- PEPE sees a pullback, however buying and selling quantity stays excessive, signaling sturdy exercise.

- Market cap decline suggests cautious investor sentiment amid broader crypto shifts.

- Full circulating provide means no future dilution dangers, retaining worth purely demand-driven.

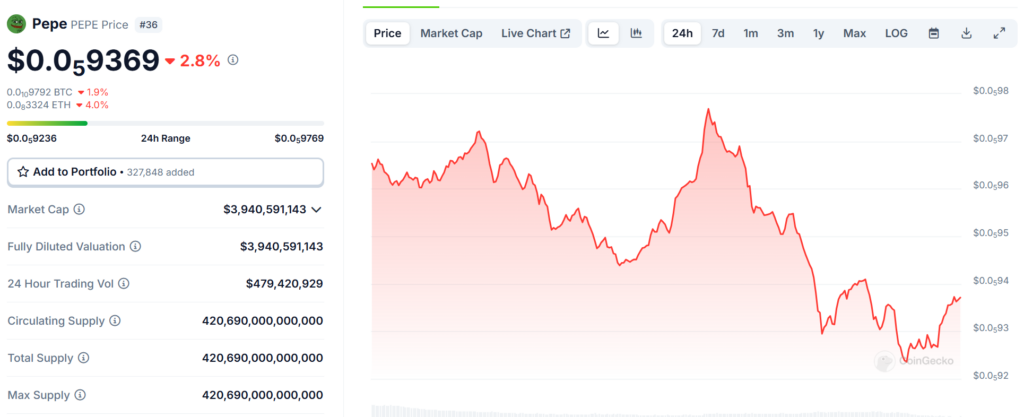

PEPE has been on a little bit of a downward pattern, now priced at $0.059371 after shifting between $0.059236 and $0.059769 over the previous 24 hours. Whereas this dip might sound regarding, it’s value noting that meme cash are naturally risky, and fast fluctuations like this are nothing new for PEPE.

Wanting on the CoinGecko knowledge, PEPE noticed some sturdy peaks earlier than hitting resistance, adopted by a gradual decline. The bounce towards the tip of the chart means that patrons are nonetheless stepping in, however the momentum is weaker in comparison with its earlier surges. The true check now’s whether or not PEPE can stabilize at these ranges or if additional drops are forward.

PEPE’s Value Motion: A Momentary Cooldown or a Shift in Momentum?

PEPE’s market cap now sits at $3.94 billion, a drop that mirrors its worth motion. Nonetheless, what stands out is the excessive 24-hour buying and selling quantity of almost $480 million. This stage of liquidity means that whilst some traders dump, others are nonetheless actively buying and selling, retaining PEPE’s market extremely engaged.

One other factor to bear in mind is that PEPE’s totally diluted valuation (FDV) is similar as its market cap, that means all tokens are already in circulation. That removes any worry of future token unlocks or dilution affecting worth motion, making PEPE’s motion solely depending on demand and market sentiment.

In contrast to newer meme cash which may undergo from surprising provide will increase, PEPE’s whole 420.69 trillion provide is already totally on the market, so worth shifts are purely pushed by buying and selling conduct.

CoinGecko

Can PEPE Maintain This Stage or Is Extra Volatility Forward?

The following few days will probably be essential in figuring out whether or not PEPE finds sturdy help round these ranges or dips additional. If shopping for stress will increase, we may see one other push towards resistance factors, but when quantity begins fading, there’s an opportunity of extra pullbacks earlier than one other try at restoration.

One factor to observe is how the broader crypto market is performing. When Bitcoin and Ethereum see volatility, meme cash like PEPE are likely to react much more dramatically. If main cryptos stabilize, PEPE would possibly observe go well with, but when the market sees additional declines, we may see one other spherical of dips earlier than a real restoration try.

Regardless of this pullback, PEPE’s excessive liquidity and engaged neighborhood make it one of many extra resilient meme cash. Whether or not that is only a cooldown earlier than one other breakout or the beginning of a bigger pattern shift stays to be seen.

The Origins of PEPE

PEPE is impressed by the legendary Pepe the Frog meme, an web icon that has been a part of on-line tradition for years. In contrast to conventional cryptos with particular utilities, PEPE thrives on community-driven hype, hypothesis, and meme energy.

It has managed to separate itself from numerous different meme cash by sustaining excessive buying and selling quantity, sturdy market engagement, and ongoing relevance within the crypto house. Whereas meme cash are sometimes unpredictable, PEPE has proven that it’s not only a short-lived pattern—it has solidified its spot among the many prime meme tokens out there.

Will PEPE bounce again from this dip, or is the hype cooling off? The following few days will give us some solutions.