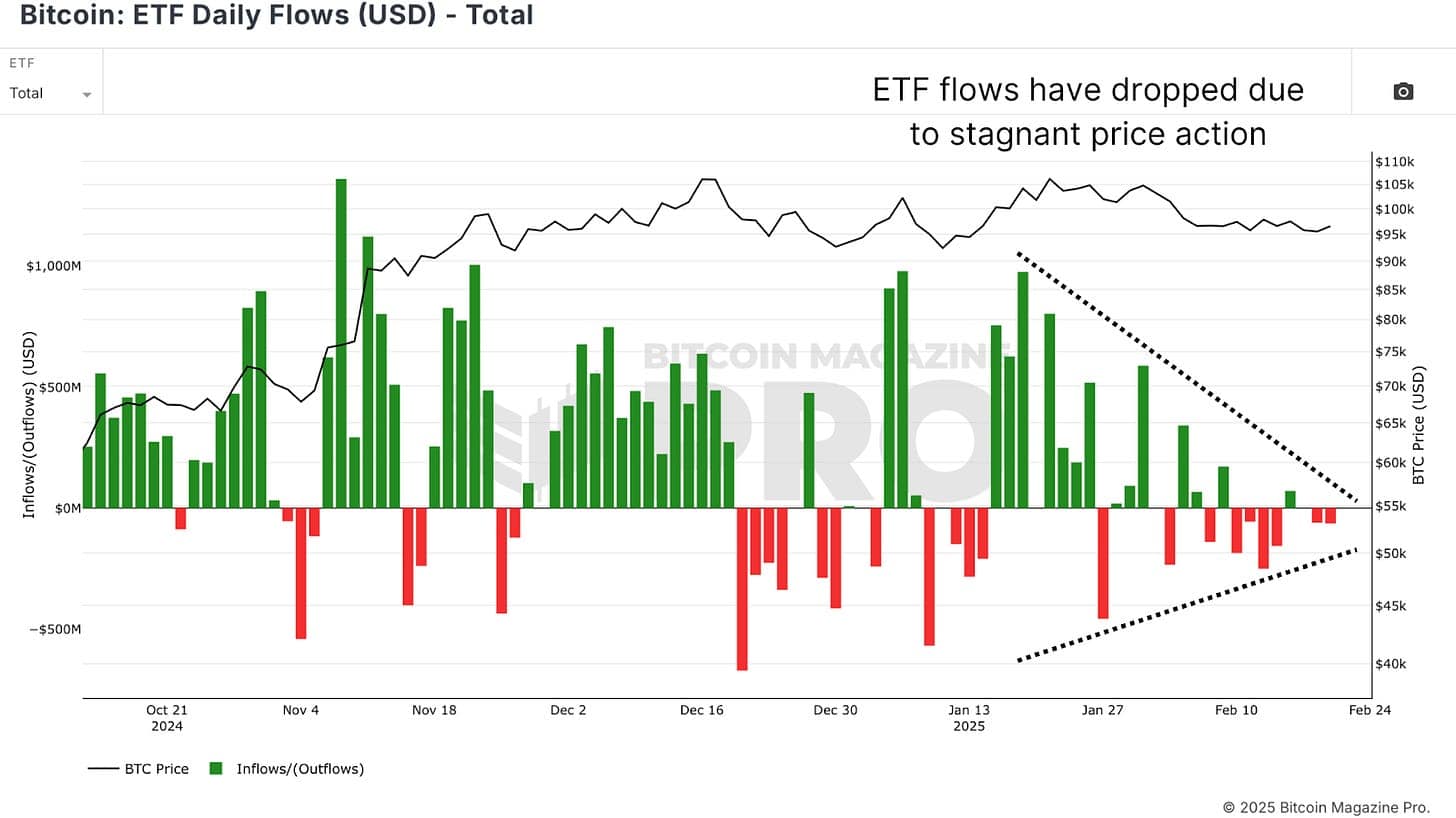

Moreover, Bitcoin ETF inflows, a proxy for institutional demand, have slowed considerably throughout this era of low volatility. This implies that main gamers are ready for a confirmed breakout earlier than including to their positions. As soon as volatility returns, we might see renewed curiosity from establishments, driving Bitcoin even greater.

View Dwell Chart 🔍

Conclusion

Bitcoin’s volatility is at one among its lowest ranges in historical past, and such situations have by no means lasted lengthy. When volatility compresses this a lot, it units the stage for an explosive transfer. The info suggests a breakout is imminent, however whether or not it leans bullish or bearish will depend on macroeconomic situations, investor sentiment, and institutional flows.

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, customized indicator alerts, and in-depth business studies, take a look at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding choices.