BNB has been within the highlight in the previous couple of weeks, with rising buying and selling quantity and rising curiosity in its ecosystem, together with meme cash like TST. Regardless of the hype, BNB’s worth is down greater than 3% within the final seven days, reflecting continued market uncertainty.

Its DMI exhibits weak development power and rising promoting stress, whereas the Ichimoku Cloud signifies a bearish setup. With EMA traces exhibiting no clear path, BNB faces a crucial second because it might both regain momentum or drop under $600 if the downtrend continues.

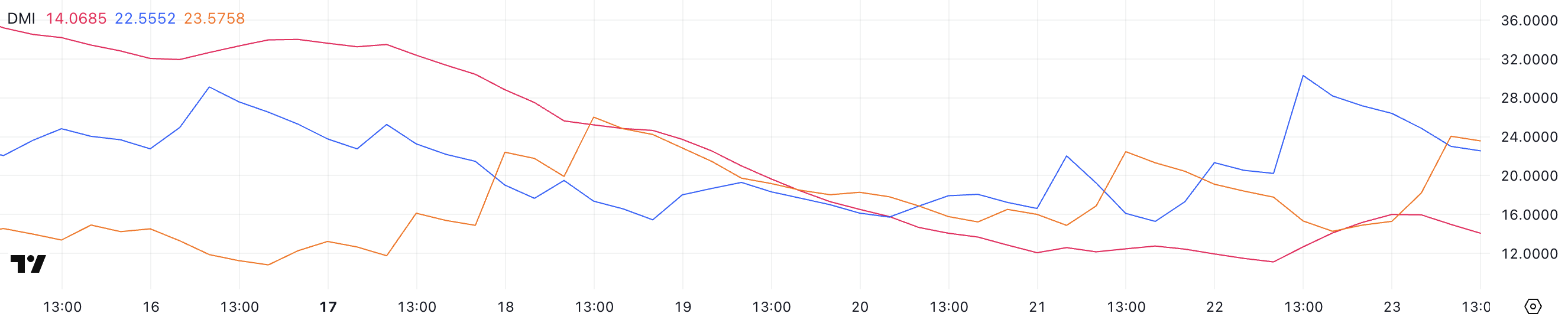

BNB DMI Reveals Consumers Tried to Achieve Management, However Sellers Are Rising Once more

BNB’s DMI chart exhibits its ADX at 14, reflecting weak development power after touching a low of 11.1 yesterday and briefly rising to almost 16 just a few hours in the past.

ADX, or the Common Directional Index, measures the power of a development with out indicating its path. It ranges from 0 to 100, with values above 25 indicating a robust development and values under 20 suggesting a weak or undefined development.

With ADX at 14, BNB is presently in a low-momentum section, indicating that the market lacks a transparent directional development.

+DI is at 22.5, up from 15.2 yesterday however down from 30.3 just a few hours in the past, suggesting that purchasing stress elevated however then weakened. In the meantime, -DI is at 23.5, rising from 14.2 someday in the past, indicating rising promoting stress.

The proximity of +DI and -DI exhibits a tug-of-war between consumers and sellers, reflecting market indecision. With ADX low and +DI and -DI shut to one another, BNB worth is prone to stay range-bound till a stronger development emerges.

If +DI crosses above -DI, it might sign a bullish reversal, whereas -DI sustaining dominance might result in additional draw back.

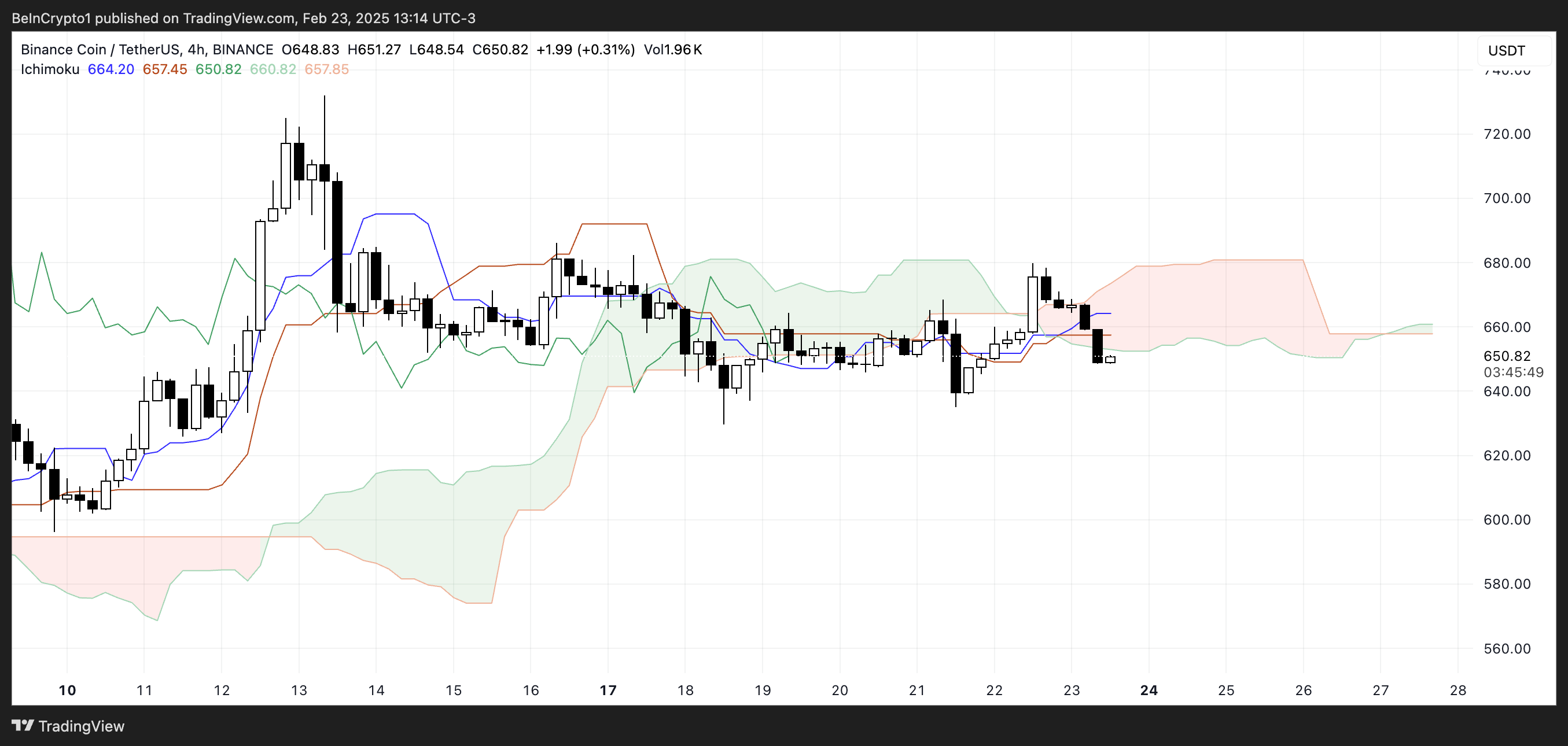

Ichimoku Cloud Reveals a Bearish Setup

The Ichimoku Cloud for BNB exhibits a bearish outlook. The value is presently buying and selling under the cloud, indicating downward momentum. The pink cloud forward suggests resistance, making it difficult for BNB to interrupt above present ranges.

The Tenkan-sen (blue line) is under the Kijun-sen (orange line), confirming a bearish crossover, which usually indicators continued promoting stress.

Moreover, the Chikou Span (inexperienced line) is under the value motion, supporting the bearish sentiment. If this downtrend continues, BNB might check decrease help ranges.

Nevertheless, a breakout above the pink cloud can be wanted to shift to a bullish outlook. For now, the bearish construction stays intact, suggesting additional draw back dangers.

BNB May Drop Under $600

BNB’s EMA traces are presently very shut to one another, indicating an absence of clear development path. This consolidation suggests market indecision, with neither bulls nor bears taking management.

Regardless of this, BNB has been within the highlight lately, with its buying and selling quantity surpassing Solana and meme cash like TST gaining consideration throughout the BNB ecosystem.

If it could possibly regain optimistic momentum, it might check the resistance at $685, and breaking this degree might push the value as much as $731.

Nevertheless, if a downtrend emerges, BNB worth might check help at $629. Shedding this degree might result in a decline to $589, marking its first drop under $600 since February 8.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.