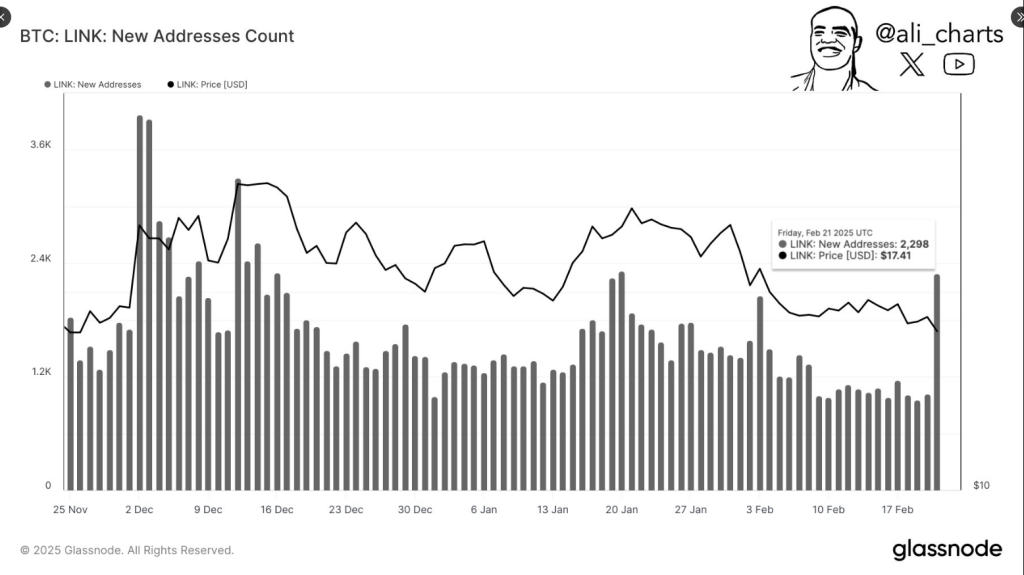

Chainlink (LINK) is proving to be remarkably resilient in a difficult market. The digital asset stays at about $16.64, however not too long ago its community reached a noteworthy milestone when 2,298 new addresses entered the ecosystem, signifying probably the most main enhance since January. Though LINK is at all times attempting to breach the $20 pricing restrict, this enhance of exercise suggests a rising adoption.

Market Dynamics Current A Multifaceted Image

The buying and selling patterns of LINK point out a persistent battle with the $18 resistance stage, which can be the 200-day exponential transferring common (EMA). The asset continues to face agency, regardless of quite a few abortive makes an attempt to beat this technical barrier. The consolidation part persists as bulls and bears interact in a tug-of-war at this important value level.

#Chainlink community development is accelerating! The variety of new $LINK addresses has surged to 2,298, its highest stage since January! pic.twitter.com/tO4CfuOBkR

— Ali (@ali_charts) February 23, 2025

Cross-Chain Innovation Propels Growth Ahead

Chainlink’s most up-to-date technological improvement is the deployment of CCIP v1.5 on the mainnet. This enhanced Cross-Chain Interoperability Protocol is a considerable development within the subject of blockchain connectivity.

The enhancement permits extra environment friendly cross-chain transfers of information and digital property, doubtlessly positioning Chainlink to amass a bigger share of the interoperability market.

Strategic Partnership Enhances Market Presence

A serious step ahead for the challenge’s ecosystem, Chainlink’s collaboration with XRP highlights the rising want for decentralized information options. This collaboration highlights the platform’s rising clout within the blockchain business.

As the necessity for dependable oracle companies retains rising throughout varied blockchain networks, these strategic partnerships could play a key position in encouraging future adoption.

Technical Evaluation Signifies Important Ranges

The value motion of LINK’s quick future seems to be contingent upon its efficiency at important technical ranges. A decisive transfer above the $18 resistance might open the door to a cost towards the psychologically important $20 mark.

Market analysts, nevertheless, warn that LINK could also be topic to elevated promoting stress if it fails to protect its present help ranges. The asset’s capability to safeguard its important help zones whereas concurrently fostering community enlargement illustrates a particular equilibrium between technical resilience and elementary enlargement.

These components—technical developments, strategic partnerships, community development, and value motion—mix to depict a challenge that’s concurrently increasing and constructing its technological infrastructure whereas navigating market uncertainties.

Featured picture from Exaclos, chart from TradingView