Ethereum is buying and selling beneath the $2,700 mark after days of struggling to reclaim it and push above $2,800. Bulls have been unable to achieve momentum, and promoting strain has saved ETH beneath key resistance ranges.

On Friday, the market was hit with adverse information as Bybit, one of many prime crypto exchanges, was hacked, resulting in a lack of $1.4 billion in ETH. This occasion triggered panic promoting, driving Ethereum’s value into decrease demand ranges, including extra uncertainty to its short-term outlook.

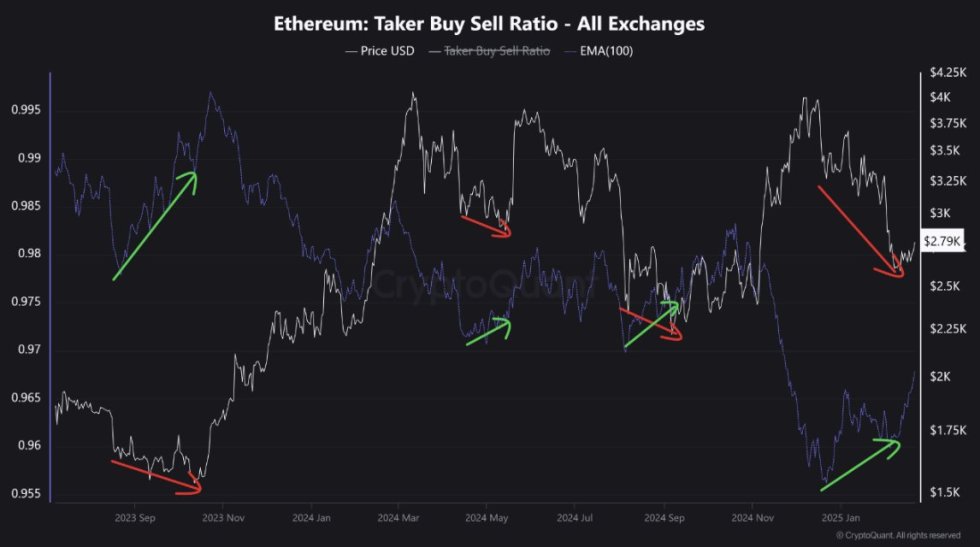

Nevertheless, CryptoQuant knowledge suggests a possible turnaround. Their newest evaluation reveals that Ethereum taker shopping for is exhibiting a bullish divergence—a key indicator that purchasing strain is growing regardless of value declines. Such a divergence has traditionally signaled the beginning of restoration rallies, as merchants and establishments accumulate ETH at decrease ranges in anticipation of a bounce.

With ETH consolidating and bullish indicators rising, the approaching days can be essential in figuring out whether or not Ethereum can reclaim the $2,700–$2,800 zone or if additional draw back is on the horizon. Merchants at the moment are waiting for key breakout ranges to verify a powerful restoration rally.

Ethereum Prepares For A Comeback

Ethereum has been struggling as buyers develop more and more impatient with the huge promoting strain and adverse sentiment surrounding the second-largest cryptocurrency. Since late December, ETH has been in a gentle decline, with no clear indicators of restoration on the horizon. Bulls have did not reclaim key resistance ranges, whereas bears proceed to regulate the market, pushing the value decrease with every failed breakout try.

Regardless of this extended bearish pattern, on-chain knowledge suggests a possible shift. CryptoQuant shared key knowledge on X, revealing an fascinating sample that has traditionally marked the tip of bearish developments and the start of bullish phases.

Based on their evaluation, when a bullish divergence happens—the place the value of Ethereum is falling, however taker shopping for quantity is rising—previous developments recommend that promoting strain is weakening. This sometimes indicators that purchasing momentum is constructing as merchants start accumulating ETH in anticipation of a pattern reversal.

In the present day, Ethereum is exhibiting a taker shopping for bullish divergence, much like earlier cases that led to bullish breakouts. Whereas the market stays unsure, this may very well be an early indication of a brand new bullish section. If Ethereum holds above present demand ranges and reclaims $2,800, a powerful restoration rally may observe.

ETH Testing Quick-Time period Demand

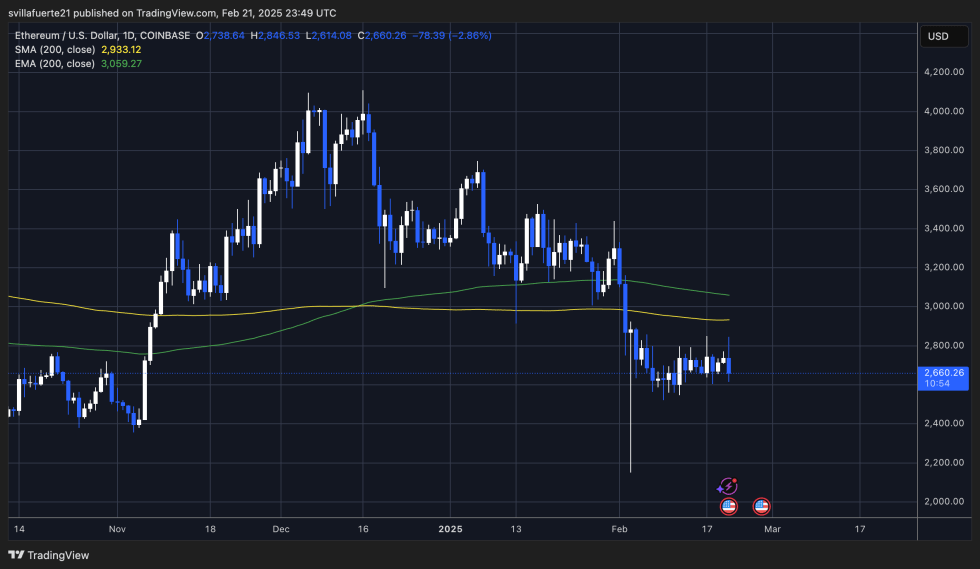

Ethereum is at the moment buying and selling at $2,660 after an underwhelming Friday, the place the value dropped 7% following the Bybit hack information and total market uncertainty. Bulls are struggling to reclaim key resistance ranges, and the shortage of sturdy demand at present ranges raises issues about Ethereum’s potential to recuperate.

For Ethereum to verify a bullish breakout, it should reclaim the $2,800 mark and push above $3,000 to achieve momentum for a sustained rally. Nevertheless, the shortage of great shopping for strain means that ETH may proceed consolidating in a decent vary except patrons step in quickly.

Regardless of the shortage of rapid power, ETH stays above the $2,600 assist degree, which has acted as a key demand zone in latest weeks. So long as Ethereum holds above $2,600 and begins reclaiming key ranges above $2,800, the potential for a bullish reversal stays on the desk. If demand will increase and ETH can set up a foothold above $2,800, a bullish section may begin at any second. Nevertheless, if Ethereum fails to carry above assist ranges, it may see additional draw back strain within the coming days.

Featured picture from Dall-E, chart from TradingView